Shares of Pinduoduo Inc. (PDD, Financial), China’s largest agriculture and interactive commerce platform, rose by almost 5% in premarket trading on Monday after the company reported mixed fourth-quarter 2021 results.

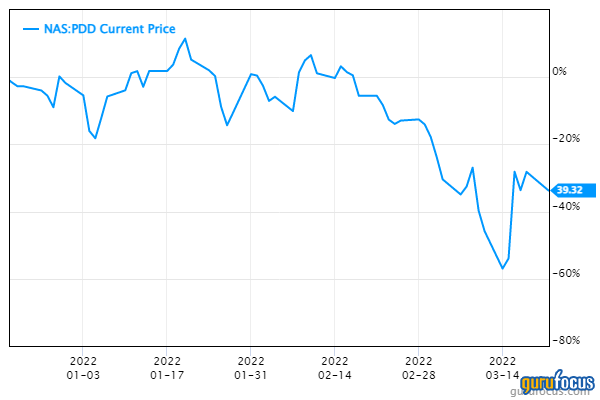

Overall, shares of Shanghai-based Pinduoduo have dropped more than 30% over the past three months after China’s economic slowdown depleted online consumption. Shortly after midday on Monday, shares were trading at around $39.03, an 8.38% dip.

Gross merchandise value (the total value of all orders for products and services placed on the Pinduoduo mobile platform, regardless of whether the products and services are actually sold, delivered or returned) for the 12-month period ended Dec. 31 was 2.44 trillion yuan ($383 billion), the company said, an increase of 46% from the prior-year period.

Total revenue for the fourth quarter was 27.23 billion yuan, an increase of 3% over the comparable quarter of 2020.

The number of average monthly active users for the quarter was 733.4 million, an increase of 2% from 719.9 million in the same quarter of 2020. Active buyers in the 12 months ended Dec. 31 totalled 868.7 million, an increase of 10% from 788.4 million for the comparable period. Annual spending per active buyer in the same 12-month period was 2,810 yuan, an increase of 33%.

“In 2021, we made the strategic shift from sales and marketing toward research and development.” Chairman and CEO Lei Chen said. “We see ourselves making more long-term investment, especially in agriculture and R&D.” Similar to the last two quarters, he added, management will allocate profits from the fourth quarter to the 10 Billion Agriculture Initiative to deepen the company’s digital inclusion efforts in agriculture.

“Our total revenue, excluding contribution from merchandise sales, was 27.1 billion yuan in the fourth quarter 2021. Our revenue growth slowed down due to moderating user growth and fluctuation in user activity,” Jun Liu, the Pinduoduo's vice president of finance, said. “At the same time, we recorded a profit in the fourth quarter, which is attributable to more controlled spending as we adjust to slower growth, and a one-off rebate from one of our service providers.”

For fiscal year 2021, total revenue was 93.9 billion yuan, representing an increase of 58% from 2020. The increase was primarily due to an increase in revenue from online marketing services and revenue from transaction services. Revenue from online marketing services and others were 72.56 billion yuan, representing an increase of 51% in 2020. Revenue from transaction services was 14.14 billion, representing an increase of 144% from a year ago.

Revenue from merchandise sales was 7.25 billion yuan for the year, an increase of 26%. Total costs of revenue were 31.7 billion yuan, an increase of 65% year over year. The company noted the increase was mainly due to higher payment processing fees, increased fulfillment fees and merchant support services.

Pinduoduo's total operating expenses were 55.33 billion yuan, compared with 49.59 billion in 2020. Sales and marketing expenses were 44.80 billion, an increase of 9% mostly due to increases in promotion and advertising activities.