POTENTIAL ALPHA FROM HIGH YIELD TOTAL RETURN SWAPS

As of 3/9/2022 | Source: J.P. Morgan DataQuery, Bloomberg, GMO

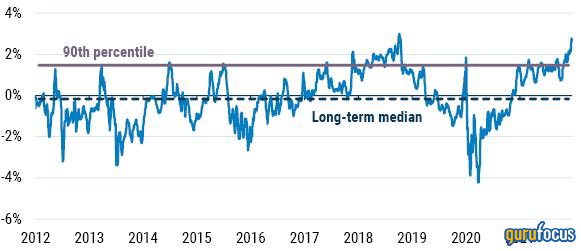

Chart shows the potential annualized alpha of total return swaps on the Markit iBoxx USD Liquid High Yield Index, relative to the underlying.

- The repercussions of Russia’s invasion of Ukraine and consequent financial sanctions have reverberated across all risk assets. U.S. high yield is no exception, despite having little direct exposure to the crisis issues.

- Spreads have cheapened significantly this year, widening by 100 bps, but there is very little sign of credit distress and default risk remains low, as evident in the outperformance of low quality CCC paper relative to BBs.

- This combination of factors has increased the demand for broad hedges against macro risks. In high yield, this often takes the form of short positions in portfolio products like total return swaps (TRS) and ETFs.

- Given the rush to hedge and a reduced investor risk appetite, these products are now trading at deep discounts to their net asset values; they’re about as cheap as they’ve ever been relative to the benchmark.

- As illustrated above, the potential alpha offered by TRS on the Markit iBoxx USD Liquid High Yield Index is a top decile opportunity. And this alpha comes with no tracking error!

- GMO’s High Yield Strategy is designed to capitalize on such structural market inefficiencies.

- Our ability to switch between individual bonds and portfolio products to obtain high yield exposure allows us to allocate efficiently and capture the best possible risk-adjusted alpha.

- The current opportunity in high yield TRS is just one aspect of our strategy, which also employs individual bond sleeves, the Credit Default Swap Index (CDX), and ETFs.

- While high yield remains vulnerable to a U.S. recession or sharp slowdown in growth, current valuations offer a better cushion against this risk than they did only a few months ago. This U.S.-centric risk exposure can help diversify a global portfolio.