Short sellers evaluate companies, including their financial statements, business models, management and other items, forensically. Why? They want to reap a big profit by shorting the stock. Examples of fraud include Enron, WorldCom, Wirecard and numerous other companies.

How about we evaluate a company to discover the hidden value? Both present and future value. To find a gem, we don’t have to chase hot, soaring stocks.

How about ancient Xerox Holdings Corp. (XRX, Financial)? Xerox has survived so many ups and downs and can flourish again, in our opinion.

Source: Xerox Presentation

A stable ship

What are Xerox's market cap and enterprise value? We chose two popular financial sites to find the values.

The enterprise value being double the market cap implies Xerox owes a sizable debt. Here is one of the slides from the company's presentation:

Now let's take a look at Xerox's balance sheet as reported for December 2021. We have rounded off the numbers, so you may see some discrepancies compared to other documents:

- Short- and long-term debt = $4.246 billion = Rounding up to $4.3 billion

- Cash and cash equivalents = $1.9 billion

- Net debt = $4.3 billion - $1.9 billion = $2.4 billion

But when we examine balance critically, we find one entry - $3.1 billion of finance receivables.

So now Xerox does not owe money, but rather has net cash.

- Net debt = $2.4 billion

- Financial receivable = $3.1 billion

- Net cash = $3.1 billion - $2.4 billion = $0.7 billion

We believe the company’s enterprise value should be reported as $3.021 billion - $0.7 billion = $2.321 billion.

A company worth $2.321 billion will generate free cash flow of about $400 million in 2022. So currently, Xerox is trading approximately six times its 2022 free cash flow.

How many companies trade at less than six times free cash flow? Many hot and rising stocks have zero to negative cash flow.

Xerox noted in its presentation that by 2023-24, it expects free cash flow of $450 million to $500 million per year.

Source: Xerox Presentation

Business update

We know Xerox's unsexy Print and Services business is declining.

FITTLE finances the equipment it sells. The company may start financing other companies' sale of equipment also. If Xerox does not make mistakes, equipment financing can generate a solid return on employed capital.

So far, Xerox has only securitized $0.56 billion out of $2.9 billion of FITTLE’s debt. For the remaining $2.3 billion, Xerox is liable, even though $2.9 billion is secured by the receivables. If the recession decreases collection of accounts receivables, Xerox will sustain the loss; currently, FITTLE is not contributing toward the free cash flow. In other words, FITTLE can cause losses, but does not add to free cash flow at this time.

Incidentally, we, naive about corporate finance, don't understand why Xerox has not securitized all $2.9 billion of FITTLE’s debt. Xerox management employs experts in financial engineering. Even the largest shareholder, Carl Icahn (Trades, Portfolio), is familiar with the finer points of passing risk on to others, by securitizing debt.

