Climage change is heating up, so governments around the world are investing huge sums to encourage the transition toward renewable energy.

As a result, President Joe Biden recently announced a plan to have 45% of the U.S. energy supply come from solar by 2050. In addition, solar panels are becoming more accessible to the average person. According to a study by the International Renewable Energy Agency, the global weighted average cost of electricity from solar photovoltaics could fall by as much as 59% by 2025. With the rising cost of traditional fossil fuels due to the Ukraine-Russia crisis, the case for solar energy is even more compelling.

Thus, certain solar energy companies are poised to ride a tailwind of initiatives and trends. Here are my top three.

First Solar

First Solar Inc. (FSLR, Financial) is first on this list as a leading solar panel manufacturer. The company's unique product is a thin film module which performs better than competitor products even in less-than-ideal conditions such as low light or extremely hot weather. In addition, these unique panels are larger in size, resulting in a lower cost per watt. This makes them particularly appealing to utility companies and large setups.

The company's revenue was up 7% in 2021 to $2.9 billion. Although not a massive growth rate, the company's profitability has increased from $317 million in 2020 to $587 million in 2021, an incredible increase of 85%. With a super strong balance sheet that consists of $1.8 billion in cash and just $240 million in long-term debt, First Solar is poised to invest for growth.

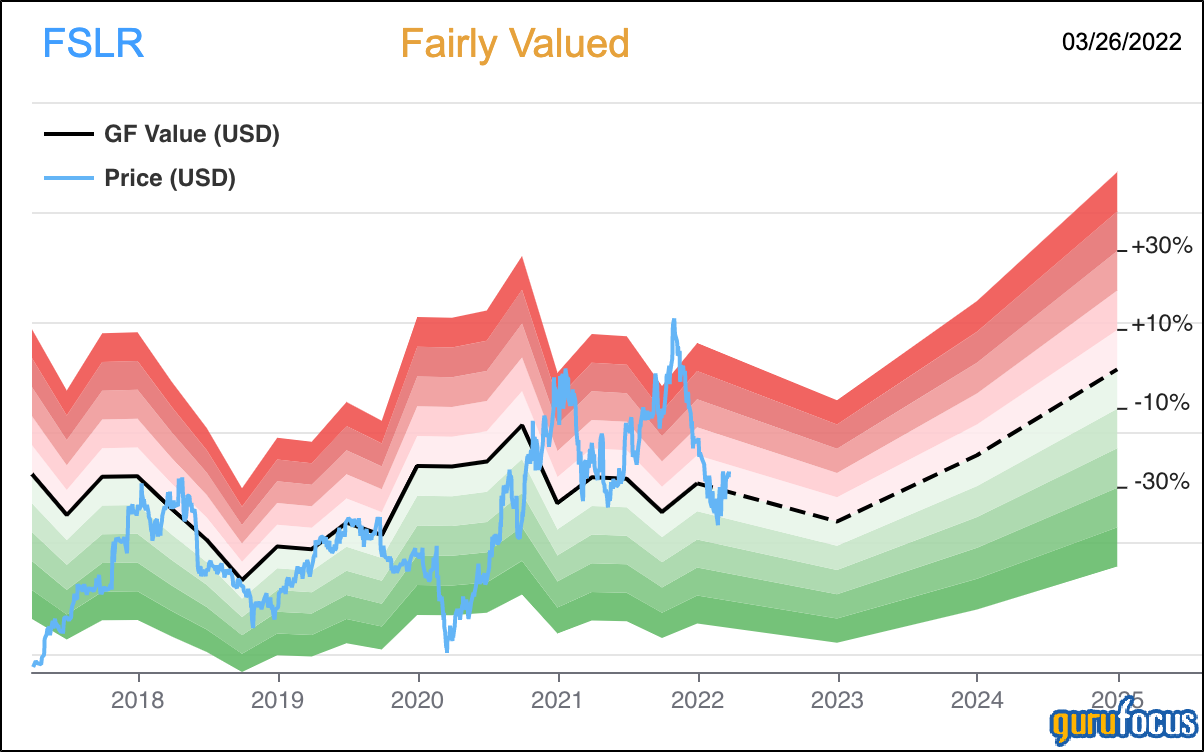

According to the GF Value Line, which takes historical ratios, past financial performance and future earnings projections into consideration, the stock is fairly valued at its current levels.

