IonQ Inc. (IONQ, Financial) was founded in 2015 as a research and development-focused company which specializes in quantum computing. The company went public via a special purpose acquisition company (SPAC) merger in October 2021, backed by investors such as Hyundai (XKRX:005380, Financial) and Breakthrough Energy, which was founded by Bill Gates (Trades, Portfolio).

The stock popped by 233% at the IPO, but is now down by 53% from its highs. In my opinion, this decline is likely due to high inflation, which has compressed the valuation multiples of all growth stocks, as well as the typical post-SPAC sell-off from those looking to make a quick buck. However, unlike most former SPAC stocks, its share price is still trading 22% above its original listing price. Let’s dive into the market opportunity, business model, financials and valuation to see why I believe IonQ could be a value opportunity.

Quantum computing

To understand IonQ's prospects, we need to first understand the quantum computing market. The global commercial quantum computing market is expected to grow at a meteoric compound annual growth rate (CAGR) of 52.9% between 2022 to 2027, reaching a valuation of $1.3 billion, according to BCC Research.

Quantum computing has the potential to change the world as we know it. Classical computers are already reaching their limits both in terms of speed and power. As IBM (IBM, Financial) states on their website, “Some Supercomputers, just aren’t that Super.” Quantum computing really does represent a potential for “quantum shift." The technology allows complex calculations to be completed in record time.

IonQ isn't without competitors. Alphabet's (GOOG, Financial)(GOOGL, Financial) Google claims to have achieved “Quantum Supremacy” with their 54 quibit (quantum bit) computer, which performed a complex calculation in 3 minutes and 20 seconds. This would have taken IBM’s most powerful supercomputer, the Summit, up to 10,000 years to complete.

Medicine is an important potential application of this technology, as Quantum computing can help to speed up the development of vaccines and drugs. Finance is also a major area with IBM and JPMorgan (JPM) already experimenting with quantum technology.

For a more detailed overview of the quantum computing market, I invite you to take a look at my YouTube channel, Motivation2Invest, where I have a video on this topic.

Business model

IonQ is the first publicly traded quantum computing company in the world. The company has approximately 60 employees, which include the former head of Google’s quantum software team, Dave Bacon.

Quantum technology is still in the prototype stage and requires a complex setup of superconductors operating at absolute zero. IonQ’s long-term mission is to increase the accessibility of quantum computers globally, a major challenge but one with lucrative potential.

The company already has commercial agreements for a quantum-computing-as-a-service (QCaaS) platform and you can already find their systems used today inside Amazon (AMZN, Financial) Web Services and Microsoft (MSFT, Financial) Azure. IonQ also develops algorithms with external partners and uses this as an extra revenue source. The company is planning to develop modular quantum computers by 2023, which can be networked together to provide scalable computing power by 2025. This technology would also operate at room temperature, which is the real game-changer.

Source: IonQ investor materials

IonQ is currently working with Hyundai to create the largest battery chemistry model ever to be run via a quantum computer. They are also producing advanced monte carlo simulations for Goldman Sachs (GS, Financial).

Quantum computing is expected to be an enabling technology for future generations of Artificial Intelligence (AI) and thus help improve the models for self-driving cars.

Growth potential

As this is still an early-stage technology company, the financial projections are all based on future orders. We don't have any past years of profitability to reference. The good news is, the company has seen its 2021 contracted booking increase by three-fold to $15.9 million, and these are expected to quadruple over the next four years.

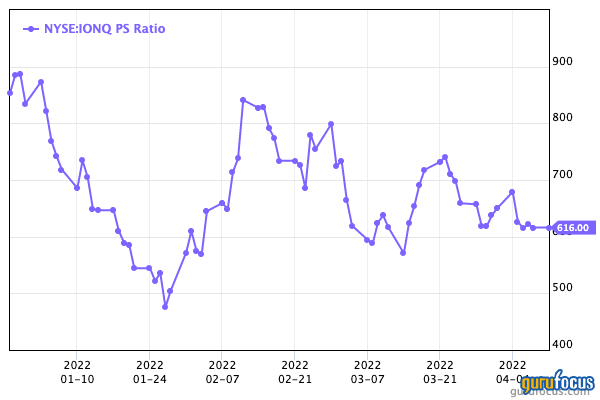

The company has $522 million in cash and is investing $20 million in research and development annually. The market cap for the company is $2.43 billion, and the price-sales ratio is a sky high 600, despite the recent share price decline. However, given the company's major partnerships, investors and massive total addressable market, I believe it would be more realistic to estimate a valuation based upon future market potential. In terms of book value, the stock is trading at four times today’s book value.

IonQ is a leading quantum computing company that has exceptional investors and counts the leading cloud providers as partners. However, there are many technical challenges ahead, and thus this stock is still a speculative investment.