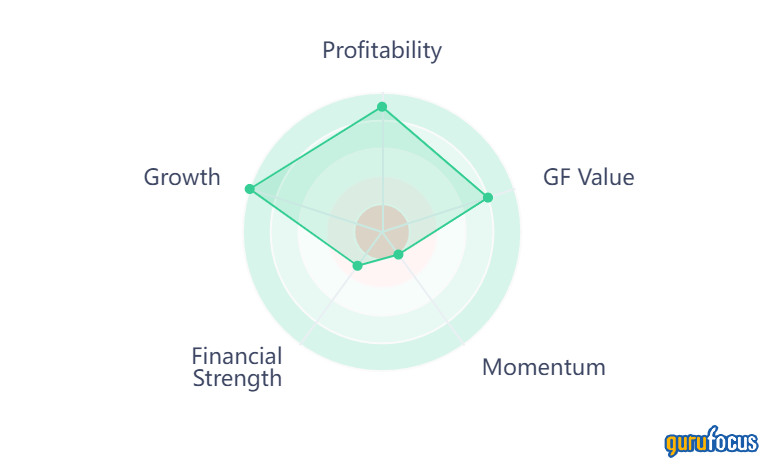

GuruFocus recently released a new stock ranking system called the GF Score. This ranking system, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021, is based on the following five key aspects:

- Financial Strength

- Profitability

- Growth

- Valuation

- Momentum

The GF Score ranges from 0 to 100, with 100 as the highest rank. The backtesting results found that stocks with a higher GF Score generally generate higher long-term returns than those with lower GF Scores. You can read more about the calculations and reasoning behind the GF Score here.

With the clean energy sector beginning to rebound from its 2021 price correction, and with the market for clean energy expected to grow at a compound annual growth rate (CAGR) of 8.4% through 2030 according to a report from Allied Market Research, I used the GuruFocus All-in-One Screener, a Premium feature, to search for the clean energy stocks trading with the highest GF Scores.

In this discussion, we will take a look at the top three stocks from this screen: SolarEdge Technologies Inc. (SEDG, Financial), Northland Power Inc. (TSX:NPI, Financial) and Solaria Energia y Medio Ambiente SA (XMAD:SLR, Financial).

SolarEdge Technologies

SolarEdge Technologies (SEDG, Financial) is an Israeli photovoltaics company that primarily produces power optimizers, solar inverters and monitoring systems that are aimed at increasing the energy output of solar power arrays.

The GF Score for SolarEdge is 87 out of 100, driven by high ranks for growth, momentum, profitability and financial strength and hindered only by a low GF Value rank.

Key metrics include a three-year revenue per share growth rate of 21.6%, an Altman Z-Score of 8.72 and return on invested capital that exceeds the weighted average cost of capital. The GF Value chart rates the stock as modestly overvalued:

SolarEdge has been a go-to component supplier for residential solar installers over the past decade. It has also expanded into commercial solar and energy storage. Increased competition has been slowing down growth as more companies crop up in the solar energy sector, which SolarEdge is combating by diversifying into electric mobility solutions in Europe.

Analysts surveyed by Morningstar estimate that SolarEdge’s revenue will grow from $1.9 billion in 2021 to $2.8 billion in 2022 and $3.5 billion in 2023, while earnings per share is expected to grow from $3.06 in 2021 to $5.16 in 2022 and $7.28 in 2023.

Northland Power

Canada-based Northland Power (TSX:NPI, Financial) is a developer and owner of clean energy facilities that has been in business since 1987. It produces electricity from clean-burning natural gas, wind and solar in Canada, Europe and Latin America, with plans to expand to the U.S. and Taiwan.

Northland Power has a GF Score of 84 out of 100. It ranks high on profitability, growth and GF Value, but lags in terms of financial strength and momentum.

Key metrics include an upward trend in the operating margin to the current 36.81%, a GF Value rating of modestly overvalued and a business predictability rank of 2.5 out of 5 stars. Poor financial strength can be seen in the cash-debt ratio of 0.09 and the Altman Z-Score of 0.79.

Northland Power is pursuing a high-growth path, first establishing regional offices in new areas to develop market expertise and then forming strategic local partnerships to accelerate market penetration. Its biggest growth pipeline is offshore wind, representing 7 Gigawatts as of its 2022 Investor Day presentation.

For 2021, Northland Power recorded revenue of 2.0 billion Canadian dollars ($1.6 billion) and earnings per share of 82 cents. According to analysts surveyed by Morningstar, the top-line is projected to rise to CA$2.1 billion in 2022 and CA$2.2 billion in 2023, while earnings per share are estimated to be CA$1.33 and CA$1.44, respectively.

Solaria Energia y Medio Ambiente

Solaria Energia y Medio Ambiente (XMAD:SLR, Financial) is a Spanish electric services company focusing on solar photovoltaic power generation. It manufactures solar panels and builds and operates solar power plants primarily in Spain, though it also has projects in Portugal and Italy.

The GF Score for Solaria Energia is 94 out of 100, driven by top scores for growth, profitability and GF Value despite low scores for financial strength and momentum.

Key metrics include a three-year revenue per share growth rate of 37.9%, a three-year Ebitda per share growth rate of 39.6% and a GF Value rating of modestly undervalued. Momentum is not on the company’s side, with the share price down 43% from highs in January 2021.

The utility provider aims to reach a capacity of 18 Gigawatts by 2030 compared to the 2 Gigawatts of capacity currently in operation or under construction. This growth will be helped along by the strength of clean energy demand in Solaria’s home country; Spain has negligible oil reserves and needs to import virtually all of its oil, putting it at high risk of energy-based economic issues.

Morningstar analysts have issued average estimates for Solaria to reach revenue of 182.7 million euros ($199.2 million) in 2022 and 261.8 million euros in 2023, up from 95 million euros in 2021, while earnings per share is predicted to rise to 0.60 euros in 2022 and 0.73 euros in 2023 compared to 0.38 euros in 2021.