Microsoft Corporation (MSFT, Financial) is a large software company that produces operating systems, productivity software, gaming systems, online services, and cloud solutions.

-Seven Year Sales Growth Rate: 9.6%

-Seven Year EPS Growth Rate: 15%+

-Dividend Yield: 2.45%

-Balance Sheet: Perfect

Despite the run-up in stock price, and although it does deserve a somewhat modest valuation to take into account uncertainty regarding Windows 8, the Azure platform, and Office Suite profitability, at less than 12 times earnings and less than 11 times free cash flow, I think Microsoft stock is a reasonable purchase at the current price in the low-to-mid $30”²s.

The company produces the Windows series of operating systems and the Office Suite of productivity software, which have held dominance in the PC market. The company has very little market share of mobile computing operating systems and software applications, but does have a strong server and tools segment, a reasonably strong gaming/media segment, and an online segment that loses money but is growing revenue and market share.

The company spends around $9 billion per year on research and development.

The upcoming release of Windows 8 aims to keep control of the PC operating system market and simultaneously take market share of tablet operating systems. Their Azure platform is a strong showing in the increasingly important area of cloud computing.

Windows and Windows Live

The Windows division produces and markets Windows products. In fiscal year 2011, the segment produced $19 billion in revenue and $12.2 billion in operating income, which were significantly up from 2009 levels, but down 2% and 6% respectively from 2010 levels. The segment enjoys huge profit margins in developed areas, but the products sell for less money in developing areas, which impacts margins.

Server and Tools

Microsoft’s server division includes Windows Server operating system, Microsoft SQL Server, Windows Azure Platform for cloud computing, System Center, and Enterprise Services. In fiscal year 2011, the segment produced $17.1 billion in revenue and $6.6 billion in operating income, which are up 11% and 19% respectively from 2010, and up significantly from 2009 as well.

Business Division

This segment primarily produces the Office Suite of productivity software, including Word, Excel, Powerpoint, SharePoint, Exchange, and Lync. For 2011, revenue was $22.2 billion, and operating income was $14.1 billion, which were up 16% and 23%, respectively, from 2010. 2010 figures were roughly flat from 2009. This is another segment that has huge profit margins for the company.

Entertainment and Devices

This segment produces the XBox 360, XBox Live, the Kinect, and Windows Phone. In 2011, revenue was $8.9 billion and operating income was $1.3 billion, which are up 45% and 114% from 2010. Between 2009 and 2010, revenue decreased a bit but operating income nearly doubled. Over the last several years, Microsoft has gained the strongest position in gaming, and this division has become much more profitable.

Online Services

This segment includes Bing and MSN, as well as advertiser tools. In 2011, revenue was $2.5 billion and the operating loss was $2.5 billion. Over the last few years, revenue has been increasing, but this segment has been a financial loss rather than a financial gain. Bing market share has grown a bit, but is still much less than Google.

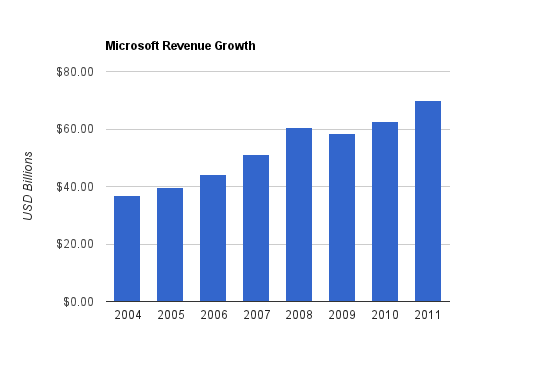

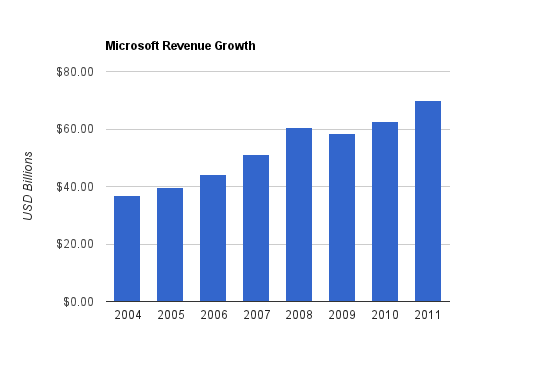

Sales growth over this period averaged 9.6% annually, which is very strong for a large company over this period of time.

