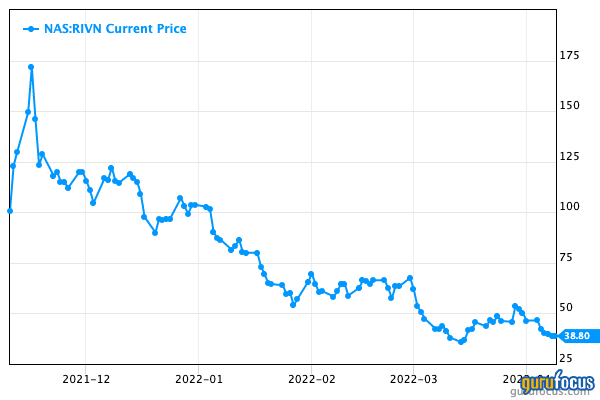

Rivian Automotive Inc. (RIVN, Financial) is a manufacturer of high-end, stylish electric vehicles such as its flagship pickup truck and SUV. The company had its initial public offering in November 2021 at $100 per share, before spiking 78% to $178. Following this bull run, high inflation numbers were released and the stock took a dive, which means it is now down by over 70% since the IPO.

Inflation and rising interest rates have squeezed the valuation multiples of growth stocks, as their valuation is weighted more upon future cash flow potential. Supply chain disruptions also impacted the company’s ability to get components effectively.

George Soros (Trades, Portfolio) was buying shares at an average price of $114 each in the fourth quarter of 2021. His position in the stock is now down substantially, but according to recent 13F filings, he hasn’t sold.

Thus, could this now represent an opportunity for growth at a reasonable price? Let’s dive into the business model, financials and valuation to find out.

EV business model

Rivian manufacturers EV vehicles which address large, profitable and underserved segments of the market. The product offering currently includes a pickup truck starting at $67,500 and an SUV retailing at $72,500. Given Ford's (F, Financial) F-150 pickup truck is one of the most popular vehicle types in the U.S., Rivian’s product offering is enticing.

The company has the possible advantage of being a first mover in the valuable pickup truck and SUV market, as the electric Ford F-150 Lightning has only recently begun production and Tesla's (TSLA, Financial) Cybertruck is not being produced at scale until 2023.

Rivian is also addressing the widely lucrative last-mile delivery van market and has a major partnership with Amazon (AMZN, Financial), which plans to buy 100,000 vans. Amazon has also invested in 18% of the company's equity. As such, I believe this gives Rivian a strong competitive advantage over rivals.

As of the end of the first quarter, Rivian had produced 2,553 EVs at its Illinois manufacturing plant. It plans to ramp up production for the rest of the year. Challenges in the supply chain have forced the company to reduce its 2022 production forecast to just 25,000 electric vehicles, but its order book is growing substantially.

Future financials

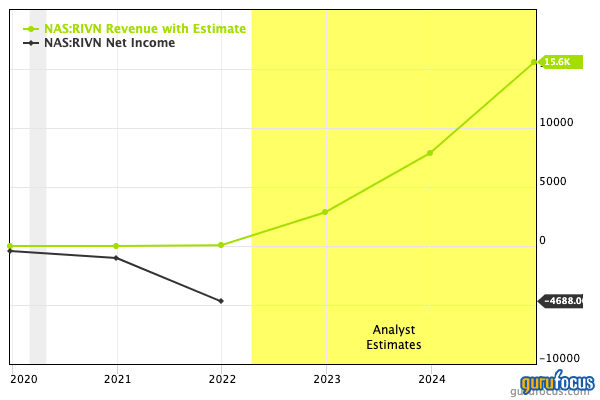

Currently, the company has 83,000 preorders for its R1 model. Assuming an average vehicle price of $70,000, this equates to $5.8 billion in preorder revenue. Given Rivian's market cap is around $33 billion currently, the stock is trading at just 5.3 times sales. In comparison, Tesla has a forward sales multiple of 10.1. Although the two companies are at very different stages, it does help to give some indication of valuation.

However, it should also be noted Rivian has a staggering $18.1 billion in cash. If we subtract this from the current market cap, we get $14.9 billion, which equates to 2.5 times sales. But of course, a large portion of this cash will need to be deployed for production costs and materials.

Final thoughts

Rivian is a growth company that has all the ingredients for potential success. The company’s partnership and investment deal with Amazon is a major competitive advantage in my eyes, as it guarantees consistent cash flows and adds immense credibility to its product range.

The stock is trading at a low valuation of just 5.3 times future order book sales, thus the only major restriction to the company's success is the current supply chain disruptions. If Rivian cannot get materials efficiently and at a low cost, this may give competitors time to get their product to market. Therefore, I see Rivian as a growth company that is reasonably priced, but volatility is expected due to the current macroeconomic conditions.