SoFi Technologies (SOFI, Financial) is a former growth stock darling which went public via a special purpose acquisition company (SPAC) merger in June 2021. The company promised record growth and was priced for perfection with a lot of optimism baked in the stock.

However, lowered guidance, the student loan moratorium and high inflation have all contributed to the current share price decline, with the stock down by over 50% from its historical average level.

Could this stock be a value opportunity now thanks to the lower share price? Let’s dive into the business model of the company to see if we can determine whether it is a fintech disruptor or just a disaster.

Business model

SoFi Technologies is most well known for its competitive student loan refinancing options. However, the company has expanded rapidly into a whole suite of financial products for millennials and the Gen-Z age category. These products include:

- Investing (Inc Crypto)

- Personal Loans

- Auto Loans

- Home Loans

- Banking

- Credit Cards

- Insurance

The company's ecosystem of financial products has proven to be very popular, and they have grown rapidly to over 3.4 million members.

SoFi also has the rights to “SoFi Stadium” in Inglewood, California, which is shared by two NFL teams and was the home of the Superbowl in 2022. This was fantastic advertising for the company and helped to give new member additions a major boost in the first quarter of fiscal 2022.

The “members benefits” SoFi offers to customers are a unique aspect of the company. As people are often driven by status symbols, access to a members' lounge and fast-track entry to the SoFi stadium offer a differentiated value proposition for consumers.

Headwinds

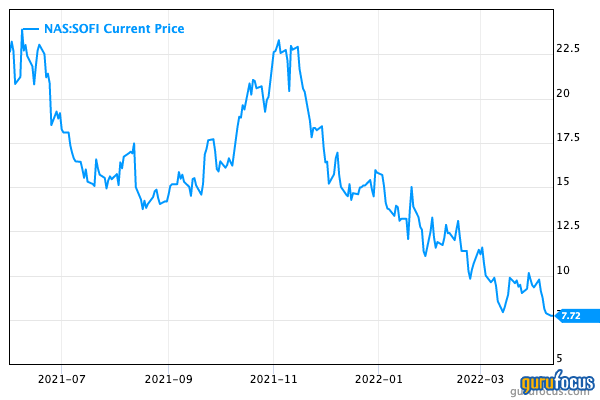

The major headwind for SoFi is the pause in federal student loan payments and interest accumulation. On April 6, 2022, U.S. President Joe Biden once again extended the pause on student loan payments for another four months until the end of August in order to delay the economic shock from student loan payments resuming. This news caused SoFi's stock to decline a further 11% to $7.72 per share. This also caused analysts to downgrade the stock's price target, which caused further pain for investors.

Financials

SoFi has been growing, with revenues up 74% to $984 million in 2021 from $565 million in 2020. However, net losses have increased substantially from $224 million to $483 million in the same timeframe.

The company reported a positive Ebitda number of $30 million, but this does contain a wide range of adjustments such as stock-based compensation. The good news is analysts are forecasting Ebitda to increase by over 200% in 2023 due to operating leverage, business growth and the end of the student loan payment pause period.

Is the stock undervalued?

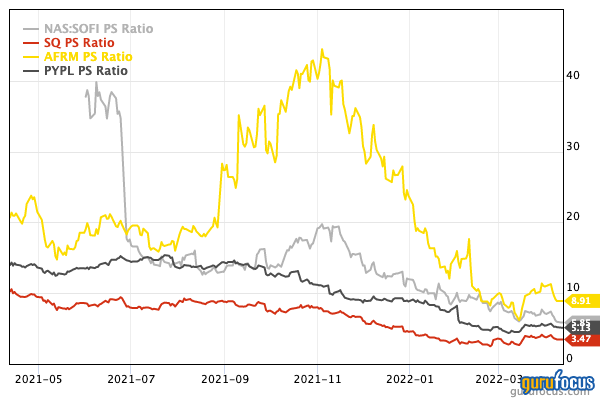

The valuation multiples have compressed substantially over the past year with the price-sales ratio going from an eye-watering 40 to just 5. The enterprise-value-to-revenue ratio has also decreased substantially.

Relative to larger fintech players such as Block (SQ, Financial), formerly Square, Affirm (AFRM, Financial) and PayPal (PYPL, Financial), the stock price is trading at similar valuations. However, bear in mind those companies are much more established and profitable.

Insiders and gurus are buying

One positive signal about SoFi is that both insiders and gurus are buying shares.

SoFi CEO Anthony Noto paid $1.1 million in March 2022 for 115,969 shares at an average price of $9.06 each, which is above the current share price of $7.60, according to filings with the SEC. The CEO now owns 3.06 million SoFi shares.

Growth stock investor Ron Baron (Trades, Portfolio) purchased 3.9 million shares in the fourth quarter of 2021, during which the stock averaged $18 per share, as per his firm's 13F filing for the period in question.

Investors should be aware that the 13F filings do not give a complete picture of a firm’s holdings as the reports only include the its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Final thoughts

SoFi has a captivating fintech business model which makes sense on paper, and they have grown membership and revenues substantially. However, the company is generating heavy losses and came in at a sky-high valuation during the IPO. The student loan payment pause is only a short-term issue, but this has still caused analysts to downgrade the stock. The high inflation macroeconomic environment is likely going to put further pressure on the stock in the short term, and thus I would expect continued volatility moving forward.