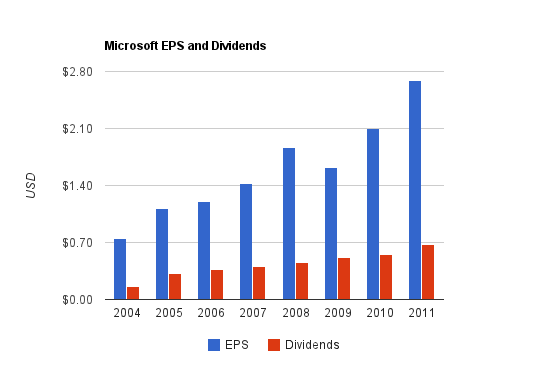

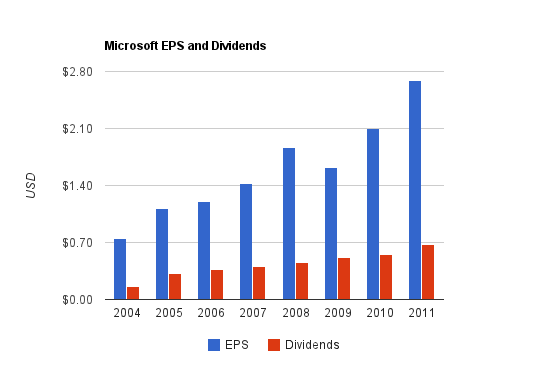

Microsoft stock has seen EPS grow by an average of 20% annually over this period, which is huge. 2004 was a bit of a low year, however, so it skews results a bit. If I calculate EPS growth over an 8 and 9 year period, I come up with approximately 14% and 16% annualized growth, respectively.

Microsoft has grown operating cash flow by an average of 9.1% annually over this period, and free cash flow by slightly under 9% per year. These have been very strong growth rates for such a large company.

Price to Free Cash Flow: 10.3

Price to Book Value: 4.3

Return on Equity: 40%

The Microsoft dividend currently comes from a dividend payout ratio of earnings of slightly under 30%, and the dividend yield is 2.45%. The yield was over 3% until Microsoft stock had its recent rally.

Between 2005 and 2011, Microsoft grew its dividend by 13.3% per year, on average. The most recent increase was from $0.16 per quarter to $0.20 per quarter, which is a 25% increase.

Over this same period, Microsoft paid about $26 billion in dividends, $74 billion in net share repurchases (money spent on shares repurchased minus the value of shares issued), and $20 billion in net acquisitions.

Generally, I’d prefer for the dividends to increase and share repurchases to decrease. Tech stocks can reasonably have lower payout ratios due to being more cyclical and potentially needing to change or invest very quickly, but I think Microsoft stock could use a 50% payout ratio or so. At the current valuation of Microsoft stock, however, share repurchases aren’t bad. The number of shares decreased from about 10.5 billion to around 8.5 billion since 2006, which fuels EPS growth and dividend growth.

Microsoft has a total debt/equity ratio of under 0.2, and the company only took out this debt to take advantage of such low interest rates. The interest coverage ratio is over 70. Total debt/income is considerably below 1. Approximately 1/3rd of shareholder equity consists of goodwill. The company has over $50 billion in cash equivalents on the balance sheet, and billions more in longer-term investments. This is lower than Apple, but higher than almost any other company.

Overall, Microsoft’s balance sheet is rock solid.

-Microsoft’s recent Windows Phone operating system has received good reviews, but has low market share. With the Nokia deal, they may over time reclaim some market share.

-Microsoft is set to launch Windows 8, which is tablet friendly as well as serving as their next PC operating system. This means that for the first time, the core product of Microsoft, rather than a side product, will be competing in the mobile area. The reviews so far are good, and in fact, the ones I’ve read propose that the OS actually looks better for the tablets than on the PC, rather than the other way around. Most of the existing criticisms, within the larger picture of good reviews, point out that changes to the desktop shell reduce usability in favor of tablet and touch screen usability. Overall, looking good.

As bandwidth has grown, it has become increasingly viable to use web-based productivity software and other applications. Microsoft is already largely on top of this trend.

-They are set to offer Infrastructure as a Service (IaaS) with their own data centers.

-In their data centers, and also eventually to be licensed to others, their Azure platform serves as a cloud operating system for data centers. This is their strong Platform as a Service (PaaS) offering.

-Their core products, like Office, now have Software as a Service (Saas) versions.

In addition, Microsoft has a history of success with businesses that many of its consumer competitors do not have.

For the most part, tech moats are built from platforms, not products. The industry seems to be shaping around developing and expanding its platforms, and products serve primarily as the gateway to those platforms. This way, rather than going boom or bust by the next wave of products, a company that relies on a platform has time to maneuver around obstacles and industry trends, and benefits from the network effect.

-Google has the largest mobile OS market share with its free Android system, and all of this serves as a gateway to other Google services, like Google Play.