Canadian Solar

Canadian Solar Inc. (CSIQ, Financial) is a global provider of solar panels, but, despite the name, doesn’t do much business in Canada. The company produces solar panels in China and provides asset management services, in which it retains some solar projects for consistent cash flow. It is also an early mover in the energy storage market, which has great prospects.

Canadian Solar has a more aggressive approach to revenue growth. With a more leveraged strategy, the company's revenue has grown 51% from $3.4 billion in 2020 to $5.2 billion in 2021. However, profits are still playing catch up as the company invests heavily in growth. The operating profit of $190 million was down from $220 million in 2020.

According to the GF Value Line, the stock was fairly valued at the time of writing.

Sunnova Energy International Inc. (NOVA, Financial) is a leading residential solar company based in the U.S. The company had over 195,400 customers as of the end of 2021, triple the number of customers compared to 2020.

The company's revenue has grown 50% over the past year, but it is still operating at a loss, losing $64 million in 2021. The good news is Sunnova expects to reach profitability by 2023.

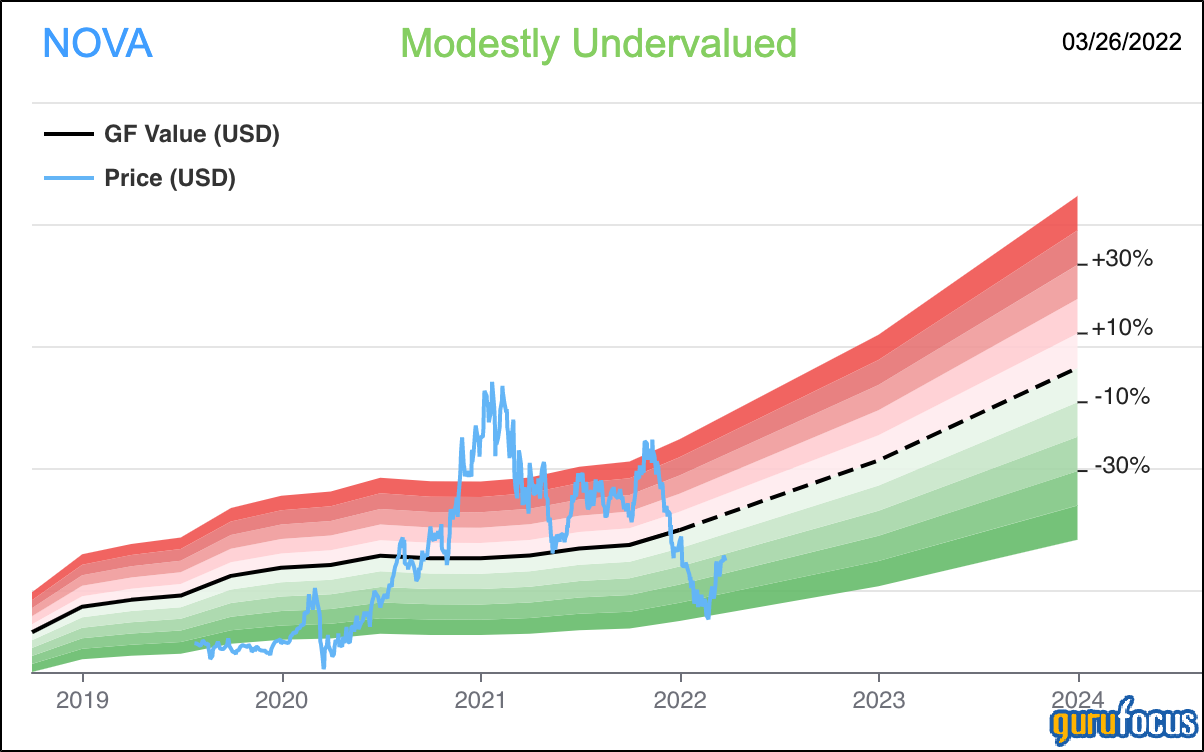

The GF Value Line indicates the company was modestly undervalued at the time of writing.

Final thoughts

Climate change, lower photovoltaic panel costs and rising fossil fuel costs all make an attractive case for the solar industry. These three companies have different strategies, but are all seeing their fundamentals improving, which makes a great case for a long-term investment opportunity.