The Mawer Canadian Equity Fund (Trades, Portfolio), part of Canada-based Mawer Funds, disclosed this week that its top-five trades during the second half of 2021 included a new position in Converge Technology Solutions Corp. (TSX:CTS, Financial), boosts to its holdings in Bank of Montreal (TSX:BMO, Financial) and iA Financial Corp. Inc. (TSX:IAG, Financial) and reductions to its positions in Suncor Energy Inc. (TSX:SU, Financial) and Canadian Natural Resources Ltd. (TSX:CNQ, Financial).

The fund seeks long-term capital appreciation by investing primarily in the stocks of larger-cap Candian companies. Mawer employs a disciplined, research-driven process to select high-quality stocks trading at a discount to intrinsic value.

The fund releases its portfolios semiannually. As of December 2021, the fund’s $4.30 billion equity portfolio contains 47 stocks, with one new position and a semiannual turnover ratio of 5%. The top three sectors in terms of weight are financial services, industrials and technology, representing 30.17%, 15.95% and 15.33% of the equity portfolio.

Converge Technology Solutions

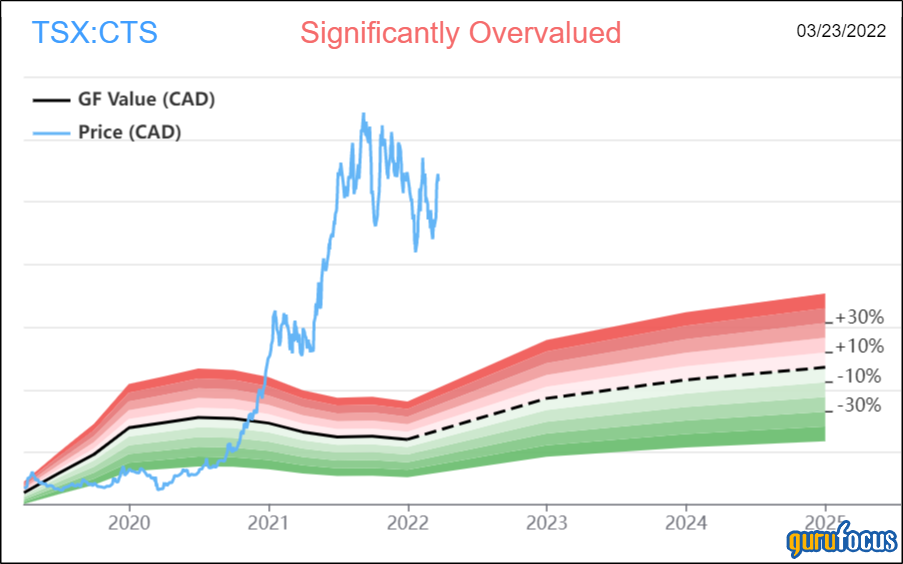

The fund purchased 4,766,500 shares of Converge Technology Solutions (TSX:CTS, Financial), giving the position 1.21% weight in the equity portfolio. Shares averaged 11.12 Canadian dollars ($8.85) during the fourth quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 3.93.

The Toronto-based software company has a GuruFocus financial strength rank of 8 on the back of a high Altman Z-score of 3.3 and debt ratios that outperform more than 90% of global competitors despite a low interest coverage ratio and a Beneish M-score that suggests possible earnings manipulation.

The Mawer New Canada Fund (Trades, Portfolio) also has a holding in Converge Technology Solutions.

Bank of Montreal

The fund added 182,225 shares of Bank of Montreal (TSX:BMO, Financial), boosting the position by 14.63% and its equity portfolio by 0.58%.

Shares of Bank of Montreal averaged CA$131.40 during the fourth quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 1.38.

The Montreal-based bank has a GuruFocus financial strength rank of 3 on the back of cash-to-debt and debt-to-equity ratios underperforming more than 86% of global competitors.

Gurus with holdings in Bank of Montreal’s U.S.-based shares (BMO, Financial) include Jeremy Grantham (Trades, Portfolio)’s GMO and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

IA Financial

The fund added 334,804 shares of iA Financial (TSX:IAG, Financial), expanding the position by 42.04% and its equity portfolio by 0.57%.

Shares of iA Financial averaged CA$71.35 during the fourth quarter; the stock is modestly overvalued based on Wednesday’s price-to-GF Value ratio of 1.11.

The Quebec-based life and health insurance company has a GuruFocus financial strength rank of 5 on the back of interest coverage and debt ratios outperforming just over half of global competitors.

Suncor Energy

The fund sold 655,882 shares of Suncor Energy (TSX:SU, Financial), curbing 17.55% of the position and 0.50% of its equity portfolio.

Shares of Suncor Energy averaged CA$27.98 during the fourth quarter; the stock is modestly undervalued based on Wednesday’s price-to-GF Value ratio of 0.85.

The Calgary, Alberta-based energy company has a GuruFocus profitability rank of 8 based on several positive investing signs, which include a high Piotroski F-score of 8 and profit margins and returns that are outperforming more than 67% of global competitors.

Canadian Natural Resources

The fund sold 328,400 shares of Canadian Natural Resources (TSX:CNQ, Financial), slicing 8.8% of the position and 0.38% of its equity portfolio.

Shares of Canadian Natural Resources averaged CA$47.24 during the fourth quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 1.42.

The Calgary, Alberta-based energy company has a GuruFocus profitability rank of 8 out of 10 based on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that outperform more than 80% of global competitors.

Also check out: