Zim Integrated Shipping Services (ZIM, Financial) is one of the top 20 global shipping companies which operates on the world's most popular trade routes. The company has benefited massively from rising freight costs, which Bloomberg estimates to have increased by up 50%.

The company's net cash generated from operations has multipled by five times to $2 billion as of the fourth quarter of 2021 thanks to increased freight rates and volume. This has left the company flush with cash, and they recently paid out a gigantic $17 per share dividend, which equated to a whopping 23% of their share price.

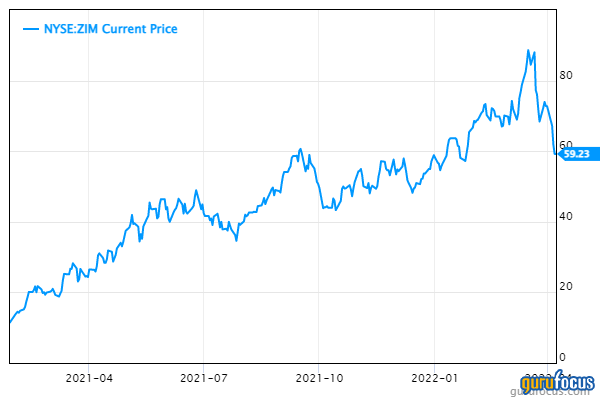

The question for investors is, is there still an opportunity left to ride the shipping wave with Zim, or has that ship already sailed?

Business model

Zim's shipping business covers the world's major trade routes. Their operations are split into three main segments, with a strong presence in the Trans-Pacific (39% of Zim's shipping) which covers Asia-America as well as Intra-Asia (27%) and the Atlantic (18%). The company runs an asset-light “chartered in capacity” model to reduce the risk to their business model as shipping is notoriously cyclical.

Zim is investing in order to increase market share in high growth emerging markets, where the firm currently has only niche offerings. These include Asia-Africa and South America, routes where an increase in trade is expected. In addition, the company has recently increased its route offerings between India, Israel and Turkey.

Financials

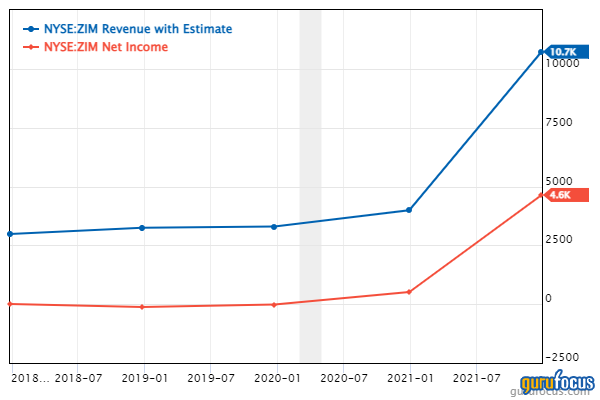

Zim produced some fantastic results in its fourth quarter of 2021 with revenue of $3.47 billion, up 155% from $1.36 billion in the prior-year quarter. This was driven by both increased freight volume and higher rates. Thanks to freight rates nearly doubling, the company's adjusted Ebitda margin has also nearly doubled from 39% in 2020 to 68% in 2021. They generated adjusted Ebitda of $2.36 billion for the fourth quarter, up a massive 344% from $531 million in the prior-year quarter.

Valuation

In terms of valuation, Zim does trade at a lower forward price-earnings ratio of 1.9 compared to its peers in the shipping industry, though this doesn't mean much considering the cyclical nature of the shipping industry. Competitors include Navios Maritime Partners (NMM, Financial), which trades at a forward price-earnings ratio of 2, and Danaos Corp. (DAC, Financial), which trades at a forward price-earnings ratio of 4.2. See the below chart for the trailing 12-month price-earnings ratios of these companies:

The big risk here is that the shipping industry is notoriously cyclical, thus the company is not expecting its prior meteoric 155% revenue growth rate to continue moving forward. Zim's guidance calls for adjusted Ebitda of approximately $7.1 billion for 2022, which is an increase of 7.5% from 2021 levels of $6.6 billion. These growth rates seem much more realistic moving forward, and I would expect a decline in revenues as shipping prices normalize. According to a McKinsey study, they do expect rates to “normalize” but still be above levels seen in 2019.

Zim is a fantastic company which has benefited from the huge tailwinds brought on by increased shipping costs. These tailwinds have left the company in a strong financial position. However, as most economists expect these rates to normalize, although at slightly higher levels than prior, I don't have high expectations of the stock moving forward, as Mr. Market will lose enthusiasm without those same high growth rates. Despite this, the stock is still trading at a low price-earnings ratio relative to competitors, they are investing for growth in key markets and have a solid strategy moving forward. Thus, as long as the company can continue growing this year, even at a lower rate, I believe the stock could be a short-term dividend play, though capital gains are at risk.