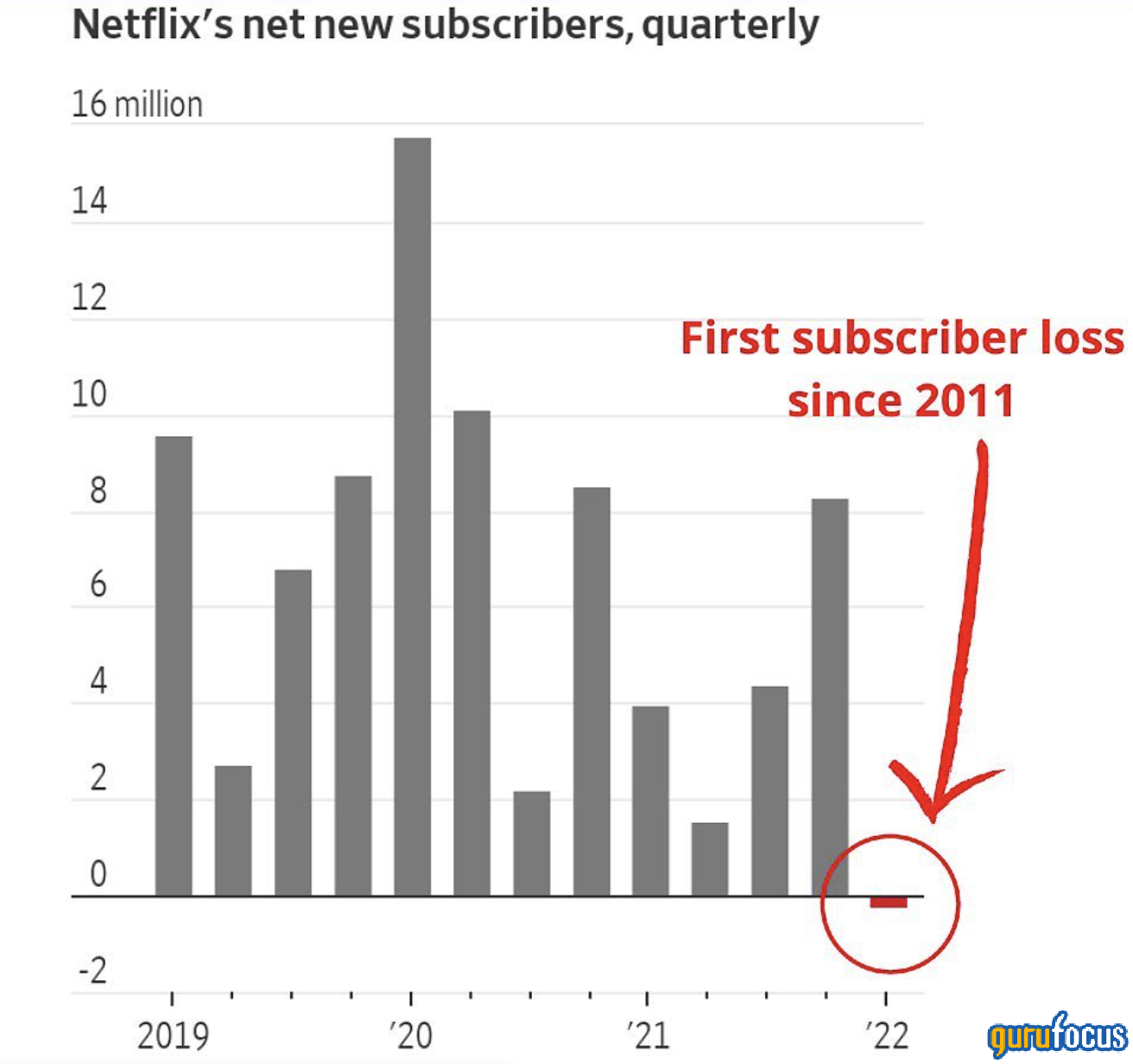

Netflix's (NFLX, Financial) net subscribers have declined unexpectedly, causing the stock to lose more than a third of its market value on Wednesday. A recent report communicated that the streaming giant's net subscriber base plummeted by roughly 200,000 users, sounding the alarm to investors.

Netflix's commentary on the event was blunt as it stated that its "revenue growth had slowed considerably... Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration - when including the large number of households sharing accounts - combined with competition, is creating revenue growth headwinds."

Source: Market Radar

I don't think this is one of those "buy the dip" moments. In fact, I believe this could be an inflection point for the stock which could see it go into free fall; here's why.

Why the user base has declined

The central issue here is purely down to industry maturity. The streaming business is a lot more crowded than it used to be, with the likes of Amazon" (AMZN, Financial) Prime Video, Warner Bros. Discovery's (WBD, Financial) HBO Max and Disney's (DIS, Financial) Disney+ spending heavily on mimicking Netflix's business model.

This is standard practice for industry development, and it's clear that the streaming business has exited the embryonic phase and entered a mature growth phase. The mature growth phase of an industry's life-cycle is characterized by rising competition and requires high re-investment rates to ascertain previous results.

Netflix's year-over-year CapEx growth of 5.35% is 51.81% lower than the industry, suggesting that the company hasn't re-invested as aggressively as it should have lately, which could help explain why it's lost its competitive advantage.

