It’s tough at first glance to determine what MicroStrategy Inc. (MSTR, Financial) actually does. It is mostly a provider of enterprise analytics and mobility software. The MicroStrategy Analytics platform delivers reports and dashboards that enable users to conduct ad hoc analysis and share insights through mobile devices or the internet. However, the company has recently embarked on a second different corporate strategy and that is to acquire and hold bitcoin.

The company was founded in 1989, went public in 1998, started buying bitcoin in August 2020 and currently has a market capitalization of $4.9 billion.

Core business

The company’s core platform delivers complex and modern analytic knowledge for both expert and casual users. In addition, it provides an open architecture for developers to embed and inject data visualizations and direct insights into third-party websites and other applications. Also, the core platform provides a governed, object-oriented semantic layer for various applications. Essentially, large data customers use MicroStategy's technology to make information and actions flow faster and to more users—so employees can make smarter, data-driven decisions. The company also offers consulting and education services to help customers deploy, optimize and manage their own analytics initiatives.

Bitcoin holdings

CEO Michael Saylor has been an outspoken evangelist for bitcoin and the company started purchasing the famed cryptocurrency in 2020. He has clearly stated before, "We're not sellers. We're only acquiring and holding Bitcoin. That's our strategy."

Also, he considered Bitcoin an inflation hedge after explaining, “I don't really think we could do anything better to position our company in an inflationary environment than to convert our balance sheet into bitcoin."

The company purchased approximately 52,922 bitcoin in 2021 at an average prirce of $2.63 billion. In 2020, 70,469 bitcoins were purchased at an average price of $15,964 per coin.

Subsequent to the end of 2021, the company purchased additional amounts and is believed to own 129,218 bitcoins as of early April, although the amount may be updated after the release of first-quarter 2022 results.

Financial results

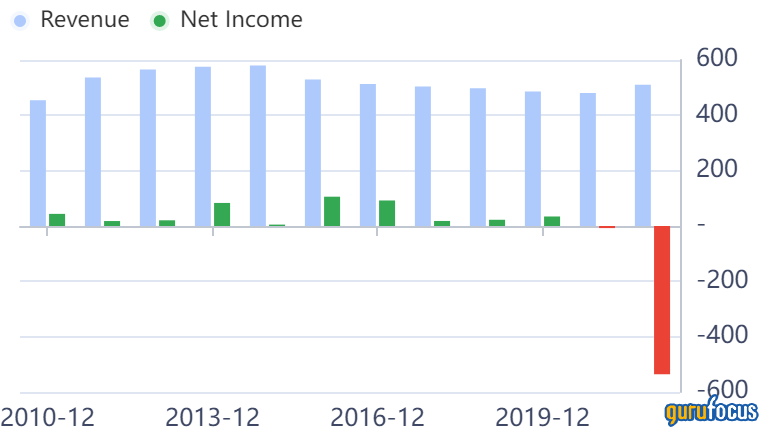

The operating results often plays second fiddle because of all the news surrounding the company’s bitcoin holdings, but 2021 was good year for the company. Revenue increased 6.3% to $510.8 million and gross profits increased 7.5%, which has a high software-style gross margin of 82%.

However only $46 million of operating income was generated during the year (ignoring the bitcoin asset impairment charge) compared to $57.1 million in the prior year.

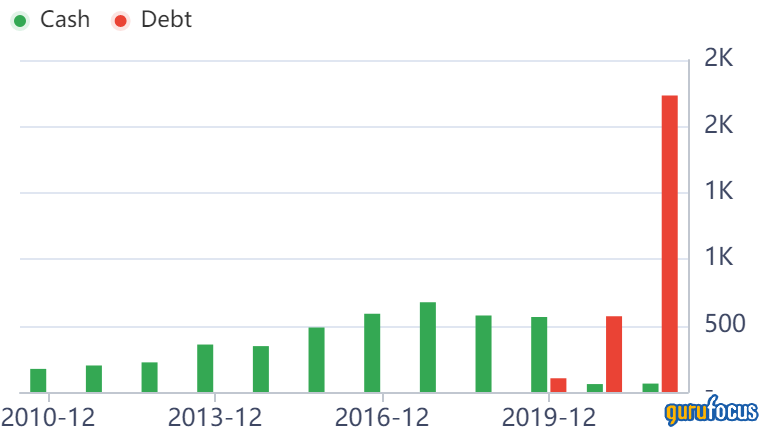

The company has a levered balance sheet as it has been using debt to finance its large-scale purchases of bitcoin. As of year-end 2021, cash was only $63.4 million, but total debt stood at $2.15 billion (excluding capital lease obligations). However, the value of its bitcoin holdings on the balance sheet was $2.85 billion. The market value of the bitcoin holdings currently stands at approximately $5.1 billion.

Valuation

Valuaing MicroStrategy can be an interesting exercise due to the large cryptocurrency holdings. The base enterprise value of the company is the market cap of $4.9 billion plus net debt of $2.01 billion for a total enterprise value of $7 billion. However, after subtracting the bitcoin value of $5.1 billion, that gets you to a net-net EV of approximately $2 billion. The company may produce net earnings in the $60 million to $70 million range in 2022, which would value the core analytics business at 30 times earnings.

However, the core business is not a great growth business at this time with only 6% revenue growth in 2021 and only 3% to 5% revenue growth expected in 2022. Further, bitcoin is not cash and endures significant price fluctuations at times. If bitcoin falls in half from here, that could mean the core business trades at 60 times earnings.

Guru trades

Gurus who purchased the stock recently include Murray Stahl (Trades, Portfolio). Gurus who have reduced holdings in MicroStrategy include Paul Tudor Jones (Trades, Portfolio).

Conclusion

MicroStrategy appears to be substantially overvalued based on comparing the core business to the ex-bitcoin enterprise value. The company made a significant wage on bitcoin with shareholder capital and borrowed money.

The success of the company's stock seems to be binary at this point. If the cryptocurrency holdings increase substantially, then there is tremendous upside. If bitcoin increases 37% from todays levels, then investors are essentially getting the core business for free. Investors should be cautious on the stock unless you have a firm conviction on the direction of cryptocurrencies going forward. In fact, when looking at the each securites 1-year chart, the price movement between the two appear to be highly correlated.