-Apple has built the most successful platform so far, as they both make plenty of cash flow from their products, and also set it up so that those products all collectively build a platform. They receive a percentage of the profits of all apps sold in their digital distribution network.

-Amazon has built a global online retail platform that has become increasingly digital as well. Its sales platform allows smaller businesses to sell their goods, and they also use their own warehouses to sell goods. They’ve entered into music and movies. They’ve entered the tablet area with the Kindle models. Rather than aiming to make tons of money on the sale of these tablets, Amazon benefits from these devices as gateways to their content system; books and media.

-Microsoft’s Windows 8 will have a Windows Store, which serves as a platform for digital distribution. In addition, Azure is their cloud platform for software producers to sell Software as a Service. They’ve also got XBox and the XBox Live, which is another platform.

When these companies combine platforms with strong brands and scale, they can build a moat. Only a few tech companies have successfully built moats without platforms, such as Intel that relies mainly on the unrivaled scale of its R&D and the patent shield built around it. I’ll be discussing at length the current tech platforms in my next dividend newsletter edition, including an overview of where the values are, and how this industry impacts lower-tech industries.

It’s worth looking, then, at some of their competitor’s valuations.

-Apple, despite their enormous success, doesn’t have a high valuation. Through these wildly successful years of iPhones and iPads, their valuation has remained fairly conservative as investors have constantly wondered whether their next product cycle will succeed or fail. I pointed out two years ago in an article called “How to Deal with Highly Valued Stocks” how low Apple’s PEG ratio was compared to its peers. Going forward, although they do have a half-trillion-dollar market capitalization and so there is a lot of money there, they’re not particularly highly valued. Their price to free cash flow is under 15 and P/E is under 17, meaning that their stock is cheaper than Procter and Gamble (PG, Financial). The forward estimates of Apple’s EPS indicate a very low forward P/E. So investors still remain, and justifiably so, cautious regarding Apple’s continued success. I expect, however, for Apple to continue to do well for now.

-Google is quantitatively cheap too. With their patent battles, Google Plus performance, and the continued reliance of their revenues and profits from advertising, investors remain uncertain. Google stock is around the same valuation as Coca Cola stock, and their forward P/E based on estimates is not particularly bullish.

-Amazon, out of the bunch is the most expensive. With their strong retail platform, successful Kindle line, entry into cloud computing, and entry into digital distribution of media, all with varying degrees of success, investors are pretty bullish. One might look at their P/E of over 100 and be reminded of tech bubble, and I wouldn’t blame them. Their price to free cash flow, however, is “only” 40. With Amazon’s growth potential, sturdy position as a platform with huge tailwinds, and relatively modest market capitalization of still under $100 billion, I wouldn’t call the company wildly overvalued. Rather expensive, sure, but not to an unjustifiable degree. They’ve also entered the cloud services space as well.

-Oracle and IBM trade for moderate valuations.

In other words, despite the rather prevalent negative sentiment towards MSFT stock, investors don’t seem to have any outsized favor to any of the major software platforms. If Microsoft’s full risks were to be realized, then surely some of these companies would benefit in an outsized way. I’m inclined to continue to purchase Microsoft, I’m bullish towards IBM as well (though I’d like to pick it up at a lower valuation), but it might not be a bad tactic to have a rather diverse spread of picks in this industry. Investors place cautious valuations on these stocks, since it can’t be known which platforms will prosper at the expense of others, so owning several of the major players in the industry may not be a bad move. Collectively, the risks are diminished through diversification, and yet quite a bit of risk seems factored into many of these major tech stocks.

-Microsoft has thus far failed to get mobile market share. Windows Phone, despite generally receiving very good reviews, has negligible market share of smart phones compared to Google Android and Apple iOS. Even among business users, market share for the system is low. But the current version is still fairly new; we’ll see over coming quarters what their market share becomes.

-Microsoft so far has no tablet operating system. Windows 8 will change this, but nonetheless, they were not first in this wave of tablets. It’s true that Windows was and is on tablets since over a decade ago, but those were very different and largely unsuccessful systems. They were PC tablets, not these so-called “post PC” tablets.

-Windows 8 has very good reviews so far, but is not without its criticisms. Windows and Office are two of Microsoft’s profitable pillars, and Windows 8 needs to do well for Microsoft to do well.

-These operating systems from competitors on mobile devices pose a threat to Microsoft’s core PC area. The moat of Windows was based on its complete market share dominance; other good operating systems never got enough exposure to compete. But with consumers becoming so familiar with iOS and Android, as desktop and mobile operating systems converge, there is risk that competitors can acquire market share upstream. Meaning, for instance, that Android could potentially break into the PC market at the expense of Microsoft’s market share. Same for Apple.

