Root Inc. (ROOT, Financial) is a disruptive U.S. car insurance company operating in 32 states. The company provides a telematics system that enables the tracking of driver habits. This data can then be used with artificial intelligence to tailor car insurance prices. In addition, the company offers homeowners insurance in 19 states and renters insurance in seven states.

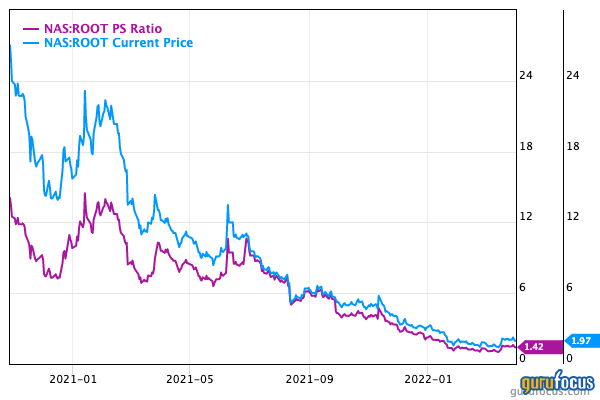

The stock had its debut in 2020 and was the largest initial public offering for an Ohio-based company ever. However, thanks to inflation, which has spiked to a 40-year high, and a planned increase in interest rates, growth stocks such as Root have seen their valuation multiples get seriously compressed. The stock is down 91% from its highs in June 2021.

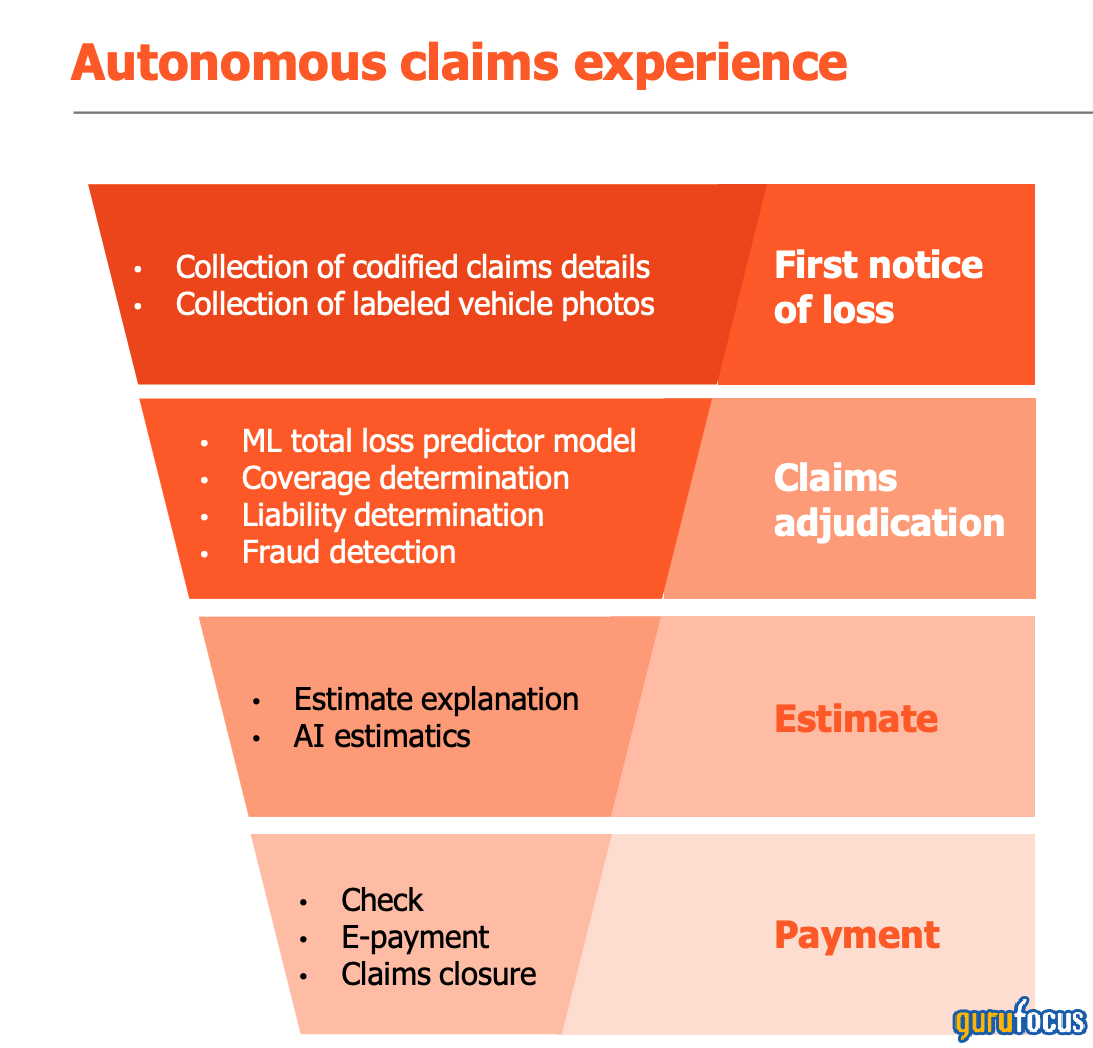

Root uses data to “Predict the future, Assess fault and Determine value.” It considers itself to be a tech company that sells insurance through its autonomous claims experience, otherwise known as an "insurtech" company.

