The Parnassus Fund, part of San Francisco-based Parnassus Funds, disclosed in a regulatory 13F filing that it entered four new positions during the first quarter: Progressive Corp. (PGR, Financial), Fortinet Inc. (FTNT, Financial), Nutrien Ltd. (NTR, Financial) and Cintas Corp. (CTAS, Financial).

Parnassus founder Jerome Dodson (Trades, Portfolio) stepped down from his fund management duties in 2020, though he still remains board chairman. In October 2021, Affiliated Managers Group Inc. (AMG, Financial) announced that it completed its partnership with Parnassus by acquiring a majority equity stake in the firm, although the terms of the deal were not disclosed.

The Parnassus Fund seeks long-term capital appreciation through a contrarian investing approach that seeks companies with wide economic moats, quality management teams and attractive valuations. Additionally, the fund avoids companies engaged in the exploration and extraction of fossil fuels.

As of March, the fund’s $909 million 13F equity portfolio contains 39 stocks with a quarterly turnover ratio of 16%. Investors should be aware that the 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

The fund’s top three sectors in terms of weight are technology, health care and consumer cyclical, representing 35.93%, 18.11% and 13.52% of the equity portfolio, respectively.

Progressive

The fund invested in 181,525 shares of Progressive (PGR, Financial), allocating 2.28% of its equity portfolio to the stake.

Shares of Progressive averaged $108.15 during the first quarter; the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 1.06.

The Mayfield Village, Ohio-based insurance company has a GF Score of 90 out of 100, driven by a growth rank of 10 out of 10 and a profitability rank of 8 out of 10 despite ranks between 5 and 6 out of 10 for financial strength, GF Value and momentum.

Other gurus with holdings in Progressive include PRIMECAP Management (Trades, Portfolio) and Glenn Greenberg (Trades, Portfolio)’s Brave Warrior Investors.

Fortinet

The fund purchased 57,395 shares of Fortinet (FTNT, Financial), giving the position 2.16% of equity portfolio space. Shares averaged $310.78 during the first quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 1.60.

The Sunnyvale, California-based cybersecurity software company has a GF Score of 82 out of 100, driven by a growth rank of 10 out of 10, a profitability rank of 9 out of 10, a financial strength rank of 7 out of 10, a momentum rank of 6 out of 10 and a GF Value rank of 3 out of 10.

Nutrien

The fund purchased 188,197 shares of Nutrien (NTR, Financial), giving the position a 2.15% equity portfolio weight.

Shares of Nutrien averaged $82.59 during the first quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 1.49.

The Canadian agriculture company has a GF Score of 82 out of 100, driven by a rank of 9 out of 10 for profitability and growth despite financial strength ranking just 5 out of 10 and GF Value and momentum ranking just 3 out of 10.

Cintas

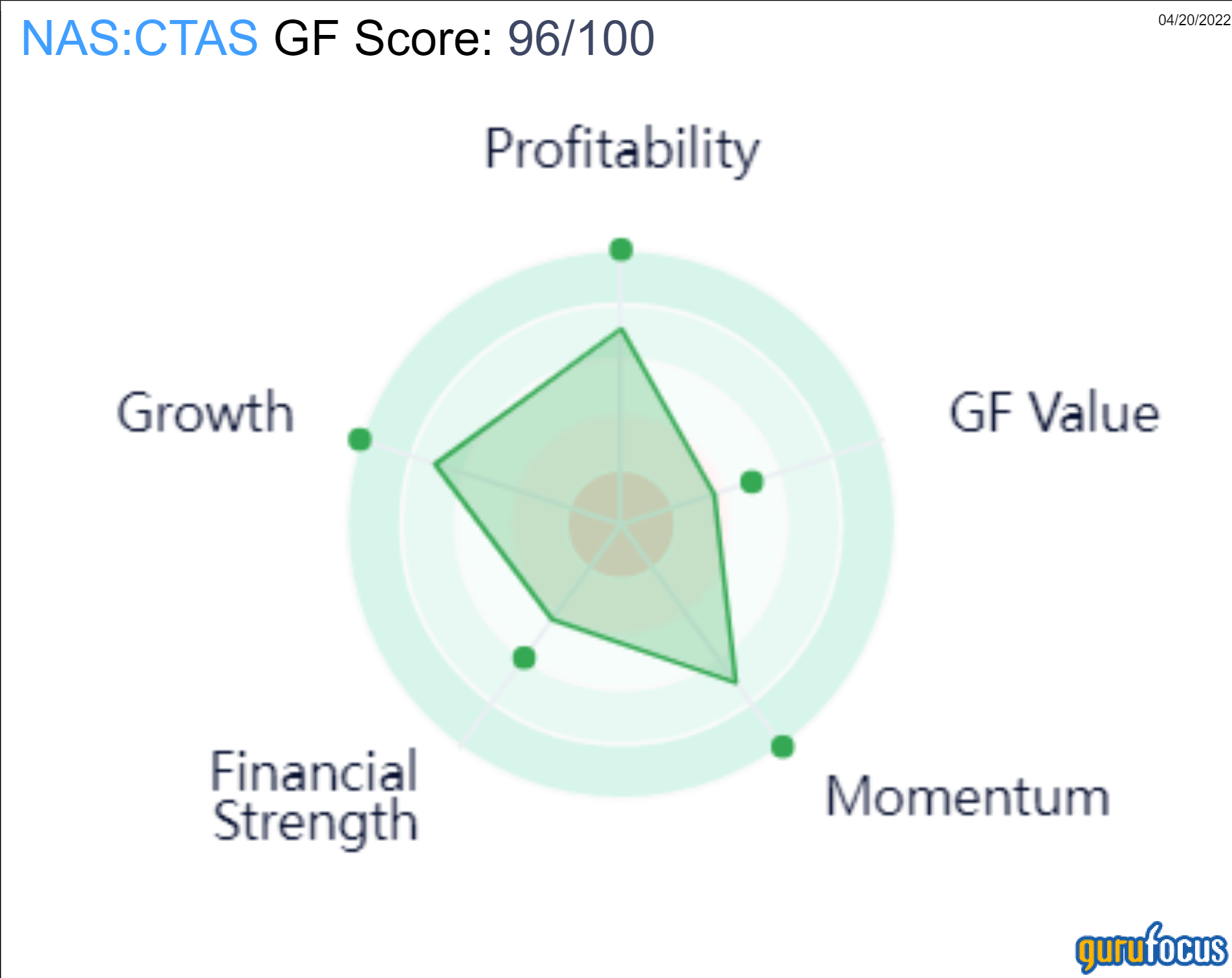

The fund purchased 45,880 shares of Cintas (CTAS, Financial), giving the position 2.15% of equity portfolio space. Shares averaged $388.96 during the first quarter; the stock is modestly overvalued based on Wednesday’s price-to-GF Value ratio of 1.16.

The Cincinnati-based uniform rental company has a GF Score of 96 out of 100, driven by a rank of 10 out of 10 for profitability, growth and momentum despite a rank between 5 and 6 out of 10 for financial strength and GF Value.

Also check out:- Glenn Greenberg Undervalued Stocks

- Glenn Greenberg Top Growth Companies

- Glenn Greenberg High Yield stocks, and

- Stocks that Glenn Greenberg keeps buying

- PRIMECAP Management Undervalued Stocks

- PRIMECAP Management Top Growth Companies

- PRIMECAP Management High Yield stocks, and

- Stocks that PRIMECAP Management keeps buying