-It is difficult to predict how quickly and to what degree businesses and consumers will shift to cloud computing, and how well Microsoft will do in that area in terms of pricing. So far, Microsoft has a strong cloud platform. This is an area that requires a lot of scale, and Microsoft can certainly bring scale to the table.

-Microsoft Office, as a Software as a Service, may not continue to be quite as profitable, and it’s a major pillar of their profitability. Even in its current state, despite the continued growth, I’m skeptical of its health. Free competitors like Libre Office or Google Docs can be good enough for many projects. Although I use Office on my work PC, I don’t even have Office on my home Windows 7 PC, as I use Libre Office and Google Docs instead, and haven’t missed it. The charts in this analysis, for instance, were not made with a Microsoft product. The counter-argument could be that, in an enterprise setting that uses SaaS, reliability is key, and so premium business-oriented offerings like the Office Suite will remain dominant. For any projects or systems that require considerable scale, that’s a good area for Microsoft.

Overall, I think Microsoft stock is a good buy at the current price in the low $30”²s, but the company is not without risks. Still, I’d point out how diversified they are. If any of the major risks were to be realized, Microsoft’s other areas may compensate. Perhaps Windows 8”²s sales won’t be as strong as hoped, and yet Azure grows more quickly than expected. Maybe Azure doesn’t get quite the market share it desires, and yet the consumer segment of XBox Live, the Kinect, and Windows Phone continue to do better. Maybe the shift towards Software as a Service or free competitors hurt the margins of the Office Suite, and yet revenues from Windows Store offset this a bit. Looking at the whole pie, I think the risk/reward situation looks rather favorable.

Stock selection that results in good returns generally occurs when the market is not in agreement on the future of a company. There’s a premium for confidence, and Microsoft’s stock currently doesn’t have that premium. Despite a decade of profitable growth, a reasonable degree of shareholder friendliness, entrance into new markets (XBox, Kinect), Microsoft has largely been judged by its lack of position in mobile computing. I propose we see what happens when the company throws the full weight of its development into mobile, such as the case with Windows 8 and to a lesser extent, Windows Phone, rather than point out its failures of side projects and attempts at market penetration.

Using a discount rate of 12% and an assumed free cash flow growth rate of only 5%, MSFT stock at the current price is nearly 25% undervalued. Using a discount rate of 13% and a free cash flow growth rate of 7%, MSFT stock is over 30% undervalued. Using zero growth and an 8% discount rate, Microsoft’s stock is still slightly undervalued. If profitability were to decline, however, then the current valuation would be too high.

In other words, all Microsoft has to do to provide a decent rate of return, is to not shrink. The sum of the Azure platform and the rest of the server and tools segment, Windows 8, Office transitioning to SaaS and competing against free software, Sharepoint and Lync, the next XBox launch and the associated Kinect, Windows Phone, and Bing, have to simply not shrink, in order for a decent rate of return to be achieved via dividends and share repurchases. And should the sum of this continue to grow at even a modest pace, the rate of return should be rather good for Microsoft stock.

If Microsoft plays its cards right, the company will have strong IaaS, PaaS, and SaaS cloud offerings, a share in app store revenues, and will have one of the better operating systems to connect to those offerings, via Windows 8 and their XBox network. They’ll also have a share of the living room, via the continued success of their current XBox and the launch of their next XBox, and the associated Kinect, which according to Guinness World Records set the record for being the fastest selling consumer electronics device ever.

Could the company shrink? Sure. But based on the diversification, and the observation that Microsoft seems to be on a reasonable path, I think that Microsoft stock does look like a decent buy in terms of risk and reward, and so I’ll be holding and potentially growing my position. If one wants to diversify, I’d also propose that the industry of software platforms as a whole looks reasonably attractively valued, and the major competitors that could potentially realize some of Microsoft’s biggest risks generally seem to have a margin of safety factored in as well.

Full Disclosure: I am long MSFT, PG, and KO at the time of this writing.

-Seven Year Sales Growth Rate: 9.6%

-Seven Year EPS Growth Rate: 15%+

-Dividend Yield: 2.45%

-Balance Sheet: Perfect

Despite the run-up in stock price, and although it does deserve a somewhat modest valuation to take into account uncertainty regarding Windows 8, the Azure platform, and Office Suite profitability, at less than 12 times earnings and less than 11 times free cash flow, I think Microsoft stock is a reasonable purchase at the current price in the low-to-mid $30”²s.

