In early 2021, in the eye of the Covid storm, there was a mix-up in the manufacturing of the Covid-19 vaccine developed by Johnson & Johnson (JNJ, Financial) and manufactured by the contractor Emergent BioSolutions Inc. (EBS, Financial). At Emergent's Bayview site in Maryland, where the AstraZeneca (AZN, Financial) Covid vaccine was also manufactured, workers had accidentally mixed up ingredients of the two vaccines. The cause was determined to be human error.

This mix-up affected 15 million J&J vaccine units, which had be discarded. Several million AstraZeneca vaccine units meant for countries outside the U.S. had to be discarded, and AstraZeneca pulled out of the contract following the incident.

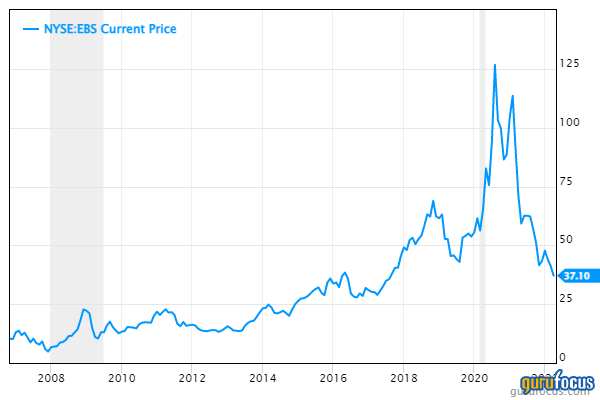

The previously high-flying Emergent stock dropped precipitously following the incident, and the company was subject to an FDA investigation and took a big hit to its reputation.

The FDA allowed Emergent to resume production later last year. The company has been in the doghouse following the vaccine mix-up incident, and the stock has not recovered yet and continues to hit new lows.

In this article, we will examine Emergent's business model, balance sheet and outlook to determine whether the stock has fallen into value territory.

About the company

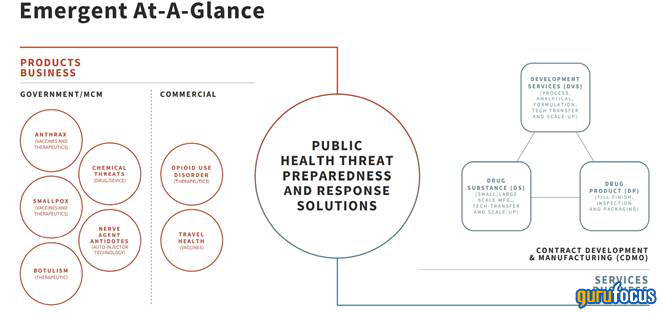

Emergent BioSolutions develops, manufactures and delivers protections against public health threats (PHT) through a portfolio and pipeline of innovative vaccines and therapeutics. It also provides contract development and manufacturing (CDMO) services to the biopharmaceutical industry (thus its involvement with with the J&J and AstraZeneca Covid vaccines).

The company has a portfolio of 10 marketed products and is developing several more. It operates in four main units: vaccines, which produces specialty vaccines for public health threats; devices, such as nasal sprays, skin lotions and injections; therapeutics, which includes antibody-based treatments; and contract development and manufacturing, which brings treatments to market through collaboration with the pharmaceutical and biotechnology industries and the United States government. Most revenue comes from U.S. government purchases of vaccine, device and therapeutic products.

Source: Emergent's website

The company has produced impressive long-term growth numbers, as shown in the table below. GuruFocus gives it a perfect 10 out of 10 growth score. Revenue growth has been strong all through, but profit growth has slowed down over the last year.

| Growth Rank | (* per share data) | ||

| Rank: 10 /10 | 10-Yr | 5-Yr | 1-Yr |

| Revenue Growth % | 16.2 | 30.1 | 14.6 |

| EBITDA Growth % | 21.8 | 30.0 | -15.0 |

| Oprt. Income Growth % | 20.0 | 32.7 | -9.6 |

| EPS w/o NRI Growth % | 18.3 | 30.0 | -24.7 |

| FCF Growth % | N/A | N/A | -75.8 |

| Book Value Growth % | 9.8 | 15.5 | 15.8 |

The company has a boom and bust pattern to its revenues and even more so with earnings, and right now, it is going through the post-pandemic bust as demand for the J&J Covid vaccine falls off.

