Energy Transfer's (ET, Financial) stock has skyrocketed by 34.70% since the start of 2022. The company's midstream operations have produced significant success lately, and its operational success will likely traverse into further stock gains. Shares have been further boosted by a lucrative natural gas deal with China. Here's why I'm bullish on the stock.

Chinese pipeline deal

Energy Transfer has signed two sale and purchase agreements with China's ENN Natural Gas (SHSE:600803, Financial) and ENN Energy Holdings Limited (HKSE:02688, Financial) to deliver approximately 2.7 million metric tons of Liquified Natural Gas (LNG).

According to Energy Transfer's president, Tom Mason, "We are very pleased to have ENN as a customer. The execution of these two SPAs represents a significant event in moving the Lake Charles LNG project towards FID. We are experiencing strong demand for long-term offtake contracts for Lake Charles LNG, and we are optimistic that we will be in a position to take a positive FID by year-end."

The deal caused the stock to surge by 4.34% on the day of the announcement, March 29, suggesting that the market has aligned itself with Energy Transfer's progress in China.

Systemic support

Energy Transfer's correlation with the energy sector is apparent by observing its alignment with the Energy Select Sector SPDR ETF.

The business' infrastructure services are thriving due to heavy spending in the energy space, with the sector achieving $1.5 trillion in CapEx during 2021.

Due to sustained elevated prices and a global short supply of evergy, we'll probably experience further growth among energy producers' profits for the rest of the year. Thus, ancillary businesses such as Energy Transfer could prosper in the short to medium term as producers compete for transportation capacity.

Stellar dividends

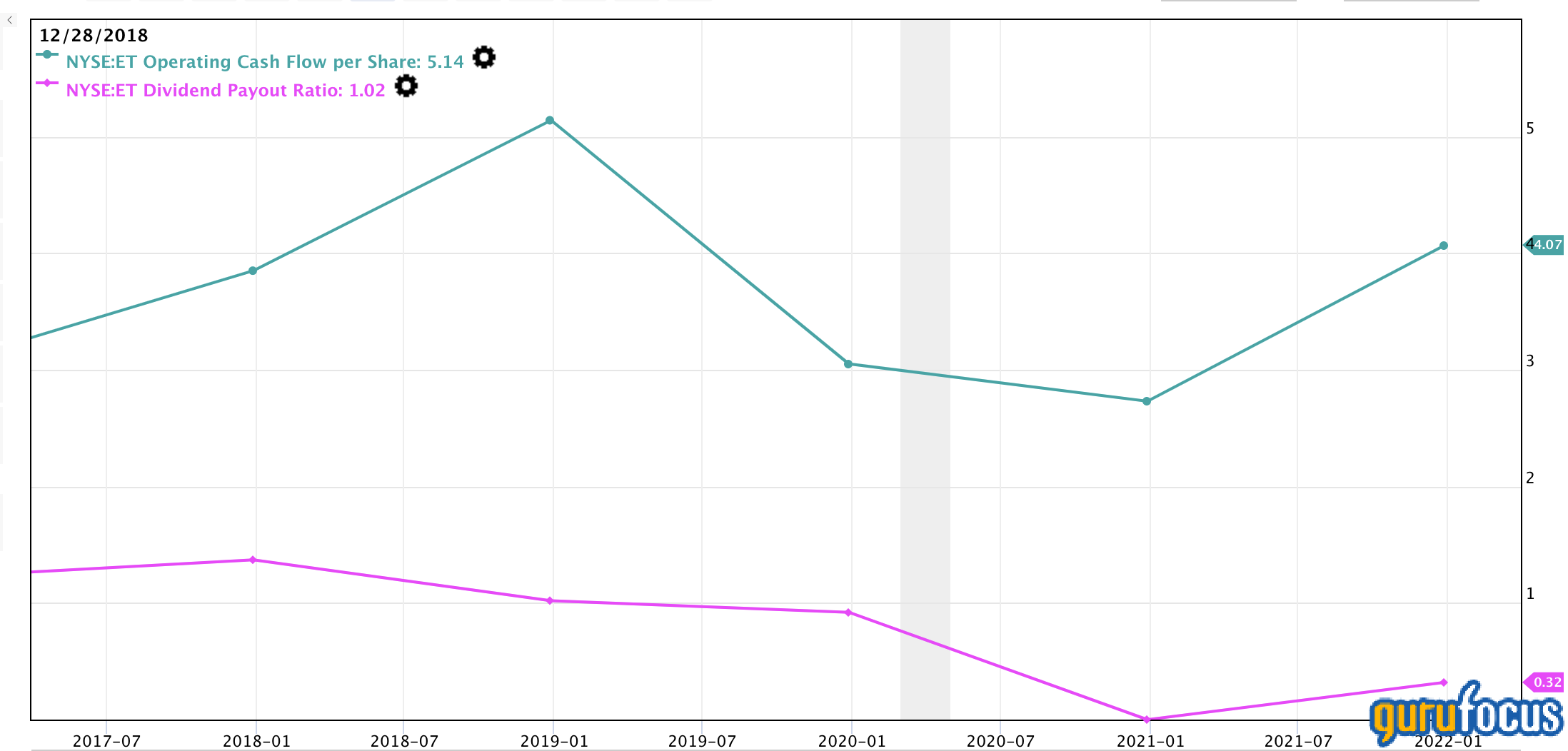

Evergy Transfer's stock is one of the main dividend attractions on the market, in my opinion. Energy Transfer has a forward dividend yield of 6.33% with a coverage ratio of 1.33. Additionally, the company's operating cash flows have blossomed lately, indicating that it's a well-covered income-generating investment for many.

The bottom line

To conclude, Energy Transfer is in great shape as demand for its services has been ignited by a surging energy sector. The company's latest pipeline deal could add much value to the firm's existing operations, in turn sustaining attractive dividend payouts.