Overview

Microsoft Corporation (NASDAQ: MSFT) is one of the largest and most well-known software companies in the world.The company produces the Windows series of operating systems and the Office Suite of productivity software, which have held dominance in the PC market. The company has very little market share of mobile computing operating systems and software applications, but does have a strong server and tools segment, a reasonably strong gaming/media segment, and an online segment that loses money but is growing revenue and market share.

The company spends around $9 billion per year on research and development.

The upcoming release of Windows 8 aims to keep control of the PC operating system market and simultaneously take market share of tablet operating systems. Their Azure platform is a strong showing in the increasingly important area of cloud computing.

Business Segments

Microsoft is divided into the following business segments:Windows and Windows Live

The Windows division produces and markets Windows products. In fiscal year 2011, the segment produced $19 billion in revenue and $12.2 billion in operating income, which were significantly up from 2009 levels, but down 2% and 6% respectively from 2010 levels. The segment enjoys huge profit margins in developed areas, but the products sell for less money in developing areas, which impacts margins.

Server and Tools

Microsoft’s server division includes Windows Server operating system, Microsoft SQL Server, Windows Azure Platform for cloud computing, System Center, and Enterprise Services. In fiscal year 2011, the segment produced $17.1 billion in revenue and $6.6 billion in operating income, which are up 11% and 19% respectively from 2010, and up significantly from 2009 as well.

Business Division

This segment primarily produces the Office Suite of productivity software, including Word, Excel, Powerpoint, SharePoint, Exchange, and Lync. For 2011, revenue was $22.2 billion, and operating income was $14.1 billion, which were up 16% and 23%, respectively, from 2010. 2010 figures were roughly flat from 2009. This is another segment that has huge profit margins for the company.

Entertainment and Devices

This segment produces the XBox 360, XBox Live, the Kinect, and Windows Phone. In 2011, revenue was $8.9 billion and operating income was $1.3 billion, which are up 45% and 114% from 2010. Between 2009 and 2010, revenue decreased a bit but operating income nearly doubled. Over the last several years, Microsoft has gained the strongest position in gaming, and this division has become much more profitable.

Online Services

This segment includes Bing and MSN, as well as advertiser tools. In 2011, revenue was $2.5 billion and the operating loss was $2.5 billion. Over the last few years, revenue has been increasing, but this segment has been a financial loss rather than a financial gain. Bing market share has grown a bit, but is still much less than Google.

Sales, Earnings, Cash Flow, and Metrics

Microsoft has had a flat stock price for much of the decade, and this sometimes leads people to assume that Microsoft itself has had flat performance. To the contrary, Microsoft has experienced rather outsized growth over this last decade. Microsoft stock, however, was vastly overvalued 10 years ago, and so over this past decade, Microsoft’s corporate performance has continually increased while Microsoft stock has remained flat due to an ever-shrinking stock valuation.Sales Growth

| Year | Revenue |

|---|---|

| 2011 | $69.943 billion |

| 2010 | $62.484 billion |

| 2009 | $58.437 billion |

| 2008 | $60.420 billion |

| 2007 | $51.122 billion |

| 2006 | $44.282 billion |

| 2005 | $39.788 billion |

| 2004 | $36.835 billion |

Income Growth

| Year | EPS |

|---|---|

| 2011 | $2.69 |

| 2010 | $2.10 |

| 2009 | $1.62 |

| 2008 | $1.87 |

| 2007 | $1.42 |

| 2006 | $1.20 |

| 2005 | $1.12 |

| 2004 | $0.75 |

Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| 2011 | $26.994 billion | $24.639 billion |

| 2010 | $24.073 billion | $22.096 billion |

| 2009 | $19.037 billion | $15.918 billion |

| 2008 | $21.612 billion | $18.430 billion |

| 2007 | $17.796 billion | $15.532 billion |

| 2006 | $14.404 billion | $12.826 billion |

| 2005 | $16.605 billion | $15.793 billion |

| 2004 | $14.626 billion | $13.517 billion |

Current Performance

Microsoft’s fiscal year ends in the middle of the calendar year. Over the trailing twelve month period, revenue is up to over $72 billion, EPS is up to $2.76, operating cash flow is up to almost $29 billion, and free cash flow is up to $26.7 billion.Metrics

Price to Earnings: 11.6Price to Free Cash Flow: 10.3

Price to Book Value: 4.3

Return on Equity: 40%

Dividends

Dividend growth can be hard to find in the tech world, but a few companies like Microsoft, IBM and Intel have begun to develop some reasonable stretches of dividend growth, and so have some of the medium-sized semiconductor companies.The Microsoft dividend currently comes from a dividend payout ratio of earnings of slightly under 30%, and the dividend yield is 2.45%. The yield was over 3% until Microsoft stock had its recent rally.