In August 2021, the company scored an exclusive partnership with Carvana Co. (CVNA, Financial), the fastest-growing online used car retailer in the U.S., to develop integrated auto insurance solutions for customers. Carvana has over 20 million website visits per month, a $20 billion market cap and is growing substantially.

This partnership is great news for Root and should widen its access to new customers moving forward. However, since signing the agreement, the stock has been sliding downward. Let’s dive into the financials to discover why.

Financials

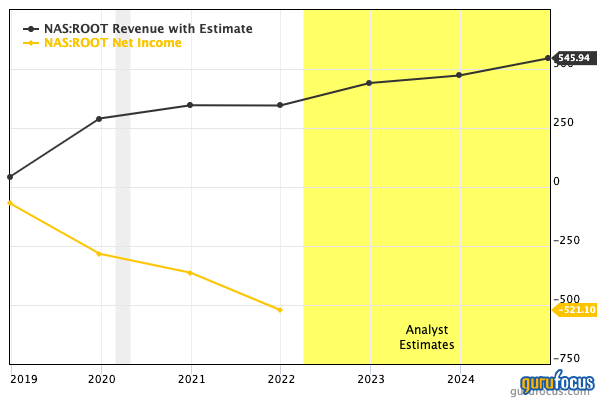

As a growth stock, the company was priced for perfection in 2020 and had a lot of optimism baked into the share price. However, since that period, the company has been growing, but not as fast as analysts hoped for.

For the fourth quarter of 2021, the company reported a gross written premium increase of 9% to $158 million and the gross earned premium increased 22% to $189 million. Root also reduced its direct operating loss from $172 million in the second quarter to $92 million.

The company still has a long way to go in terms of growth in profitability and I would call the stock a speculative play, but its price-sales ratio is the lowest it has ever been at 1.42.

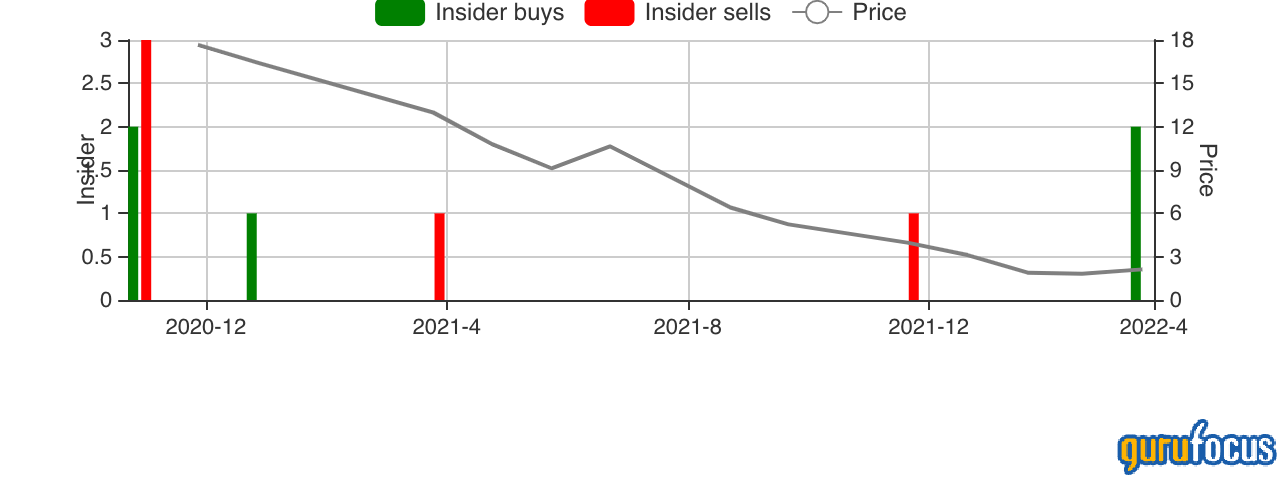

Insiders buying

Root has also had insiders buying recently.

Chief Financial Officer Daniel H. Rosenthal bought 100,000 shares for $152,000, which represented an increase of around 10%, bringing his total holding to over 1 million shares. The stock has risen 23% since the purchase in March, but is still down 84% from highs. This is good news for the company as the CFO is the person who handles the financial forecasts for the company. Thus, it’s good to see he is bullish on its prospects.

Root has a disruptive business model, which on paper should be very enticing to customers. The company's asset-light, data-driven method of insurance offers flexibility and accuracy. Its partnership with Carvana is huge news and the insider buying is also a positive.

The stock looks to be relatively undervalued if we compare it to historic multiples, but Root still has a long way to go before becoming profitable. The macro environment of rising interest rates is keeping the stock depressed right now, and thus will be an issue until inflation subsides.