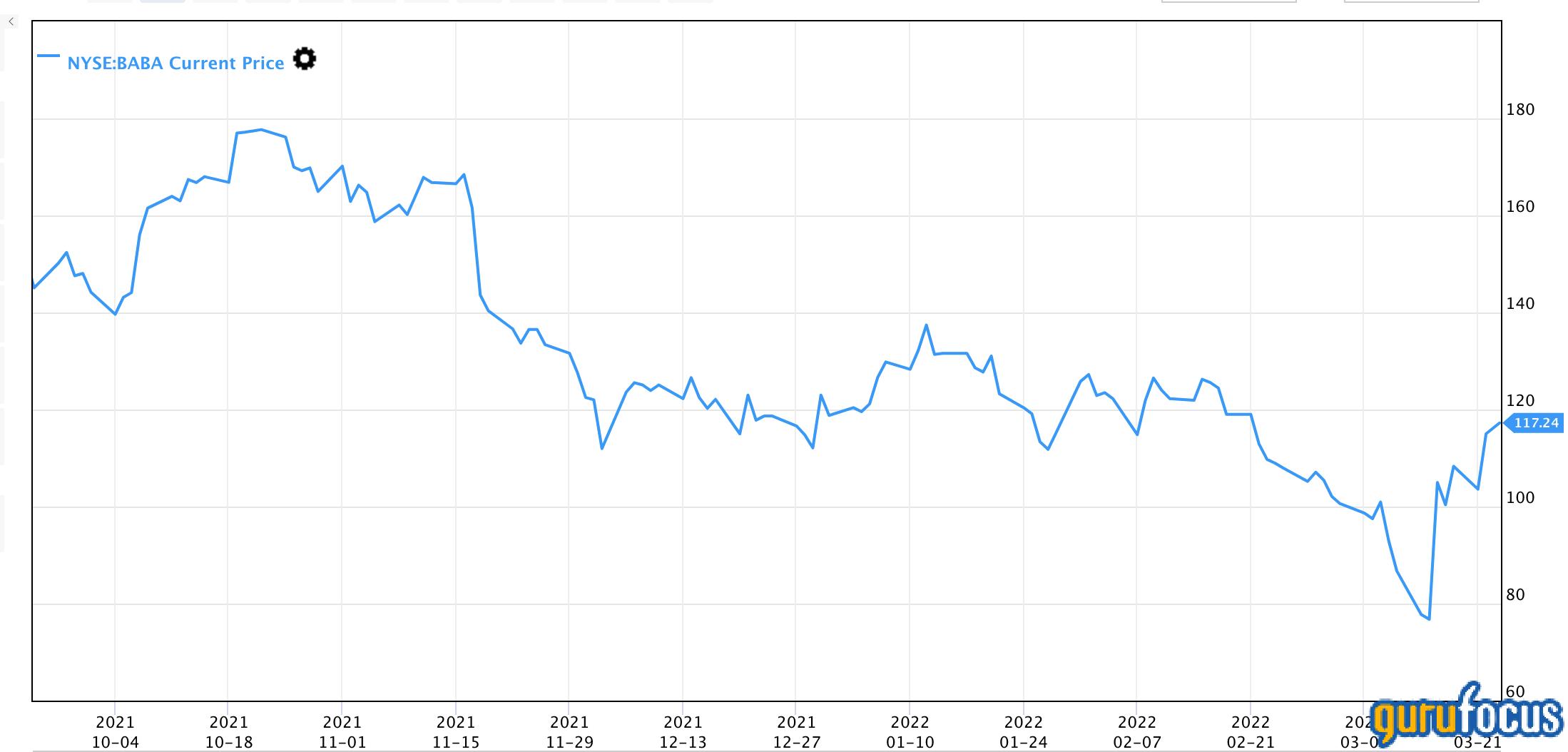

I've written a few articles in the past on why Alibaba (BABA, Financial) has struggled. The short version of those articles is, I was extremely bearish on the stock. However, I think the tides have turned for now. Alibaba is facing less systemic risk from both U.S. and Chinese regulators, and a variety of idiosyncratic factors have aligned for its shares, especially its American depositary receipts (which were down more than its China shares), to perform well. In fact, I'm now bullish on the stock; here's why.

Chinese stocks' trajectory

Chinese stocks, especially large-cap tech stocks, have been provided with a boost lately after central regulatory authorities provided their support to the economy and the financial markets in a statement that was quoted saying: "Regarding macroeconomic operation, we must implement the decisions and arrangements of the CPC Central Committee, effectively invigorate the economy in the first quarter, proactively respond to monetary policy, and maintain moderate growth in new loans."

Much of the downturn of Chinese stocks during the past couple of years has been due to the Chinese government's regulatory crackdown to combat technology firms' growing power.

Although the risk of de-listings of American depositary receipts such as Alibaba's persists due to a law passed by the U.S. Congress in 2020, the systemic risk across the board seems to have tapered for now.

A sleeping giant

Alibaba has been restricted by systemic risk for quite some time now, causing it to be somewhat of a sleeping giant. The company reported revenue worth $38.33 billion during its third quarter and $2.67 in earnings per share.

To elaborate, the firm posted a 13% increase in China retail commerce and a 26% increase in local consumer services. In addition, on an international front, Alibaba produced a 19% increase in global sales attributed to the rising activity in e-commerce.

The predominant factor that sets Alibaba apart from most of its rivals is that it's a company with a global presence. In 2021 alone, Alibaba's global commerce retail grew by 25%, suggesting that it's a universally integrated firm rather than a Chinese pure-play.

What about the de-listing risk?

The risk of the U.S. Securities and Exchanges Commission (SEC) de-listing Chinese stocks persists. However, with a more than 50% year-to-date downturn, it seems as though the market's priced it in for Alibaba. Alibaba's American depositary receipts will continue to hold excess risk until matters are completely smoothed with U.S. governing authorities, but negotiation progress has been made since last year.

Valuation

Alibaba's U.S. listing is a vastly undervalued asset. The shares are trading at a 61.32% discount to earnings, a 73.46% discount to sales and a 42.90% discount to its cash flows, suggesting that we're looking at a bargain.

Final word

I believe Alibaba is set to achieve the returns that most of its investors desired this time last year. Systemic risk has tapered, and a clear path to success is paved. The company blasted past its latest revenue forecast, with international sales being one of the catalysts. Furthermore, Alibaba's American depository receipts are undervalued and de-risked versus their historical average.