Microsoft Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $0.68 |

| 2010 | $0.55 |

| 2009 | $0.52 |

| 2008 | $0.46 |

| 2007 | $0.41 |

| 2006 | $0.37 |

| 2005 | $0.32 |

Share Repurchases and Acquisitions

Between 2006 and 2011, Microsoft brought in around $110 billion in free cash flow.Over this same period, Microsoft paid about $26 billion in dividends, $74 billion in net share repurchases (money spent on shares repurchased minus the value of shares issued), and $20 billion in net acquisitions.

Generally, I’d prefer for the dividends to increase and share repurchases to decrease. Tech stocks can reasonably have lower payout ratios due to being more cyclical and potentially needing to change or invest very quickly, but I think Microsoft stock could use a 50% payout ratio or so. At the current valuation of Microsoft stock, however, share repurchases aren’t bad. The number of shares decreased from about 10.5 billion to around 8.5 billion since 2006, which fuels EPS growth and dividend growth.

Balance Sheet

Microsoft is one of four non-financial companies that has a perfect AAA balance sheet, along with Exxon Mobil (XOM, Financial), Johnson and Johnson (JNJ, Financial), and Automatic Data Processing (ADP, Financial).Microsoft has a total debt/equity ratio of under 0.2, and the company only took out this debt to take advantage of such low interest rates. The interest coverage ratio is over 70. Total debt/income is considerably below 1. Approximately 1/3rd of shareholder equity consists of goodwill. The company has over $50 billion in cash equivalents on the balance sheet, and billions more in longer-term investments. This is lower than Apple, but higher than almost any other company.

Overall, Microsoft’s balance sheet is rock solid.

Investment Thesis

Microsoft faces a changing world. The market of smart phones has grown like wildfire, tablets are catching on, and cloud computing (minus the hype) is becoming an increasingly important hardware and software area to be involved in. Microsoft has largely missed out on the mobile proliferation, but is already a strong player with regards to the cloud. Some of these changes may erode Microsoft’s dominance in its key PC market, and so the market has placed a rather low valuation on Microsoft stock despite these excellent growth numbers and balance sheet.Smart Phones and Tablets

Continued advances in technology have allowed smaller devices to have the power of what computers used to have. We can now do most of what we can do on a computer on a phone or tablet as well, albeit with some sacrifice of ergonomics and usability. Unfortunately for Microsoft, they’ve largely missed out on this trend so far, while Google, Apple, Amazon, and others, have benefited.-Microsoft’s recent Windows Phone operating system has received good reviews, but has low market share. With the Nokia deal, they may over time reclaim some market share.

-Microsoft is set to launch Windows 8, which is tablet friendly as well as serving as their next PC operating system. This means that for the first time, the core product of Microsoft, rather than a side product, will be competing in the mobile area. The reviews so far are good, and in fact, the ones I’ve read propose that the OS actually looks better for the tablets than on the PC, rather than the other way around. Most of the existing criticisms, within the larger picture of good reviews, point out that changes to the desktop shell reduce usability in favor of tablet and touch screen usability. Overall, looking good.

“Cloud” Computing

Cloud computing, minus the hype, means a gradual shift to server computing from client computing. It also means virtualization and distributed computing among the servers.As bandwidth has grown, it has become increasingly viable to use web-based productivity software and other applications. Microsoft is already largely on top of this trend.

-They are set to offer Infrastructure as a Service (IaaS) with their own data centers.

-In their data centers, and also eventually to be licensed to others, their Azure platform serves as a cloud operating system for data centers. This is their strong Platform as a Service (PaaS) offering.

-Their core products, like Office, now have Software as a Service (Saas) versions.

In addition, Microsoft has a history of success with businesses that many of its consumer competitors do not have.

Tech Moats are Built from Platforms, not Products

Technology has been an area where many dividend investors have wisely avoided. My position, however, is that technology has finally gotten to the point where, in a few blue-chip cases, there has been some industry maturation, and some dividend growth and economic moats can be found.For the most part, tech moats are built from platforms, not products. The industry seems to be shaping around developing and expanding its platforms, and products serve primarily as the gateway to those platforms. This way, rather than going boom or bust by the next wave of products, a company that relies on a platform has time to maneuver around obstacles and industry trends, and benefits from the network effect.

-Google has the largest mobile OS market share with its free Android system, and all of this serves as a gateway to other Google services, like Google Play.

-Apple has built the most successful platform so far, as they both make plenty of cash flow from their products, and also set it up so that those products all collectively build a platform. They receive a percentage of the profits of all apps sold in their digital distribution network.