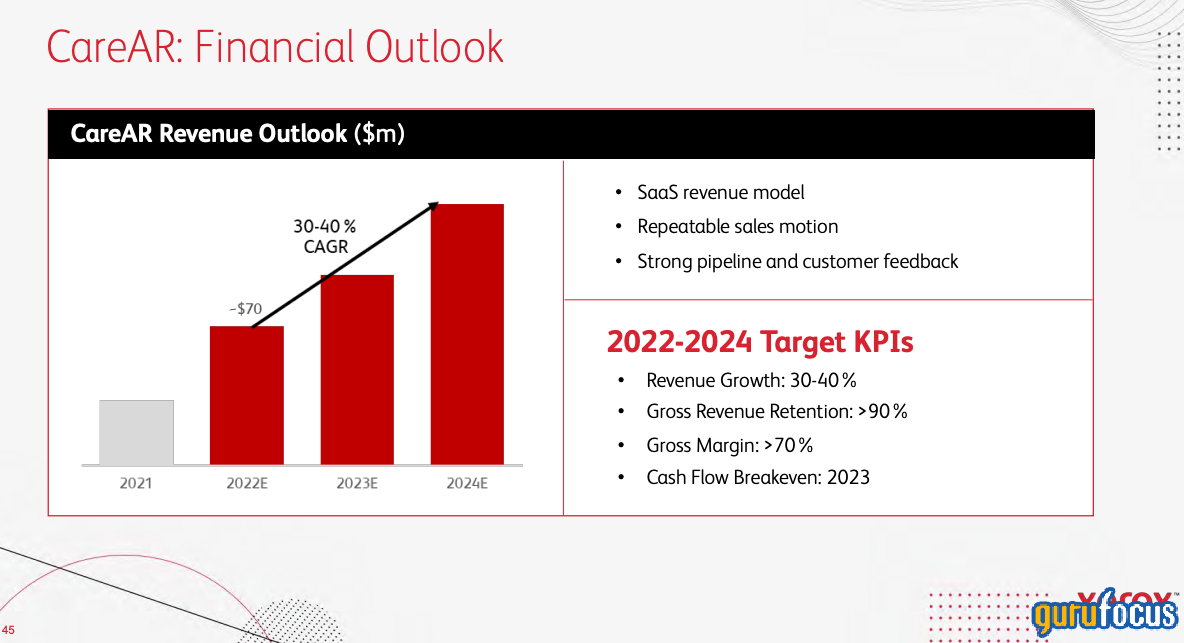

Xerox bought CareAR, which uses subscriptions to deliver an augmented (reality) customer experience. With labor shortages, the CareAR business can grow substantially.

Source: Xerox Presentation

Source: Xerox Presentation

The company has projected the valuation of three businesses as follows:

Source: Xerox Presentation

For clarity, we reformatted the slide as follows:

The above projections imply Xerox's equity value rangese between $32 and $58. Compare the projected share price to the current share price of $19.32. I will be delighted if the $32 projections come to pass; that’s a gain of 60%. While I am awaiting a potential 60% gain, I will collect a 5.32% yield. Which bank or the financial company returns 5% on the invested money?

Cloud Nine

Xerox is acting like a startup. If one of the following business units takes off, Xerox's stock price can substantially increase.

Source: Xerox Presentation

Source: Xerox Presentation

In the past, unfortunately, Xerox has not monetized its innovations. We wish them the best this time.

Management

As a major shareholder, Icahn nominated some members of his firm to Xerox's board of directors. Naturally, the successful investor does not want to lose money. The management team seems experienced and shareholder-friendly. Time will tell, however.

Competition

The Print and Services business faces tough competition from Brother Industries Ltd. (BRTHY, Financial), Lexmark International Inc. (LXK, Financial), Canon Inc. (CAJ, Financial), HP Inc. (HPQ, Financial) and other companies. So many companies engage in equipment financing. Competitors to CareAR will also likely spring up.

Limitations of our analysis

We interpreted net cash on the Xerox balance sheet differently than most analysts. Are we right in our interpretation? You decide for yourself.

The businesses of FITTLE and CareAR may not take off.

PARC's pie-in-the-sky ideas may stay in the research lab and might not get commercialized.

Conclusion

In 1938, Chester Carlson invented xerography, an imaging process. Joseph C. Wilson, credited as the "founder of Xerox", saw the promise of Carlson's invention and, in 1946, signed an agreement to develop it as a commercial product. Xerox was born.

Xerox became a fixture for small and large businesses. No wonder it became part of the business lexicon.

Steve Jobs visited the Xerox PARC facility, which resulted in a revelationary moment, a graphical user interface. All of us use a graphical user interface every day.

We believe Xerox's old business can continue to provide decent cash flow while other businesses take off.

As Xerox's valuation has declined significantly, another company headed by strong leaders may purchase it to take advantage of low interest rates. Will Icahn agree to sell the company? Yes, if he gets a pretty penny.

We do not engage in day trading, so we don’t expect Xerox to double overnight. It may take some time for investors to realize Xerox's intrinsic value. Regardless, we believe at the current price Xerox offers an appealing opportunity for long-term investment with a time horizon of three to five years.

Disclaimer

We have a beneficial long-term position in the shares of Xerox either through stock ownership, options, or other derivatives. We wrote this article to express our opinions. We are not receiving compensation from any individual or entity for it.

If the management makes mistakes, the economy tanks, competitions give away printers at no charge, Carl Icahn (Trades, Portfolio) loses interest in Xerox, or for any other reason, Xerox’s stock price can decline dramatically. We do not guarantee that Xerox stock price will increase but we say clearly and loudly that as we believe that Xerox is undervalued, we invested our own money in Xerox.

You should not treat any opinion expressed in this article as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of our opinion. This is not investment advice. Before you invest in anything you might possibly read in our articles or those of the other people offering investment advice online, do your own research to verify the soundness of what you might have read. Please consult your investment advisor before making any decisions.