Accenture (ACN, Financial) is a global consulting powerhouse which specializes in IT and professional services. The firm boasts three quarters of the Fortune Global 500 as clients, and of their top 100, 98 have been with them for over 10 years. Accenture has seen tremendous revenue growth over the past few years, hitting $50.5 billion in revenues in 2021, up 14% year-over-year.

Legendary value investor Joel Greenblatt (Trades, Portfolio) was also buying shares of accenture during the fourth quarter of 2021, during which shares traded for an average price of $346. Since then, the share price is down 6% from the quarter's average. In addition, activist investor Daniel Loeb (Trades, Portfolio) and value investor Paul Tudor Jones (Trades, Portfolio) were also buying Accenture in the fourth quarter, though overall, there were more gurus selling the stock than buying it.

Let's dive into Accenture's business model, financials and valuation to see what it is about the company that has such famous gurus interested in the stock.

Let's dive into Accenture's business model, financials and valuation to see what it is about the company that has such famous gurus interested in the stock.

Business model

Accenture is a global consulting firm which caters to over 75% of the Fortune 500. The firm focuses on delivering “360° value," which they define as the financial business case and unique value a client may be seeking. They generally focus on helping large enterprises digitally transform their operations, boost revenue growth and streamline operations.

Their services include: Strategy and Consulting, Interactive, Technology and Operations. These services are offered across five industry groups: Communications, Media and Technology, Financial Services, Health and Public Service and Products and Resources.

In order to provide these services, Accenture's people are their key, and they currently employ a mind-blowing 624,000 people globally. They invested $900 million in learning and development for their employees and have over 8,200 patents. This represents a technology moat for the business.

Strong financials

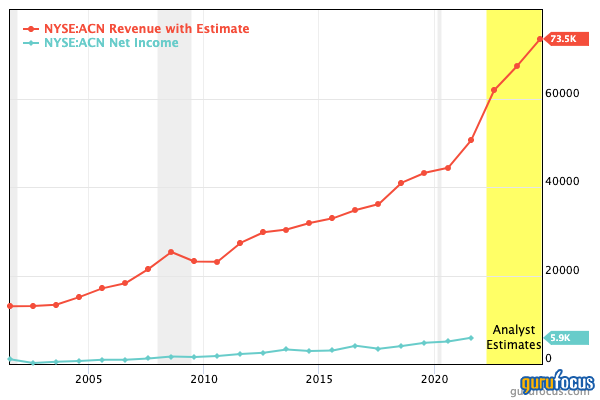

Accenture has been growing revenues strong over the past few years. In 2021, the firm achieved $50.5 billion in revenue, which represented 14% growth year-over-year. Their gross margin increased 1% to a healthy 32.4% and they achieved an operating margin of 15.1%, which was an increase of 40 basis points compared to 2020.

Accenture's balance sheet is strong with $8 billion in cash and just $53 million in long-term debt. They have an annual dividend yield of 1.14% and were buying back $3.7 billion worth of shares in 2021, which shows confidence in the business.

Accenture is also investing heavily into acquisitions, with $4.2 billion spent on 46 acquisitions in 2021 alone. In addition, they invested $1.1 billion in research and development, which is usually a trait of firms which provide long-term value.

Is the stock undervalued?

In terms of valuation, the GF Value chart suggests the stock is modestly overvalued at today’s price.

Final thoughts

I believe Accenture is a fantastic firm and truly is a consulting powerhouse. They are poised to continue to ride the wave of IT transformation, and the financials are a record of the business model's success. In terms of valuation, though, the GF Value suggests the stock is modestly overvalued, and I am inclined to agree with this assessment, especially given the number of undervalued technology stocks in the market currently.