-Amazon has built a global online retail platform that has become increasingly digital as well. Its sales platform allows smaller businesses to sell their goods, and they also use their own warehouses to sell goods. They’ve entered into music and movies. They’ve entered the tablet area with the Kindle models. Rather than aiming to make tons of money on the sale of these tablets, Amazon benefits from these devices as gateways to their content system; books and media.

-Microsoft’s Windows 8 will have a Windows Store, which serves as a platform for digital distribution. In addition, Azure is their cloud platform for software producers to sell Software as a Service. They’ve also got XBox and the XBox Live, which is another platform.

When these companies combine platforms with strong brands and scale, they can build a moat. Only a few tech companies have successfully built moats without platforms, such as Intel that relies mainly on the unrivaled scale of its R&D and the patent shield built around it. I’ll be discussing at length the current tech platforms in my next dividend newsletter edition, including an overview of where the values are, and how this industry impacts lower-tech industries.

Stock Valuation

Microsoft currently has a low valuation at under 11 times free cash flow, and under 12 times earnings. I would say that a fairly modest valuation is justified, because tech, even platforms, can be somewhat uncertain. Microsoft has to successfully launch a new operating system, claim some mobile market share, and retain profitability as things shift towards the cloud.It’s worth looking, then, at some of their competitor’s valuations.

-Apple, despite their enormous success, doesn’t have a high valuation. Through these wildly successful years of iPhones and iPads, their valuation has remained fairly conservative as investors have constantly wondered whether their next product cycle will succeed or fail. I pointed out two years ago in an article called “How to Deal with Highly Valued Stocks” how low Apple’s PEG ratio was compared to its peers. Going forward, although they do have a half-trillion-dollar market capitalization and so there is a lot of money there, they’re not particularly highly valued. Their price to free cash flow is under 15 and P/E is under 17, meaning that their stock is cheaper than Procter and Gamble (PG, Financial). The forward estimates of Apple’s EPS indicate a very low forward P/E. So investors still remain, and justifiably so, cautious regarding Apple’s continued success. I expect, however, for Apple to continue to do well for now.

-Google is quantitatively cheap too. With their patent battles, Google Plus performance, and the continued reliance of their revenues and profits from advertising, investors remain uncertain. Google stock is around the same valuation as Coca Cola stock, and their forward P/E based on estimates is not particularly bullish.

-Amazon, out of the bunch is the most expensive. With their strong retail platform, successful Kindle line, entry into cloud computing, and entry into digital distribution of media, all with varying degrees of success, investors are pretty bullish. One might look at their P/E of over 100 and be reminded of tech bubble, and I wouldn’t blame them. Their price to free cash flow, however, is “only” 40. With Amazon’s growth potential, sturdy position as a platform with huge tailwinds, and relatively modest market capitalization of still under $100 billion, I wouldn’t call the company wildly overvalued. Rather expensive, sure, but not to an unjustifiable degree. They’ve also entered the cloud services space as well.

-Oracle and IBM trade for moderate valuations.

In other words, despite the rather prevalent negative sentiment towards MSFT stock, investors don’t seem to have any outsized favor to any of the major software platforms. If Microsoft’s full risks were to be realized, then surely some of these companies would benefit in an outsized way. I’m inclined to continue to purchase Microsoft, I’m bullish towards IBM as well (though I’d like to pick it up at a lower valuation), but it might not be a bad tactic to have a rather diverse spread of picks in this industry. Investors place cautious valuations on these stocks, since it can’t be known which platforms will prosper at the expense of others, so owning several of the major players in the industry may not be a bad move. Collectively, the risks are diminished through diversification, and yet quite a bit of risk seems factored into many of these major tech stocks.

Risks

Microsoft has considerable risks, which is why the valuation is so low compared to all the quantitative aspects of the company.-Microsoft has thus far failed to get mobile market share. Windows Phone, despite generally receiving very good reviews, has negligible market share of smart phones compared to Google Android and Apple iOS. Even among business users, market share for the system is low. But the current version is still fairly new; we’ll see over coming quarters what their market share becomes.

-Microsoft so far has no tablet operating system. Windows 8 will change this, but nonetheless, they were not first in this wave of tablets. It’s true that Windows was and is on tablets since over a decade ago, but those were very different and largely unsuccessful systems. They were PC tablets, not these so-called “post PC” tablets.

-Windows 8 has very good reviews so far, but is not without its criticisms. Windows and Office are two of Microsoft’s profitable pillars, and Windows 8 needs to do well for Microsoft to do well.