Economic implications

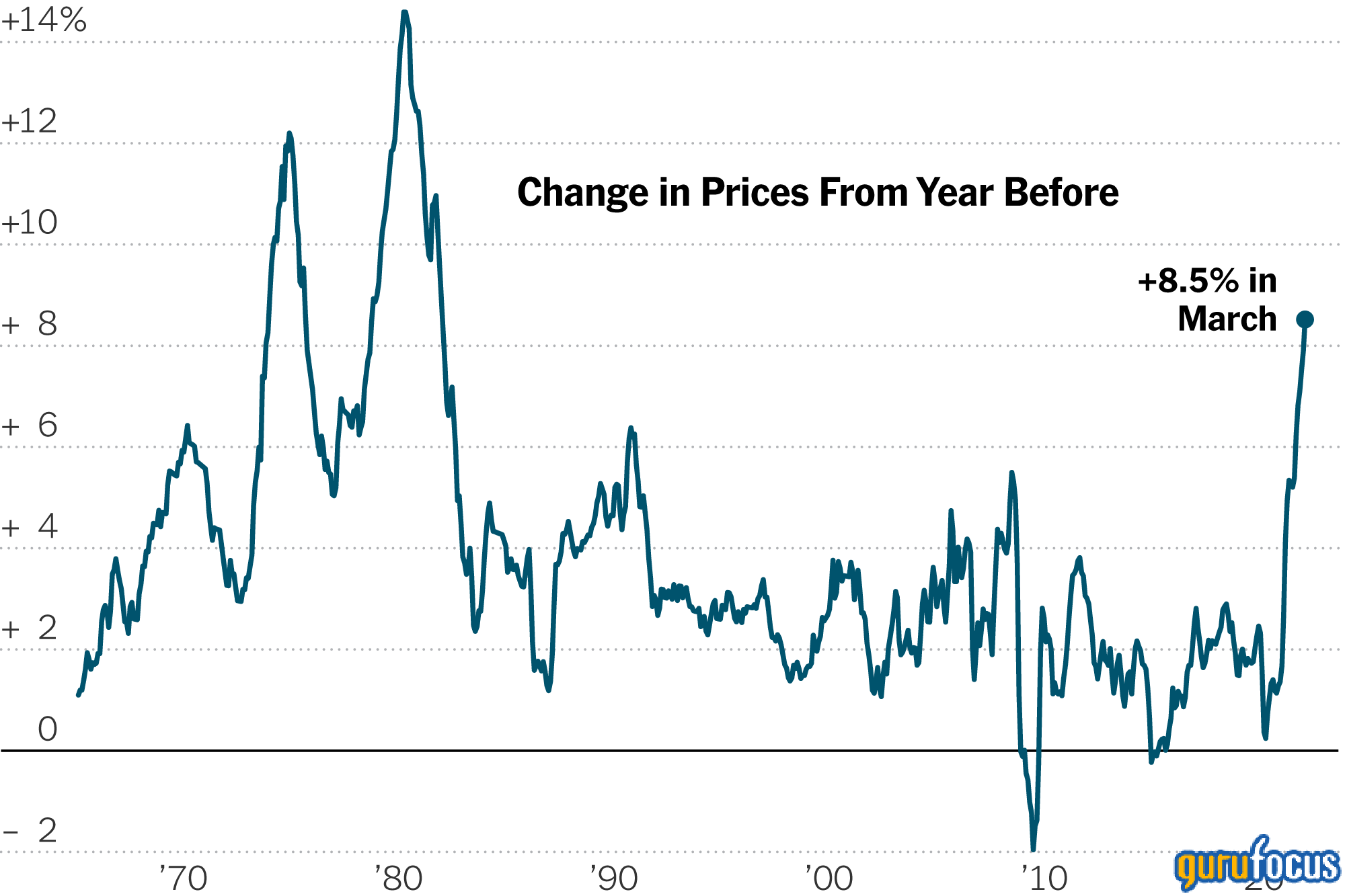

A macroeconomic vantage point tells us that Netflix could face cyclical headwinds. Subscription services are discretionary products that typically don't progress well during contractionary economic circumstances. The economy's growth trajectory is slowing, as indicated by the World Bank, which recently cut its global growth forecast by 0.9%.

The charts below show the recent rise in household obligations and debt and the rise in broad-based inflation. Households are likely to unsubscribe from non-essentials when faced with rising obligations to meet daily needs, which could lead to a sustained period of slow subscriber growth for the streaming space.

Source: GuruFocus

Source: The New York Times

Valuation woes

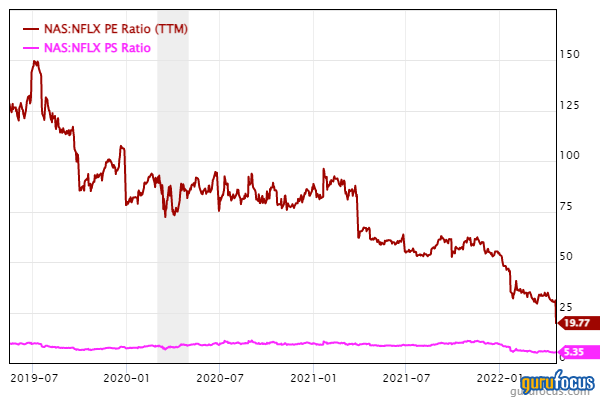

Netflix is trading at 5.35 times its sales even after today's decline, which tells us the stock is overvalued no matter how it's looked at. The price-sales ratio can be utilized to value companies even during growth phases and isn't catered towards mature firms as much as other price multiples. The metric should ideally be 1.00 or lower for a stock to be considered undervalued, which Netflix's isn't.

Furthermore, Netflix's price-earnings ratio of 19.77 is also of concern. The stock is still overvalued compared to peers in the diversified media industry on an earnings basis, indicating that investors expecting value won't get it.

The bottom line

Netflix's stock capitulation shouldn't be of any surprise, in my view. Rising household obligations, crowdedness in the streaming space and an unimpressive re-investment rate have led to underwhelming results. Additionally, the stock is overvalued even after the recent tumble, which has left it on a fragile foundation.