In light of St. Patrick’s Day, five gold stocks with high guru ownership as of the fourth quarter of 2021 include Barrick Gold Corp. (GOLD, Financial), Kinross Gold Corp. (KGC, Financial), Franco-Nevada Corp. (FNV, Financial), Newmont Corp. (NEM, Financial) and Royal Gold Corp. (RGLD, Financial) according to the Aggregated Portfolio of Gurus, a Premium feature of GuruFocus.

The holiday, which celebrates the foremost patron saint of Ireland, traditionally features parades, festivals, green attire and gold coins.

As investors celebrate the Irish holiday, GuruFocus’ Aggregated Portfolio listed several gold mining companies that have at least eight gurus owning shares based on fourth-quarter 13F portfolio statistics. Investors should be aware that the 13F filings do not give a complete picture of a guru’s holdings; they only consider a guru’s U.S.-based holdings and American depository receipts, yet they can still provide valuable information.

Barrick Gold

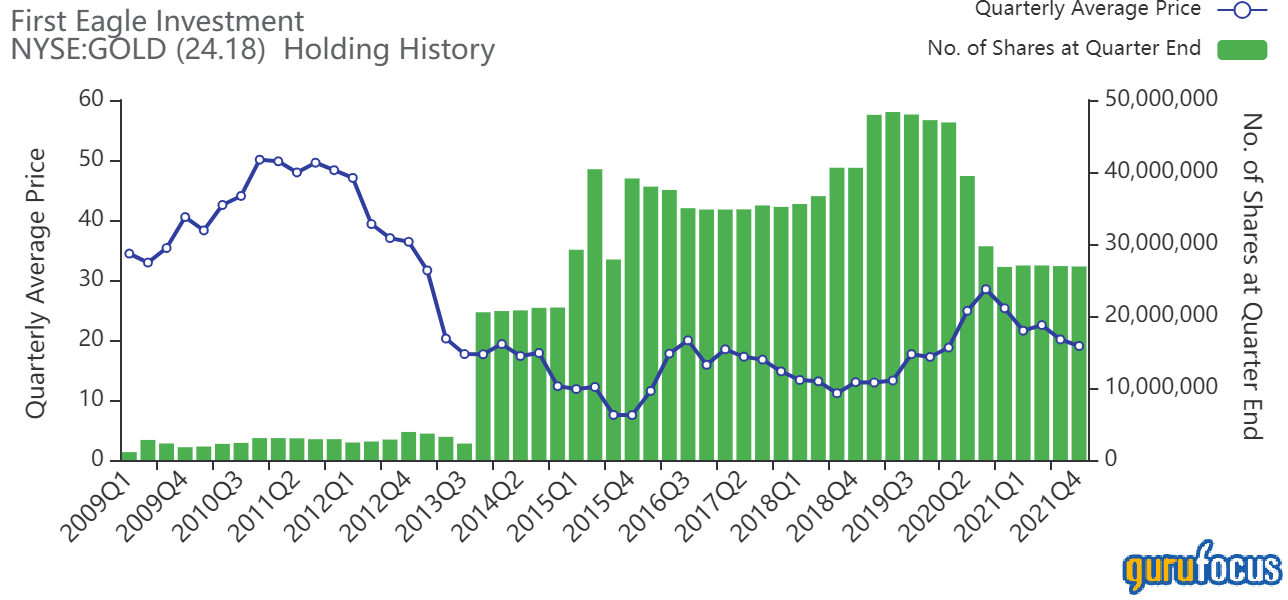

Eleven gurus own shares of Barrick Gold (GOLD, Financial) with a combined weight of 18.94%.

Shares of Barrick Gold traded around $24.22, showing the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.18.

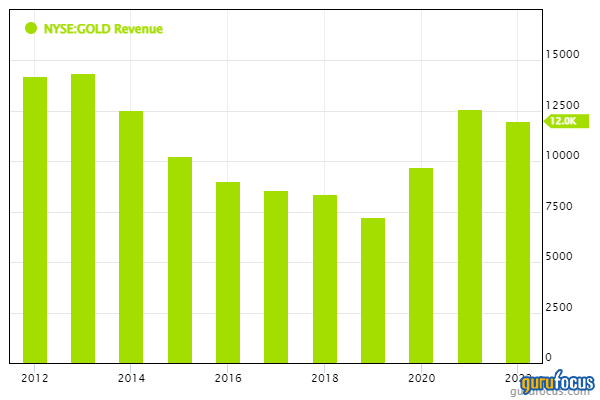

The Toronto-based company has a GuruFocus profitability rank of 8 based on several positive investing signs, which include profit margins and three-year revenue and earnings growth rates that outperform more than 85% of global competitors.

Gurus with holdings in Barrick Gold include First Eagle Investment (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies and John Paulson (Trades, Portfolio)’s Paulson & Co.

Kinross Gold

Ten gurus own shares of Kinross Gold (KGC, Financial) with a combined weight of 7.06%.

Shares of Kinross Gold traded around $5.69, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.98.

The Toronto-based company has a GuruFocus profitability rank of 7 on the back of returns outperforming more than 77% of global competitors despite revenue and earnings growth rates outperforming just over half of global gold mining companies.

Franco-Nevada

Nine gurus own shares of Franco-Nevada (FNV, Financial) with a combined weight of 5.71%.

Shares of Franco-Nevada traded around $156.59, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.95.

The Toronto-based company has a GuruFocus profitability rank of 10 based on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 7 and profit margins and returns that outperform more than 90% of global competitors.

Newmont

Eight gurus own shares of Newmont (NEM, Financial) with a combined weight of 7.41%.

Shares of Newmont traded around $73.52, showing the stock is modestly overvalued based on Thursday’s price-to-GF Value ratio of 1.16.

The Denver-based company has a GuruFocus profitability rank of 7 based on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that are outperforming more than 70% of global competitors.

Royal Gold

Eight gurus own shares of Royal Gold (RGLD, Financial) with a combined weight of 3.21%.

Shares of Royal Gold traded around $136.37, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.97.

The Denver-based company has a GuruFocus profitability rank of 8 on the back of profit margins and returns outperforming more than 90% of global competitors despite three-year revenue growth rates outperforming just over 59% of global gold mining companies.