The industrial sector has been one of the worst performers over the last year. The iShares U.S. Industrials ETF (IYJ, Financial) has lost 9.6% so far in 2022, compared to a 6.7% decline in the S&P 500 Index.

Investors looking to pick up some high-quality names in a beaten-down sector could do well looking at industrial stocks, in my view. This article will examine two highly profitable industrial stocks that offer a dividend yield superior to the 1.3% average yield for the S&P 500 Index.

Cummins

First up is Cummins Inc. (CMI, Financial), a leading designer and manufacturer of truck engines. The $28 billion company has annual revenue of $24 billion.

Cummins is one of the top names in its industry and offers engine solutions for heavy, medium and light-duty trucks. The company has five segments: Engines, Distribution, Components, Power Systems and New Power. Through these segments, Cummins offers comprehensive solutions to customers.

With growing pressure to reduce emissions, Cummins is in an advantageous position to meet the needs of its customers due to the strength of its emission solutions business. The New Power segment, which is small compared to other segments as it produced just $34 million of revenue in the most recent quarter, should see strong growth in the coming years as the truck manufacturing industry turns to more electric vehicles.

Cummins' business has performed solidly over the long-term as revenue has a compound annual growth rate (CAGR) of 3.7% over the last decade. Earnings per share have seen 7.1% annual growth over the same period. A lower share count aided results, but net profit still improved 4.1% during this time.

As a result of its business performance, Cummins ranks well on its GuruFocus profitability rank.

Cummins receives an 8 out of 10 from GuruFocus on its profitability rank. The best showing is on return on equity, which tops 94% of the 2,629 companies in the industrial products industry. This is also near the high end of the company’s 10-year median.

Other areas where Cummins scores well is return on capital and return on assets, which are better than 86% and 82% of its peer group, respectively, but close to the median for the company. Net margin is in the top third of the competition and very close to the high end for the last decade.

The company does have some weaker areas, including three-year revenue growth, which is only better than 57% of the industry and right in the middle of Cummins’ own history. Three-year earnings per share without non-recurring items growth is worse than 53% of peers and on the low end of the 10-year scale.

Cummins has used its highly profitable business to return capital to shareholders. Aside from reducing its share count by nearly 3% annually over the last decade, Cummins has raised its dividend by 10.7% during the period. In total, the company has increased its dividend for 16 consecutive years. Shares yield 3%, which compares favorably to the stock’s 10-year average yield of 2.4%, according to Value Line.

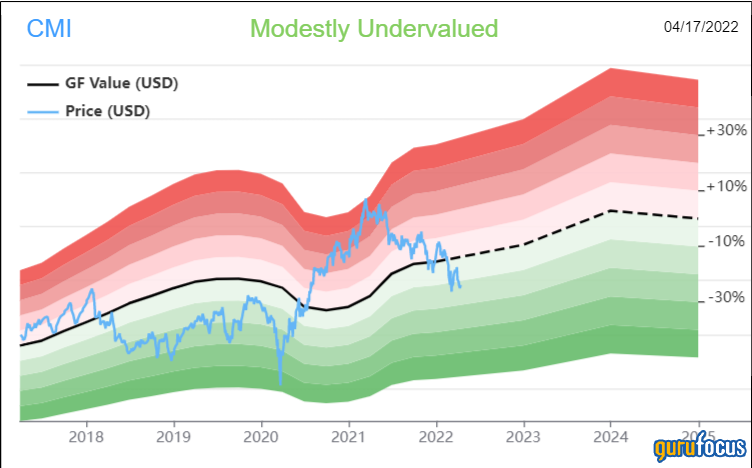

The stock is down more than the sector ETF as shares have fallen 10.8% since the start of the year. Shares of the stock look to be trading below their fair value according to the GF Value chart.

Cummins closed the most recent trading session at $195.94. With a GF Value of $221.97, shares have a price-to-GF-Value ratio of 0.88. Reaching the GF Value would result in a return of more than 13% before the dividend is factored in. The stock hasn’t traded this far below the GF Value since the middle of 2020. Cummins receives a rating of modestly undervalued from GuruFocus.

Snap-On

The next industrial name to consider is Snap-On Incorporated (SNA, Financial), a leading name in the tools industry. The company has a market capitalization of $11.3 billion and annual revenue of $4.3 billion.

Snap-On is global leader in the manufacturing of both common and specialty tools as well as diagnostic equipment, software and service solutions for professional customers. Among the products in the company’s portfolio are hand and power tools, storage, information systems and shop equipment. The company also produces equipment and tools used by vehicle repair centers.

Perhaps the company’s largest competitive advantages are its portfolio of high-quality products and strong brand appeal to customers. Customers depend on tools and equipment to help complete repairs on time and budget, making the higher costs for Snap-On’s products worth the additional expense.

Top-line growth has been 4.2% annually since 2012, but where the company really shines is on its bottom-line showing. Earnings per share have nearly tripled over the last decade, resulting in an earnings CAGR north of 12%. The share count has been lowered somewhat over the period, but the net profit margin has improved from 10.4% in 2012 to 19.3% last year. Snap-On has become extremely efficient at turning sales into profits over the long-tern.

Considering this, it is not surprising that the company scores so well on profitability.

Snap-On scores a near-perfect score of 9 out of 10 on profitability form GuruFocus. The company is better than the vast majority of its peers on almost any metric. Return on capital, operating margin, net margin and return on assets top 96%, 95%, 95% and 91% of the industrial products industry, respectively. These scores are also at the very top end of the company’s 10-year performance.

Three-year revenue growth is exactly in the middle of the results for the last decade, but still beats almost two-thirds of the competition. Other areas of concern would be the three-year Ebitda growth rate and the three-year earnings per share without non-recurring items growth rate as these scores are only above what approximately half of the industry have produced. They are also at or below the median of the 10-year historical performance. That said, Snap-On’s profitability rankings are overwhelming above most of its peer group on nearly every metric.

The income investor should also find the company attractive. Snap-On has raised its dividend for just 12 years, but the pace of increases has been strong. Snap-On’s dividend has a CAGR of 15.8% for the last decade. Growth hasn’t slowed all that much in the medium-term as the five-year dividend CAGR is 14.7%. Snap-On yields 2.7% as of Thursday. For context, the average yield is 2% for the last decade.

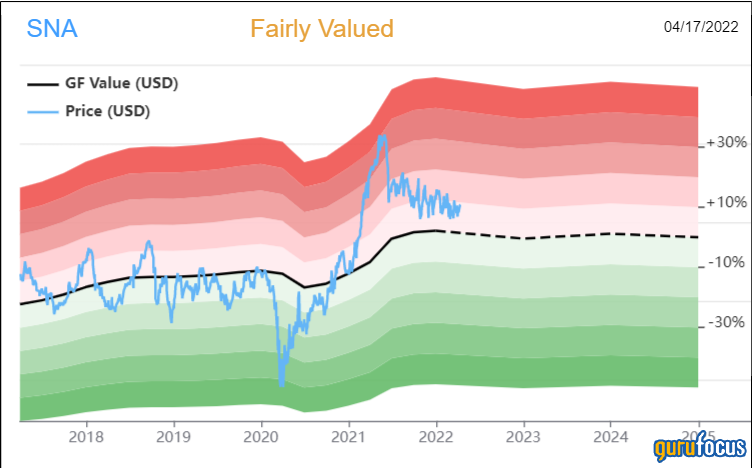

Snap-On has held up much better than the sector ETF, losing just 1% year-to-date, likely on account of its strong business model. Therefore, the stock isn’t offering a discount to its GF Value.

Snap-On has a current share price of $211.16 and a GF Value of $193.24, equating to a price-to-GF-Value ratio of 1.09. Shares would decline 8.5% if they were to retrace to the GF Value. That being the case, Snap-On hasn’t traded this close to its GF Value since late 2020. The stock is rated as fairly valued by GuruFocus.

Final thoughts

The industrial sector has been a major point of weakness so far this year, with the iShares sector ETF down almost 10%. For investors looking to pick amongst the rubble, there are several high-quality names that are extremely profitable. This could allow them to outperform their weaker counterparts in the long-term.

Cummins and Snap-On are two such examples. Both companies rank very highly amongst their peers on several metrics. Cummins shares offer the potential for double-digit returns by my estimates, while Snap-On is running just ahead of its GF Value. Each stock is also offering a yield that is more than double the average yield of the S&P 500 Index.