Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial), Warren Buffett (Trades, Portfolio)’s investing conglomerate, has recently purchased 121 million shares of HP Inc. (HPQ, Financial) worth approximately $4.2 billion, which equates to a 11.4% stake in the company. This new information was revealed in Form 3 and Form 4 SEC filings, released on Wednesday, April 6.

According to the filings, Buffett paid around $35 to $37 per share to acquire the holding. On Thursday, following the news, HP's shares spiked 15% to trade around the $40 mark. HP’s share price is up by over 132% since the April 2020 lows and now has a market cap of $40 billion. With Buffett's backing, could HP be a value opportunity for other investors as well?

Business model

HP is a blue-chip technology company that focuses on Personal Systems such as PCs as well as Printers, which includes market-leading 3D printers. According to the company's fiscal first quarter 2022 earnings report, they make 72% of their revenue from the Personal Systems segment of the business and 28% from Printing. HP operates globally with 40% of sales coming from North America, 35% from Europe, the Middle East and Africa and 25% from Asia-Pacific.

The company has seen strong demand in their Personal Systems segment and released a variety of new lightweight notebook devices and gaming PCs at the CES Exhibition 2022. Their Printing segment saw softer demand in the quarter thanks to an ongoing recovery in office printing.

HP is invested heavily into hybrid work solutions, and on March 28, it announced the acquisition of Poly, a leader in video conferencing solutions, cameras, headsets, voice and software. This acquisition will help drive the peripherals and workforce solutions parts of HP’s business, which represent $100 billion and $200 billion market segments and are growing at 8% to 9%, respectively.

The company also recently announced the acquisition of Choose Packaging, a leading eco-packaging provider which owns the patent to the only commercially available zero-plastic paper bottle in the world.

Growing financials

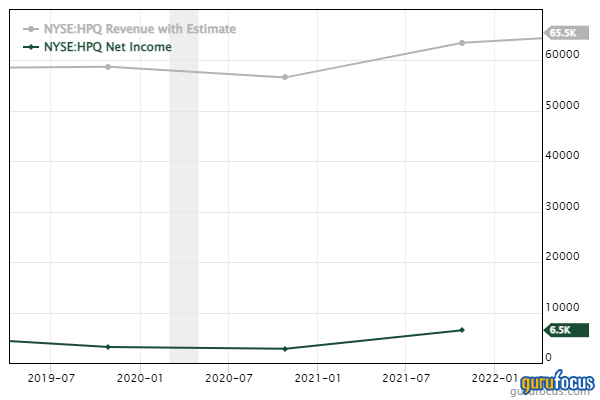

HP grew its revenue by 14% to $64.9 billion in the trailing 12 months. This is on top of a strong 20% gross margin and an 8.75% operating margin, both of which have been trending up since the end of 2019, which is great to see.

The company's Personal Systems segment has generated strong growth, with revenue up 15% in the first quarter of fiscal 2022 compared to the same quarter of last year. On the other hand, Printing revenue was down 4% for the quarter.

Valuation

According to the GF Value chart, a unique intrinsic value calculation from GuruFocus, the stock is modestly overvalued.

Buffett’s Berkshire has bought a substantial number of shares, but it should be noted many other guru investors such as Joel Greenblatt (Trades, Portfolio) were reducing their positions in recent quarters. As we can see in the below chart, gurus have mostly been net sellers of this stock in the past couple of years.

HP is a legacy blue-chip technology company that is re-inventing itself with acquisitions in both the hybrid work and eco-packaging industry. The company has seen strong demand in its Personal Systems segment and high revenue growth as a business overall. However, their high operating margin (18.2%) printer segment is seeing softer demand from the commercial space and could be a sign of longer-term decline.

Buffett’s Berkshire may see a value opportunity here, as it has acquired 11.4% of the company. Perhaps the famous value investor sees growth opportunities among the acquisitions. Personally, I believe the stock is fairly valued and has long-term growth potential.

Also check out: