Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (BRK.A) (BRK.B, Financial) disclosed on April 7 that it purchased an 11.4% stake in HP Inc. (HPQ, Financial) worth $4.2 billion.

Some investors may be wondering why Buffett would be interested in a business that appears to be in decline. However, Buffett has a history of buying when other investors fail to see the true value of a stock; I think a similar case is happening here.

The stock market perceives HP as a declining business, with both of its segments, Printers and Personal Computers, seemingly past their heyday as more documents move exclusively online and an increasing percentage of computing is done via mobile devices such as phones and tablets.

A price-earnings ratio of just 8 implies a no-growth stock, yet on a per-share basis, the stock delivered an earnings per share growth rate of 17% over the past three years. Part of this is share repurchases. The rest is from the other peripheral businesses. Yes, Printers is declining slowly, but both printing and PC usage will be here for a long time.

Market participants frequently overestimate the decline of industries and overly discount companies just because of their maturity. A prime example is the tobacco industry which, despite declining volume, has continued to do well for its shareholders.

Meanwhile, HP is not standing around doing nothing. It is using it cash flow to acquire other businesses, like it acquisition of hybrid work solution company Poly (POLY) in March 2021 for $3.3 Billion.

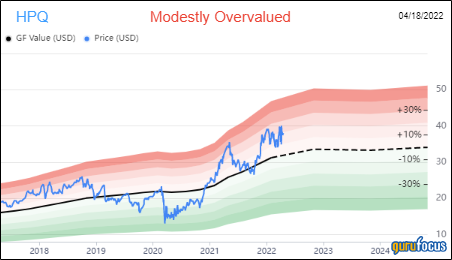

The GF Value chart puts HP's stock in overvalued territory:

The GF score is quite healthy, showing the potential to perform well in the future based on bactesting studies conducted by GuruFocus:

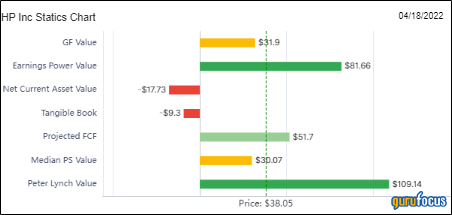

The Valuation Box shows strong Earning Power Value and Projected FCF valuations:

Earning Power Value (EPV) is based on the concept first popularized by Columbia Professor Greenblatt that one should value a stock based on the current free cash flow of a company and not on future projections which may, or may not, come true. It is arguably a better way to analyze stocks than Discounted Cash Flow analysis that relies on highly speculative growth assumptions many years into the future. The main assumption: Current profitability is sustainable.

Since the intrinsic value calculations based on Discounted Cash Flow or Discounted Earnings cannot be applied to companies without consistent revenue and earnings, GuruFocus has developed a valuation model based on the present value of 6 years ofnormalized Free Cash Flow and 80% of Book Value of the company. The details of how we calculate the intrinsic value of stocks are described in detail here.

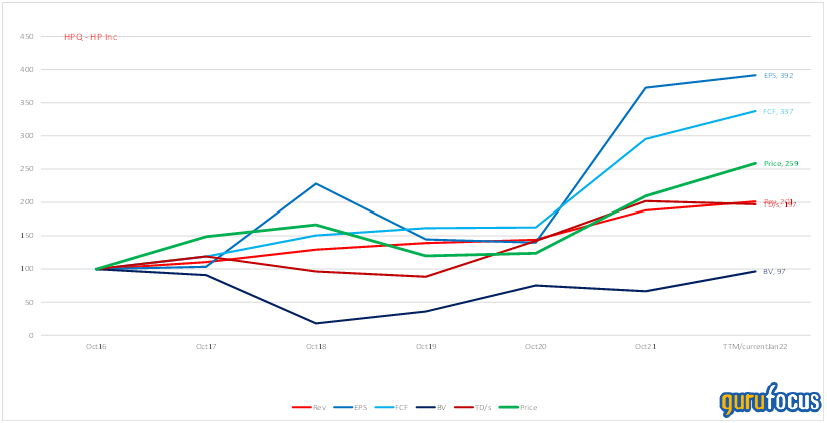

HP in its current form was created in 2015 when the enterprise business (HPE) was spun out and the consulting business was sold off. Growth per share has been quite strong since then, aided by generous stock buybacks:

| Growth (Per Share) | ||

| 5 Yr | 1 Yr | |

| Revenue Growth (%) | 12.2 | 32.4 |

| EBITDA Growth (%) | 18.4 | 115.5 |

| Oprt. Income Growth (%) | 10.1 | 64.3 |

| EPS w/o NRI Growth (%) | 21.1 | 136.3 |

| Free Cash Flow Growth (%) | 20.2 | 108.6 |

| Book Value Growth (%) | 5.3 | N/A |

The following table shows segment revenues and earnings before taxes (all figures in USD millions). The company is growing at mid-single digits and is not truly in decline as per the market narrative.

| Revenues | Revenues | Revenues | Annualized Growth | Earnings Before Taxes | Earnings Before Taxes | Earnings Before Taxes | Annualized Growth | |

| Report Date | 10/31/2019 | 10/31/2020 | 10/31/2021 | 10/31/2019 | 10/31/2020 | 10/31/2021 | ||

| Personal Systems | 38694 | 38997 | 43359 | 5.86% | 1898 | 2312 | 3101 | 27.82% |

| Printing | 20066 | 17641 | 20128 | 0.15% | 3202 | 2495 | 3636 | 6.56% |

| Corporate Investments | 2 | 2 | 3 | -96 | -69 | -96 | ||

| Total | 58762 | 56640 | 63490 | 3.95% | 5004 | 4738 | 6641 | 15.20% |

The following chart shows the progress of various metrics starting in 2016 (indexed to 100). For instance, the index for Earnings Per Share (EPS) had nearly quadrupled to 392.

Conclusion

I believe Buffett's move on HP is quintessential value investing 101. Price is what you pay, value is what you get. I see a low-risk, growing business selling for a single digit price-earnings ratio. The market is focused on the negatives, but looking beyond the surface level on the company's earnings numbers reveals a very different picture.