Chase Coleman (Trades, Portfolio), founder of Tiger Global Management and one of Julian Robertson (Trades, Portfolio)’s former “tiger cubs,” disclosed earlier this week he cut back his stake in VTEX (VTEX, Financial) by 40.59%.

The guru’s New York-based hedge fund, which was established in 2001, is known for focusing on small-cap stocks and technology startups, having been an early investor in companies like Facebook Inc. (FB, Financial) and Spotify Technology SA (SPOT, Financial).

According to GuruFocus Real-Time Picks, a Premium feature based on 13D and 13G filings, Coleman sold 4.6 million shares of the London-based software company on March 30, impacting the equity portfolio by -0.07%. The stock traded for an average price $6.95 per share on the day of the transaction.

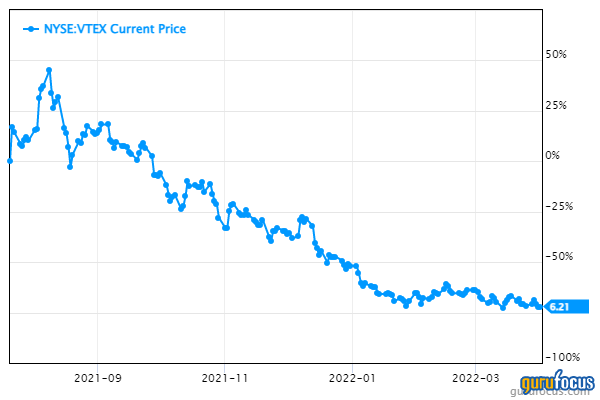

He now holds a total of 6.72 million shares, accounting for 0.10% of the equity portfolio. GuruFocus estimates Coleman has lost 74.13% on the investment since establishing it in the third quarter of 2021.

The tech company, which provides a digital commerce platform for enterprise brands and retailers to build online stores, integrate and manage orders across channels and create marketplaces to sell products from third-party vendors, has a $1.17 billion market cap; its shares were trading around $6.13 on Friday with a price-book ratio of 3.67 and a price-sales ratio of 9.42.

Since its initial public offering in July 2021, the stock has tumbled nearly 75%.

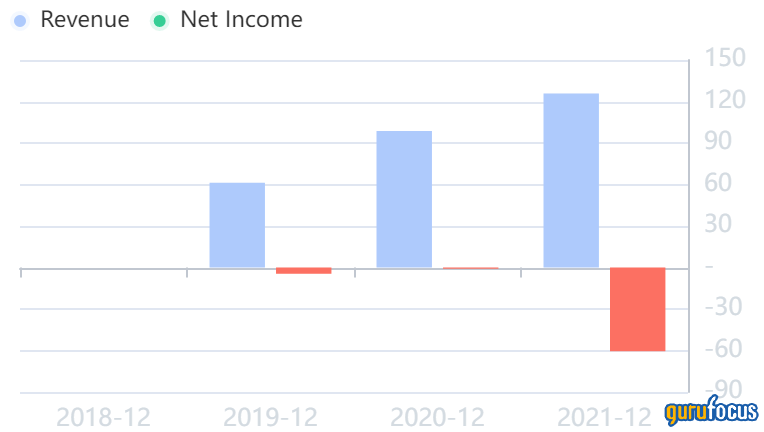

On Feb. 24, VTEX reported its financial results for the fourth quarter and full fiscal 2021.

For the three months ended Dec. 31, the company posted a net loss of $10.9 million on $37.1 million in revenue. While revenue grew 27.5% from the prior-year quarter, the net income loss widened. Gross merchandise value also increased 14.7% to $2.9 billion.

As for the full year, VTEX recorded a net income loss of $60.5 million on $125.8 million in revenue. Both figures were up from 2020. GMV gained 29.1% to $9.7 billion.

GuruFocus rated VTEX’s financial strength 8 out of 10. Although the Sloan ration is indicative of poor earnings quality, the robust Altman Z-Score of 8.4 indicates the company is in good standing.

The company’s profitability did not fare as well, scoring a 2 out of 10 rating due to negative margins and returns on equity, assets and capital that underperform a majority of competitors. VTEX also has a low Piotroski F-Score of 3 out of 9, meaning operations appear to be in poor shape.

Despite the reduction, Coleman remains VTEX’s largest guru shareholder with 3.52% of its outstanding shares. Steve Mandel (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Paul Tudor Jones (Trades, Portfolio) also had positions in the stock as of the end of the fourth quarter of 2021.

Portfolio composition

Over half of Coleman’s $53.76 billion equity portfolio, which was composed of 169 stocks as of Dec. 31, was invested in the technology sector.

Other software companies the guru was invested in as of the end of the fourth quarter included Microsoft Corp. (MSFT, Financial), Snowflake Inc. (SNOW, Financial), CrowdStrike Holdings Inc. (CRWD, Financial), ServiceNow Inc. (NOW, Financial) and Workday Inc. (WDAY, Financial).

Also check out: