Steven Romick (Trades, Portfolio) disclosed his portfolio for the first quarter of 2022 earlier this week.

Part of Los Angeles-based investment firm First Pacific Advisors (Trades, Portfolio), the guru manages the FPA Crescent Fund along with Brian Selmo and Mark Landecker. Taking both long and short positions, the fund's objective is to generate returns with less risk than the market while avoiding permanent loss of capital. Its strategy combines deep research with a focus on strong fundamentals, attractive risk-reward and diversification across geographies, market caps, sectors and capital structure.

Romick entered nine new positions, sold out of one holding and added to or trimmed a slew of other existing investments during the three months ended March 31. Among his most notable trades listed in the 13F filing were boosts to Amazon.com Inc. (AMZN, Financial) and Netflix Inc. (NFLX, Financial), reduced bets on Activision Blizzard Inc. (ATVI, Financial) and Broadcom Inc. (AVGO, Financial) and the divestment of SoftBank Group Corp. (TSE:9984, Financial). He also covered two short positions in the SPDR S&P 500 ETF Trust (SPY, Financial) and SoftBank Corp. (TSE:9434, Financial).

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as they only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Amazon

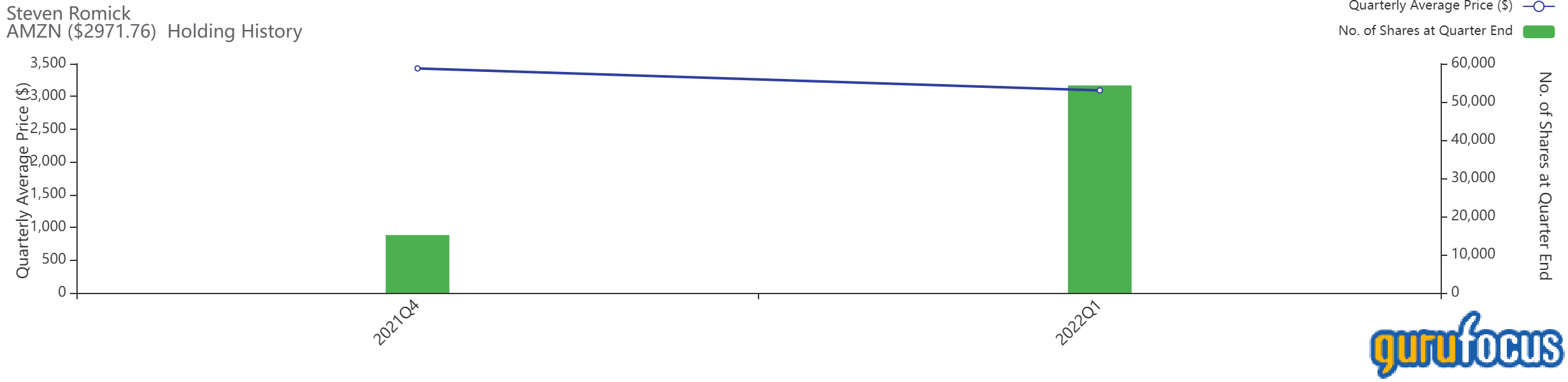

With an impact of 1.83% on the equity portfolio, the investor increased his Amazon (AMZN, Financial) position by 258.6%, buying 39,142 shares. The stock traded for an average price of $3,092.09 per share during the quarter.

Romick now holds 54,278 shares total, accounting for 2.54% of the equity portfolio. GuruFocus estimates he has lost 6.71% on the investment so far.

The Seattle-based e-commerce giant has a $1.5 trillion market cap; its shares were trading around $2,950.67 on Friday with a price-earnings ratio of 45.55, a price-book ratio of 10.87 and a price-sales ratio of 3.23.

The GF Value Line suggests the stock is modestly undervalued currently based on historical ratios, past financial performance and future earnings projections.

Amazon’s financial strength was rated 7 out of 10 by GuruFocus. In addition to adequate interest coverage, the company has a high Altman Z-Score of 4.98, indicating it is in good standing even though assets are building up at a faster rate than revenue is growing. The return on invested capital also exceeds the weighted average cost of capital, meaning value is being created as the company grows.

The company’s profitability fared even better with a 9 out of 10 rating due to operating margin expansion, strong returns on equity, assets and capital that top a majority of competitors and a high Piotroski F-Score of 7 out of 9, indicating business conditions are healthy. As a result of consistent earnings and revenue growth, Amazon has a predictability rank of five out of five stars. According to GuruFocus, companies with this rank return an average of 12.1% annually over a 10-year period.

Of the many gurus invested in Amazon, Ken Fisher (Trades, Portfolio) has the largest stake with 0.43% of its outstanding shares. Baillie Gifford (Trades, Portfolio), Frank Sands (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Steve Mandel (Trades, Portfolio), Warren Buffett (Trades, Portfolio), Al Gore (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio) and several others also have positions in the stock.

Netflix

Impacting the equity portfolio by 1.23%, Romick upped his Netflix (NFLX, Financial) holding by 538.05%, buying 229,145 shares. During the quarter, shares traded for an average price of $417.64 each.

He now holds 271,733 shares total, representing 1.46% of the equity portfolio. GuruFocus data shows he has lost 37.63% on the investment so far as the stock has come under pressure in recent months.

The streaming giant headquartered in Los Gatos, California has a market cap of $97.38 billion; its shares were trading around $216.34 on Friday with a price-earnings ratio of 19.89, a price-book ratio of 5.55 and a price-sales ratio of 3.27.

According to the GF Value Line, the stock is significantly undervalued currently.

GuruFocus rated Netflix’s financial strength 6 out of 10, driven by sufficient interest coverage and a high Altman Z-Score of 3.7. The ROIC also overshadows the WACC, so value is being created.

The company’s profitability scored a 9 out of 10 rating on the back of operating margin expansion, strong returns that outperform a majority of industry peers and a high Piotroski F-Score of 7. Steady earnings and revenue growth contributed to a five-star predictability rank.

With a 1.76% stake, Baillie Gifford (Trades, Portfolio) is Netflix’s largest guru shareholder. Other top guru investors include Fisher, Sands, Segalas and Chase Coleman (Trades, Portfolio).

Activision Blizzard

The guru pared back his Activision Blizzard (ATVI, Financial) stake by 61.09%, selling 1.4 million shares. The transaction had an impact of -1.28% on the equity portfolio. The sock traded for an average per-share price of $77.76 during the quarter.

Romick now holds 900,174 shares total, which make up 1.04% of the equity portfolio. He has gained an estimated 14.93% on the investment so far according to GuruFocus.

The Santa Monica, California-based video game publisher, which is in the process of being acquired by Microsoft (MSFT, Financial), has a $61.38 billion market cap; its shares were trading around $78.91 on Friday with a price-earnings ratio of 22.84, a price-book ratio of 3.49 and a price-sales ratio of 7.01.

Based on the GF Value Line, the stock appears to be fairly valued currently.

Activision’s financial strength was rated 8 out of 10 by GuruFocus. In addition to a comfortable level of interest coverage and a robust Altman Z-Score of 6.89, the ROIC eclipses the WACC, meaning value creation is occurring.

The company’s profitability fared even better, scoring a 9 out of 10 rating due to operating margin expansion and strong returns that outperform a majority of competitors. Activision Blizzard also has a moderate Piotroski F-Score of 6, indicating conditions are typical for a stable company. Due to consistent earnings and revenue growth, the company has a three-star predictability rank. GuruFocus data shows companies with this rank return, on average, 8.2% annually.

Buffett is Activision Blizzard’s largest guru shareholder with a 1.88% stake. PRIMECAP, First Pacific, Lee Ainslie (Trades, Portfolio), Mairs and Power (Trades, Portfolio) and George Soros (Trades, Portfolio) also have significant holdings.

Broadcom

Romick curbed the Broadcom (AVGO, Financial) holding by 19.22%, selling 103,194 shares. The transaction impacted the equity portfolio by -0.93%. The stock traded for an average price of $598.73 per share during the quarter.

He now holds 433,610 shares total, giving it 3.92% space in the equity portfolio. After being Romick’s largest holding last quarter, it is now his fifth-largest holding. GuruFocus data shows he has gained an estimated 71.50% on the investment since the second quarter of 2018.

The semiconductor manufacturing company, which is headquartered in San Jose, California, has a market cap of $243.34 billion; its shares were trading around $590.61 on Friday with a price-earnings ratio of 33.97, a price-book ratio of 10.64 and a price-sales ratio of 8.96.

The GF Value Line suggests the stock is significantly overvalued currently.

GuruFocus rated Broadcom’s financial strength 5 out of 10. In addition to adequate interest coverage, the Altman Z-Score of 3.87 indicates the company is in good standing. The ROIC also surpasses the WACC, so value is being created.

The company’s profitability scored a 9 out of 10 rating, boosted by an expanding operating margin, strong returns that top a majority of industry peers and a high Piotroski F-Score of 9. Supported by steady earnings and revenue growth, Broadcom also has a four-star predictability rank. GuruFocus says companies with this rank return an average of 9.8% annually.

Of the gurus invested in Broadcom, Barrow, Hanley, Mewhinney & Strauss has the largest position with 0.24% of its outstanding shares. First Pacific, Fisher, Philippe Laffont (Trades, Portfolio), Sarah Ketterer (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies and several other gurus also own the stock.

SoftBank Group

With an impact of -1.26% on the equity portfolio, Romick sold his 1.96 million remaining shares of SoftBank Group (TSE:9984, Financial). During the quarter, shares traded for an average price of 5,174.83 yen ($40.15) each.

GuruFocus estimates he lost 0.49% on the investment over its lifetime.

The Japanese telecommunications and e-commerce conglomerate has a market cap of 9.19 trillion yen; its shares closed at 5,579 yen on Thursday with a price-earnings ratio of 5.11, a price-book ratio of 0.84 and a price-sales ratio of 1.62.

According to the GF Value Line, the stock is a possible value trap currently. As such, potential investors should do thorough research before making a decision.

SoftBank Group’s financial strength was rated 2 out of 10 by GuruFocus. As the company has issued new long-term debt over the past several years, it has weak interest coverage. The low Altman Z-Score of 0.69 warns the company could be at risk of bankruptcy if it does not improve its liquidity. The ROIC has also fallen below the WACC, indicating it is struggling to create value.

The company’s profitability fared better with a 6 out of 10 rating. In addition to operating margin expansion, it is being supported by returns that outperform over half of its competitors and a high Piotroski F-Score of 8. SoftBank Group’s steady earnings and revenue growth also contributed to a one-star predictability rank. Companies with this rank have been found to return an average of 1.1% annually.

The Hennessy Japan Fund (Trades, Portfolio), T. Rowe Price Equity Japan Fund, Matthews Japan Fund (Trades, Portfolio) and the iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio) all own the stock.

Covering short positions

The FPA Crescent Fund also partially covered its short positions for the SPDR S&P 500 ETF Trust (SPY, Financial) and SoftBank Corp. (TSE:9434, Financial).

This exchange-traded fund tracks the performance of the Standard & Poor’s 500 Index. The short position was established in the third quarter of 2021 and was worth 505,929 shares. During the quarter, the fund bought 102,498 shares of the ETF to cover downside risk. Shares traded for an average price of $444.05 during the period.

The fund also completely covered its short position in telecom company SoftBank, a subsidiary of SoftBank Group, buying 1.43 million shares. This short position was originally established in the first quarter of 2020 and was worth -1.52 million shares at the time.

Additional trades and portfolio performance

During the quarter, Romick also established positions in Herbalife Nutrition Ltd. (HLF, Financial) and Delivery Hero SE (XTER:DHER, Financial), added to the Open Text Corp. (OTEX, Financial) stake and trimmed investments in Glencore PLC (LSE:GLEN, Financial), Wells Fargo & Co. (WFC, Financial) and Aon PLC (AON, Financial).

The guru’s $6.96 billion equity portfolio, which is composed of 132 stocks, is largely invested in the communication services and financial services sectors, followed by the technology space.

The FPA Crescent Fund posted a return of 15.17% for 2021, underperforming the S&P 500’s 28.71% return.

Also check out: