Founded in 1916, Chicago-based Boeing Co. (BA, Financial) designs, develops, manufactures, sells, services and supports commercial jetliners, military aircraft, satellites, missile defense systems and human space flight launch systems. The company operates under 4 business segments: Commercial Airplanes, Defense, Space & Security, Global Services and Boeing Capital.

Boeing is the largest aircraft manufacturer in the U.S., competing against its European counterpart, Airbus SE (EADSF, Financial). The company is also one of the largest components of the Dow Jones Industrial Average, but its stock has taken a beating this year and is down almost 10%. The recent crash of a China Eastern Airlines flight did not help the market performance of Boeing's stock, but a closer look at the possible impact of this crash suggests the company is unlikely to face dire financial consequences resulting from this catastrophic event, so contrarian investors might find this to be a good opportunity to get some exposure to Boeing.

What we know about the crash

Boeing made it into the headlines yet again last week following reports of one of its aircraft crashing.

Flight MU 5735, a Boeing 737-800 aircraft carrying 123 passengers and nine crew members, crashed in Southern China on March 21. As per the video footage, the aircraft headed toward the ground in an extremely steep descent before crashing into the wooded mountains, leaving no survivors. The investigations are still going on, so it is too early to arrive at any definite conclusions as to the cause. The cockpit voice recorder was recovered last Wednesday and the flight data recorders manufactured by Honeywell International Inc. (HON, Financial) were recovered on Sunday. The engine of this model was manufactured by CFM International, a 50-50 joint venture between General Electric Co. (GE, Financial) and France-based Safran (XPAR:SAF, Financial). This aircraft was delivered to China Eastern Airlines in 2015 and has been in operation ever since.

On the day of the crash, the stock sank to $180 from just over $192 as investors weighed the possibility of Boeing’s 737-800 aircraft being grounded, but soon recovered as experts suggested the crash might not be the result of a manufacturing error.

Not similar to other recent crashes

The China Eastern crash brought back memories of the Lion Air crash in 2018 and the Ethiopian Air crash in 2019, two catastrophes that involved Boeing's 737 MAX aircraft. The 737 MAX family first came into action in 2016, so the aircraft that were involved in these crashes were relatively new. In both instances, the recovered flight data showed the pilots were unable to control the aircraft’s movements because of a software malfunction in the automated system that pushed the aircraft down despite efforts to point the nose up. At the time of the crashes, 30 airline carriers operated the MAX. These companies were then forced to ground the aircraft to ensure customer and crew safety. More than 40 countries banned the MAX from entering their airspace as well. Unsurprisingly, these negative developments ended up costing Boeing millions of dollars in lost revenue and legal fees.

The China Eastern crash, however, involved a 737-800 jet, which Bloomberg reported is considered one of the safest aircraft to have ever been manufactured. There are approximately 4,200 Boeing 737-800s in service globally, and in its 25-year operating history, only nine fatal accidents have been reported. Unlike the 737 MAX, which was relatively new in 2019, the 737-800 model has a strong track record, which suggests a worldwide grounding of the aircraft is highly unlikely at this point.

Boeing is slowly getting back on track

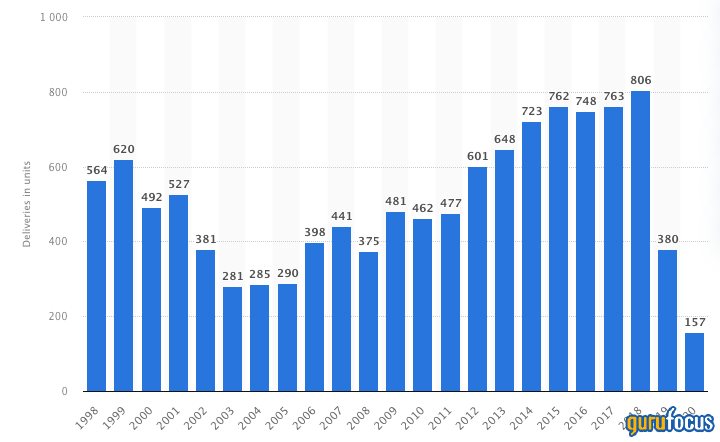

The end of mobility restrictions and increasing travel demand are likely to benefit the sale of new Boeing jets, especially the MAX. The company has been working on upgrading the trim wheel issues and the maneuvering characteristics sugmentation system to better identify sensor data, while explicitly training pilots on the special features of Boeing 737 MAX aircraft to avoid debacles in the future. As illustrated below, Boeing’s aircraft deliveries reached a new low in 2020 because of the issues with the 737 MAX and the lackluster demand for air travel due to the Covid-19 pandemic.

Boeing’s aircraft deliveries from 1998 to 2020

Source: Statista

Last year, Boeing delivered 340 aircraft, 245 of which were MAX jets. The strong comeback suggests airline carriers have already moved past the catastrophic events in 2018 and 2019 to focus on the multitude of benefits offered by these new aircraft, such as increased fuel efficiency and more value for money in terms of in-flight technology. With many airline companies looking for ways to remain competitive by achieving cost efficiencies, the 737 MAX is likely to become a cash cow for Boeing in the next several years.

Long runway for growth

Many carriers have been upgrading their fleets as concerns related to fuel efficiency and carbon emissions take center stage. For instance, United Airlines Holdings Inc. (UAL, Financial) purchased 200 Boeing 737 MAX aircraft along with 70 Airbus 321 Neo aircraft last year. On the other hand, the U.S. government is looking to strengthen the country’s defense system by investing $753 billion in the coming years, which could prove to be a tailwind for Boeing given its expertise in defense systems.

With the anticipation of greater demand, the company plans to boost the production of 737 aircraft to around 38 per month by the first half of this year and 47 per month by the second half of 2023. As per numbers released in January, Boeing is currently manufacturing 27 aircraft per month. Before being grounded, Boeing was producing 52 MAX jets a month, which suggests the company can indeed boost its production rates even further if the demand recovers from here, which is likely to happen as the travel sector finally makes a comeback from the recession lows.

Takeaway

The recent Boeing crash in China has seemingly affected investors' confidence in the company, but the accident is still under investigation and the footage suggests it might not have anything to do with a malfunctioning system. As one of the leading manufacturers of aircraft, Boeing seems well positioned to grow in the coming years as a supercycle of aircraft upgrades is likely to happen sooner rather than later as airline companies are coming under pressure to reduce carbon emissions and have a positive impact on achieving sustainability goals. The recent drop in Boeing's stock price presents a good opportunity for contrarian investors who are focused on long-term capital gains.