Tyler Technologies (TYL, Financial) may not be the typical hyper-growth tech play, but it is a highly stable company dealing in a relatively underrated domain – government software. The company has achieved decent top-line growth over the years, and its recent acquisition of NIC is being integrated well into the organization and generating strong synergies.

Tyler delivered a strong finish to 2021 with organic growth in the high-single digits despite pandemic-induced headwinds such as lengthening sales cycles, budgetary pressures on clients and so on. Let us take a closer look at the company and why I believe it has potential as a long-term investment, even if its valuation may seem a bit pricey.

Strong positioning and steady growth

Tyler Technologies is the dominant player in a sluggish and underserved segment of government operational software. Given its positioning, I believe the company has a 10-year runway for double-digit top-line growth, particularly given software-as-a-service (SaaS) demand and the need to update legacy enterprise resource planning methods in local governments grow.

Tyler works with cities, counties, schools, courts and other local government entities to meet their needs. Existing core systems at customer sites are at least 20 years old, running on ancient software code, with no incoming wave of fluent programmers to keep them running.

Tyler is also moving away from core solutions and toward more transactional recurring revenue through various channels. Over the last five years, the primary sources of these revenues have been e-filing for court documents and local village hall web portals for essential services like paying a water bill online. Given Tyler's core systems, which enable governmental units' normal operations, such as financial management, human resources, revenue management, tax billing and asset management, as well as an extremely slow-moving customer base and the typical long-tail investment in such core software systems, I believe customer retention will remain extremely high and excess returns will remain for at least the next 20 years.

In addition, the company believes that government buyers are increasingly following enterprise customers' lead in seeking best-in-class functionality and more sophisticated total cost of ownership considerations over price comparisons. Combining these factors creates a barrier to new competitors, and while it is possible to replicate Tyler's services, it would be costly and time-consuming.

Tyler also benefits from a fragmented market, with no companies of comparable size or scale focused on the local public sector. Tyler is inching toward representing the path of least resistance to prospective customers. It has established itself across the United States and is moving toward state and even federal deals, especially after the Socrata and NIC acquisitions.

The NIC acquisition

Tyler Technologies went on to acquire NIC in April 2021 in an all-cash transaction valued at approximately $2.3 billion. NIC is a leading digital government solution and payments company that serves more than 7,100 federal, state and local government agencies.

There is a pandemic-led shift of government to online services and electronic payments as more citizens and businesses are interacting digitally with the government. NIC is well equipped to deliver user-friendly digital services such as applying for unemployment insurance, submitting business filings, renewing licenses, accessing information and making secure payments without visiting a government office.

This acquisition brings together Tyler’s strength in local government and NIC’s strength in state government, which is expected to expand the business significantly by bringing vertical applications to clients. Tyler has a history of successful acquisitions, and I believe NIC will contribute meaningfully to the top-line growth of the company.

SaaS transactions driving revenues

Tyler has made significant progress in 2021 in terms of various SaaS transactions bringing in revenue stability. The company entered into a five-year extension of its e-filing arrangement with the Texas Office of Court Administration valued at $98 million. The extension includes a Scrota-based interactive reporting layer that eliminates hundreds of hours of manual reporting.

Apart from this, the company’s largest new SaaS deal was with Jackson County, Missouri for its iasWorld appraisal and tax solution as well as appraisal services valued at approximately $18 million. Other significant contracts signed include multi-suite license arrangements for the company’s Munis ERP and SaaS agreements for EnerGov civic services solutions and public safety solutions.

The company made 10 SaaS deals and three license contracts for various solutions, each valued at over $ 1 million each. In their recent quarterly results, the management announced a deal with the Colorado Division of Real Estate for a new combination license and SaaS deal worth nearly $1 million for their case management and development platform, enterprise data platform and NIC's electronic payment solution. The company has been able to cross-sell multiple Tyler solutions in a single deal.

Valuation

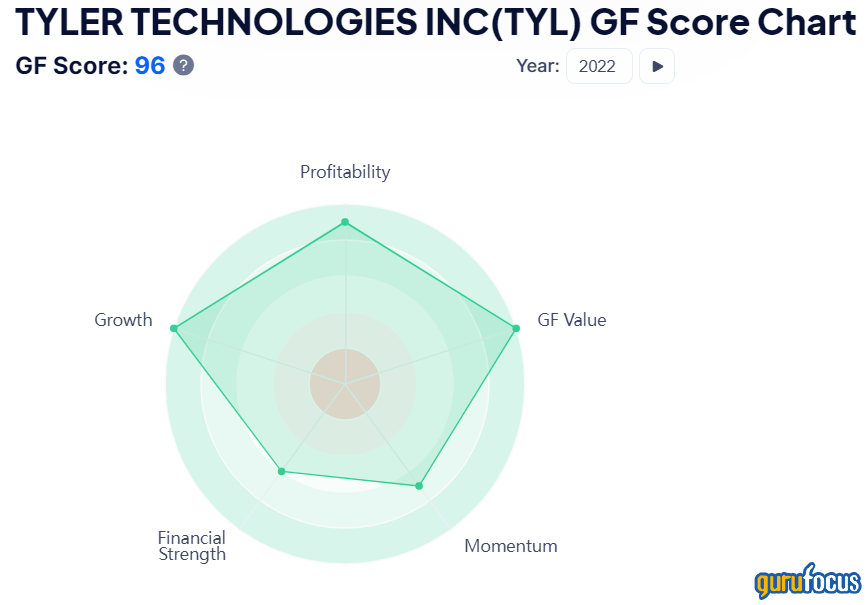

As we can see in the above GF Score chart, Tyler has a GF Score of 96, indicating that it is offering immense value at its current price given its decent growth prospects and profitability.

While its current enterprise-value-to-revenue multiple of 11.8 and its price-earnings ratio of 112.4 are by no means cheap, especially for a company that is growing slower than most of its software industry peers, Tyler’s premium is largely associated with the strong foreseeability of business given its long contracts with government entities. Despite the recent stock correction, Tyler can still be considered a bit pricey, but there is no doubt that its fundamentals and growth prospects are strong.