-These operating systems from competitors on mobile devices pose a threat to Microsoft’s core PC area. The moat of Windows was based on its complete market share dominance; other good operating systems never got enough exposure to compete. But with consumers becoming so familiar with iOS and Android, as desktop and mobile operating systems converge, there is risk that competitors can acquire market share upstream. Meaning, for instance, that Android could potentially break into the PC market at the expense of Microsoft’s market share. Same for Apple.

-It is difficult to predict how quickly and to what degree businesses and consumers will shift to cloud computing, and how well Microsoft will do in that area in terms of pricing. So far, Microsoft has a strong cloud platform. This is an area that requires a lot of scale, and Microsoft can certainly bring scale to the table.

-Microsoft Office, as a Software as a Service, may not continue to be quite as profitable, and it’s a major pillar of their profitability. Even in its current state, despite the continued growth, I’m skeptical of its health. Free competitors like Libre Office or Google Docs can be good enough for many projects. Although I use Office on my work PC, I don’t even have Office on my home Windows 7 PC, as I use Libre Office and Google Docs instead, and haven’t missed it. The charts in this analysis, for instance, were not made with a Microsoft product. The counter-argument could be that, in an enterprise setting that uses SaaS, reliability is key, and so premium business-oriented offerings like the Office Suite will remain dominant. For any projects or systems that require considerable scale, that’s a good area for Microsoft.

Conclusion and Valuation of Microsoft Stock

I acquired shares of Microsoft stock back when they were in mid-$20”²s, and frankly, I’m a bit disappointed by this rally, because I would have liked to acquire more shares at a cheaper price, and Microsoft is repurchasing their own shares, so it’s better for them to stay low. Nonetheless, despite the rally, I think the numbers show that the stock is still trading for a reasonably attractive valuation, even after taking into account the risks.Overall, I think Microsoft stock is a good buy at the current price in the low $30”²s, but the company is not without risks. Still, I’d point out how diversified they are. If any of the major risks were to be realized, Microsoft’s other areas may compensate. Perhaps Windows 8”²s sales won’t be as strong as hoped, and yet Azure grows more quickly than expected. Maybe Azure doesn’t get quite the market share it desires, and yet the consumer segment of XBox Live, the Kinect, and Windows Phone continue to do better. Maybe the shift towards Software as a Service or free competitors hurt the margins of the Office Suite, and yet revenues from Windows Store offset this a bit. Looking at the whole pie, I think the risk/reward situation looks rather favorable.

Stock selection that results in good returns generally occurs when the market is not in agreement on the future of a company. There’s a premium for confidence, and Microsoft’s stock currently doesn’t have that premium. Despite a decade of profitable growth, a reasonable degree of shareholder friendliness, entrance into new markets (XBox, Kinect), Microsoft has largely been judged by its lack of position in mobile computing. I propose we see what happens when the company throws the full weight of its development into mobile, such as the case with Windows 8 and to a lesser extent, Windows Phone, rather than point out its failures of side projects and attempts at market penetration.

Using a discount rate of 12% and an assumed free cash flow growth rate of only 5%, MSFT stock at the current price is nearly 25% undervalued. Using a discount rate of 13% and a free cash flow growth rate of 7%, MSFT stock is over 30% undervalued. Using zero growth and an 8% discount rate, Microsoft’s stock is still slightly undervalued. If profitability were to decline, however, then the current valuation would be too high.

In other words, all Microsoft has to do to provide a decent rate of return, is to not shrink. The sum of the Azure platform and the rest of the server and tools segment, Windows 8, Office transitioning to SaaS and competing against free software, Sharepoint and Lync, the next XBox launch and the associated Kinect, Windows Phone, and Bing, have to simply not shrink, in order for a decent rate of return to be achieved via dividends and share repurchases. And should the sum of this continue to grow at even a modest pace, the rate of return should be rather good for Microsoft stock.

If Microsoft plays its cards right, the company will have strong IaaS, PaaS, and SaaS cloud offerings, a share in app store revenues, and will have one of the better operating systems to connect to those offerings, via Windows 8 and their XBox network. They’ll also have a share of the living room, via the continued success of their current XBox and the launch of their next XBox, and the associated Kinect, which according to Guinness World Records set the record for being the fastest selling consumer electronics device ever.

Could the company shrink? Sure. But based on the diversification, and the observation that Microsoft seems to be on a reasonable path, I think that Microsoft stock does look like a decent buy in terms of risk and reward, and so I’ll be holding and potentially growing my position. If one wants to diversify, I’d also propose that the industry of software platforms as a whole looks reasonably attractively valued, and the major competitors that could potentially realize some of Microsoft’s biggest risks generally seem to have a margin of safety factored in as well.

Full Disclosure: I am long MSFT, PG, and KO at the time of this writing.