The CEO of DocuSign Inc. (DOCU, Financial) recently purchased 66,882 shares of his company. Since the shares were priced in the mid-$70s, Dan Springer’s investment totaled nearly $5 million.

Last December, he also purchased about $5 million worth of shares: 34,751 of them at an average price of $143.86 per share. That was right after the share price plunged 42%.

With the price at $86.49 at midday on Friday, Springer is ahead on the most recent buy, but seriously underwater on the December purchase.

Don’t feel too sorry for him, though. He received a stock bonus of $18,933,688 for 2021, according to Salary.com. Indeed, many critics of the company complain that DocuSign pays its executives too much (more in the profitability section below).

Why is he buying?

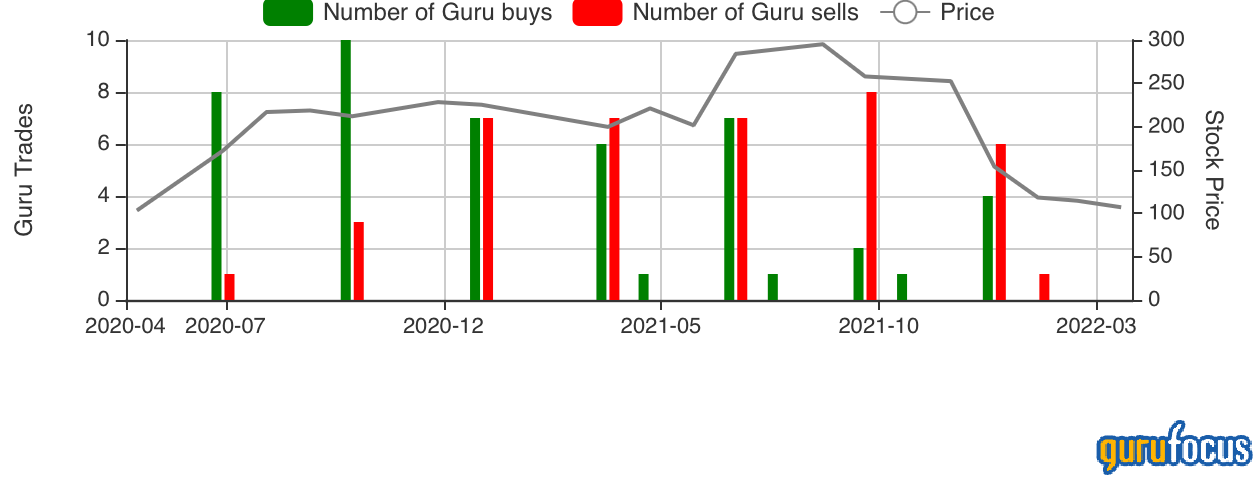

Let’s start with a chart of the share price (the company has traded publicly since 2018):

Both buys temporarily countered significant declines, and while the purchases did not set off a buying frenzy, they temporarily provided some price stability.

Should we follow the CEO and consider investing in the company? Let’s first review the fundamentals and valuation.

About DocuSign

The company began with electronic signature software and has since expanded into a suite called the DocuSign Agreement Cloud. According to the company, its new platform covers the entire agreement process. It provides this example in its 10-K filing for 2021:

“Hundreds of integrations with other systems where work gets done, such as applications offered by Google, Microsoft, Oracle, Salesforce, SAP, and Workday. For example, because of an integration that embeds DocuSign functionality into the Salesforce user experience, a sales representative can generate, send, and track an agreement via DocuSign services without ever leaving the Salesforce application. Behind the scenes, account data from Salesforce can automatically pre-fill the agreement. After signature, DocuSign services can pass any other data collected or generated in the agreement process back to Salesforce.”

Competition

DocuSign’s main global competitor is Adobe Inc. (ADBE, Financial), which entered the electronic signature business after acquiring EchoSign (now Adobe Sign) in 2011. It also competes with niche vendors that focus on specific industries, geographic regions or product areas.

Financial strength

DocuSign receives a moderate rating for financial strength, which is not surprising when we look at the amount of debt it has taken on in recent years:

Note that debt now exceeds its cash. Still, the company has a high Altman Z-Score, showing the debt does not compromise the company’s viability.

Another reason for the mediocre score turns up at the bottom of the table, where the weighted average cost of capital exceeds the return on invested capital. The WACC is 5.24% while the ROIC is -2.84%. This is not a healthy situation.

Free cash flow, the lifeblood of a growth company, has grown significantly:

Profitability

Given all the negative numbers for margins and returns, we should not be surprised at the dismal profitability rating of 2 out of 10. And the current numbers are better than those produced in the past (shown by the dark green bars in the history column).

In addition to the margins, executive and other compensation is also an issue. According to its financials for the year ending Jan. 31, its net loss from continuing operations was $69.97 billion while its stock-based compensation amounted to $408.54 billion.

There is encouraging news at the bottom of the table, where the company shows strong revenue and earnings per share growth. Can it grow them enough to achieve consistent profitability?

This chart shows how these two metrics have grown over the four years since DocuSign went public:

Dividends

DocuSign does not pay a dividend, and shareholders have experienced some dilution because of new share issuances.

Valuation

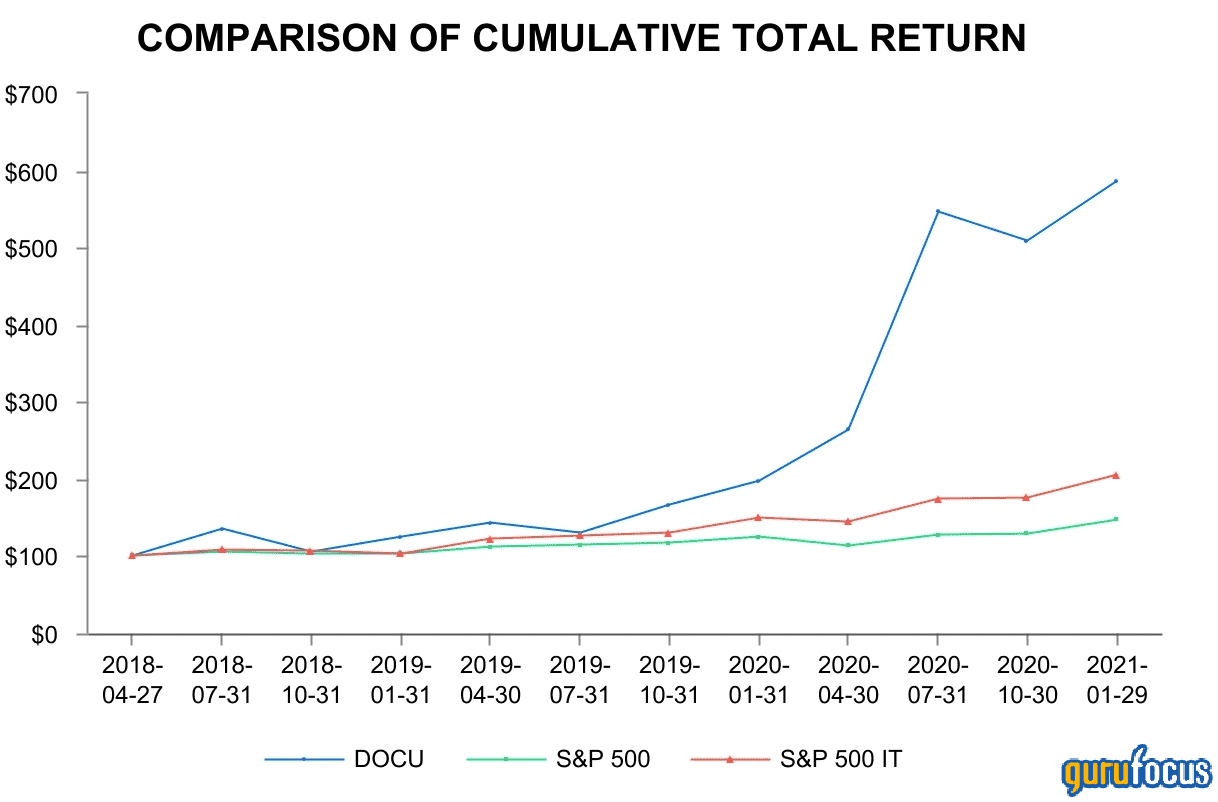

According to this chart in its annual filing with the SEC, DocuSign outperformed both the S&P 500 and the S&P 500 Information Technology Index until 2021:

Annualized returns:

- Year to date: -34.65%

- One year: -55.84%

- Three years: 21.61%

Total annual returns:

- 2018: 0.88%

- 2019: 84.91%

- 2020: 199.96%

- 2021: -31.48%

- 2022: -34.65%

This company has to be a poster child of roller coaster stocks. Thanks to the pandemic and restrictions on face-to-face meetings, the stock soared nearly 200% in 2020, before collapsing in 2021 and so far this year.

Valuation

A quick glimpse of the first three lines on this table explains why DocuSign receives such a low rating for value. All three are very high, making it hard to justify a purchase.

There is no PEG ratio on the table because the five-year Ebitda average is 0.00% (PEG is calculated by dividing the price-earnings ratio by the five-year average of Ebitda).

The GF Value chart arrives at an undervalued conclusion, but also warns the company could be a value trap (in other words, too good to be true and you could face a loss if you buy based solely on the low price).

Is DocuSign a value trap?

While investors should ask themselves whether or not the stock is a value trap, there are several reasons I think it is not.

The first reason is the Altman Z-Score. As shown above on the financial strength table, DocuSign is considered to have its financial house in order and there is no risk of bankruptcy or serious financial problems.

Second, it provides a service that addresses a proven need, reporting that it has 1.17 million paying customers and more than a billion users. Also, according to the website, its services save customers $36 in time and materials per agreement and customers see 80% faster turnaround time. It is used by 15 of the top 15 Fortune 500 financial companies and 14 of the top 15 Fortune 500 health care companies.

We’ve also seen the company can generate exceptional revenue and earnings. It is growing its free cash flow quickly, and that should translate into even more growth in the next few years.

Finally, DocuSign is experiencing the same pullback as the Invesco Nasdaq QQQ ETF (QQQ, Financial) and the Technology Select Sector SPDR Fund (XLK, Financial), only more severely.

Gurus

The leading investors have done more selling than buying for the past three quarters, after ramping up their holdings early in the pandemic:

Seven gurus held stakes in DocuSign at the end of the fourth quarter of 2021. The three biggest holdings were those of:

- Chase Coleman (Trades, Portfolio) of Tiger Global Management, who reduced his position by 5.21% to finish the quarter with 6,927,480 shares. That represented a 3.55% stake in DocuSign and 2.30% of the fund’s assets.

- Ken Fisher (Trades, Portfolio) of Fisher Asset Management held 3,052,026 shares. This was a new holding for him.

- Catherine Wood (Trades, Portfolio) of ARK Investment Management, who increased her stake by 38.97% to 2,531,306 shares.

Conclusion

Springer has shown confidence in DocuSign and in his belief the share price has room (and reasons) to grow.

There’s no doubt such moves were needed. Its essential metrics went backward in 2021; as they did so, many investors lost confidence and hit the “sell” button. But while it’s down, it’s far from out. The balance sheet remains strong and the company knows how to generate sales.

As for the value of the shares, some will see a bargain. The price is well below the highs it hit in the past year. Still, prudent investors will want to wait to gain some confidence DocuSign has turned the corner on profitability. This is a company that likely needs several years to improve its margins and reduce its executive compensation.