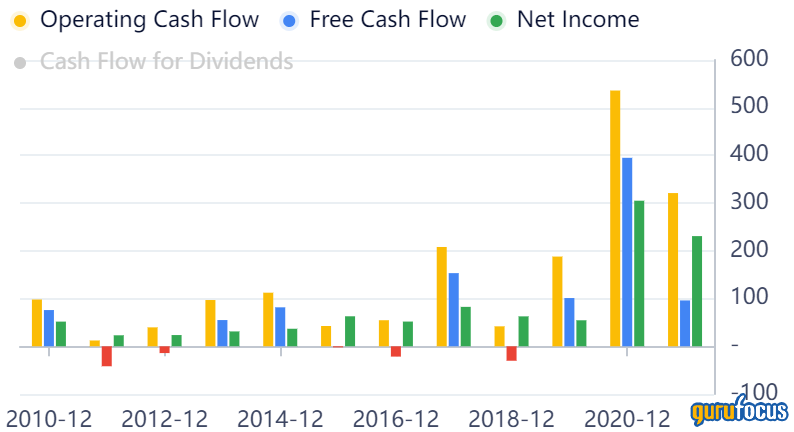

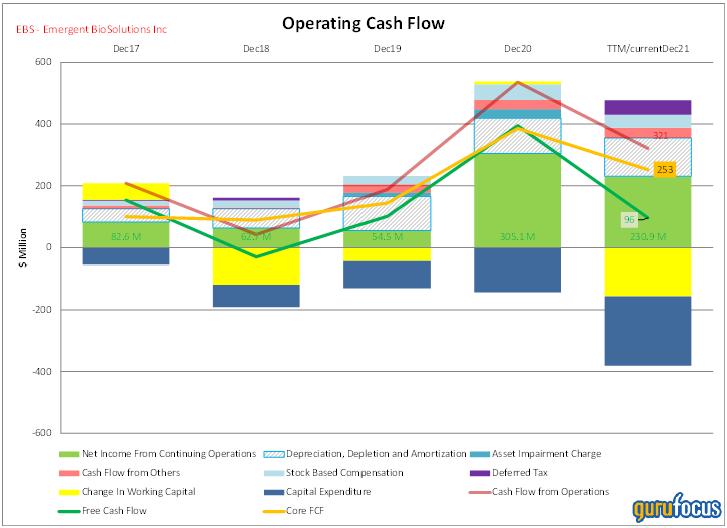

Despite its manufacturing mishap, the company has made a lot of money during the Covid crisis. The following diagram lays out the company's earnings and cash flow. The current price-earnings ratio is 8.75. Though the business is expected to slow down in the next couple of years as the pandemic abates, it should revive again 2024 and later, according to analysts' estimates. The forward price-earnings ratio is ~19.

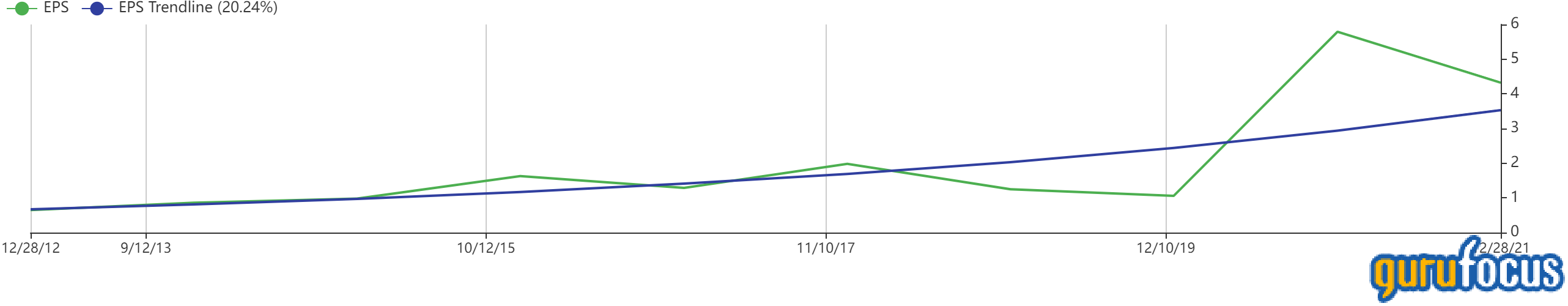

The earnings per share trendline shows growth at over 20% per year over the last 10 years, so its helpful to keep the long-term in mind.

Valuation

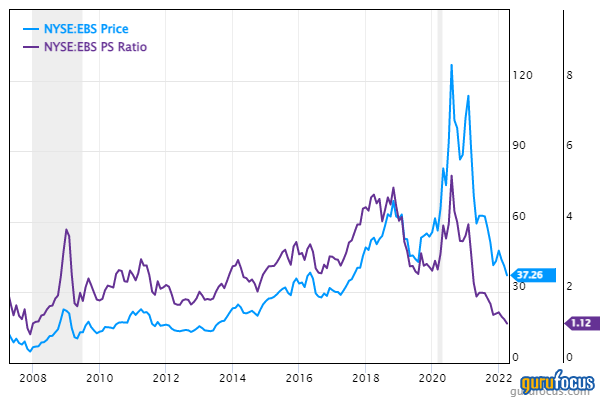

Analyzing historical price multiples for Emergent, I think think the stock could double once it puts its current problems and the Covid bust behind it. I say that because in 2016 to 2018, the stock was trading at a price-sales ratio of around 3 to 4, which has now dropped all the way to 1.12. I think the market has overreacted to the downside.

I used the GuruFocus discounted cash flow (DCF) calculator to arrive at an estimate of fair value, using the assumptions in the screenshot below. According to my assumptions, which include 12% annual earnings growth for the next decade and a discount rate of 9%, the company has a wide margin of safety at the current price.

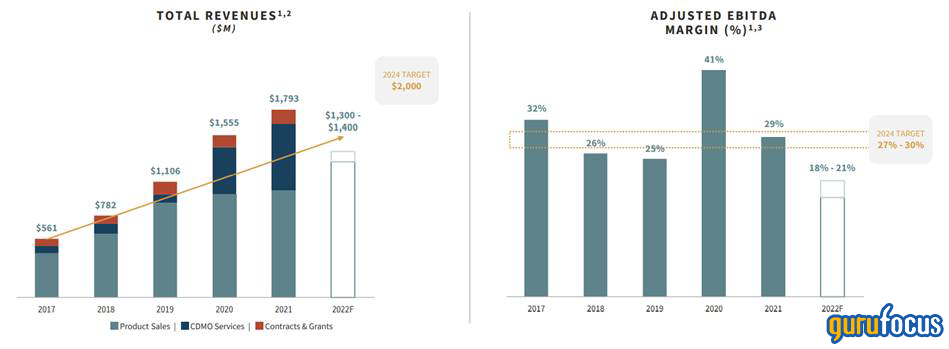

Emergent is currently guiding for a reduction of revenues and Ebitda margins in 2022 as demand for Covid vaccines wanes. However, it is aiming for recovery in subsequent years, so it looks like 2022 is going to be transition year for the company.

Source: Emergent's website

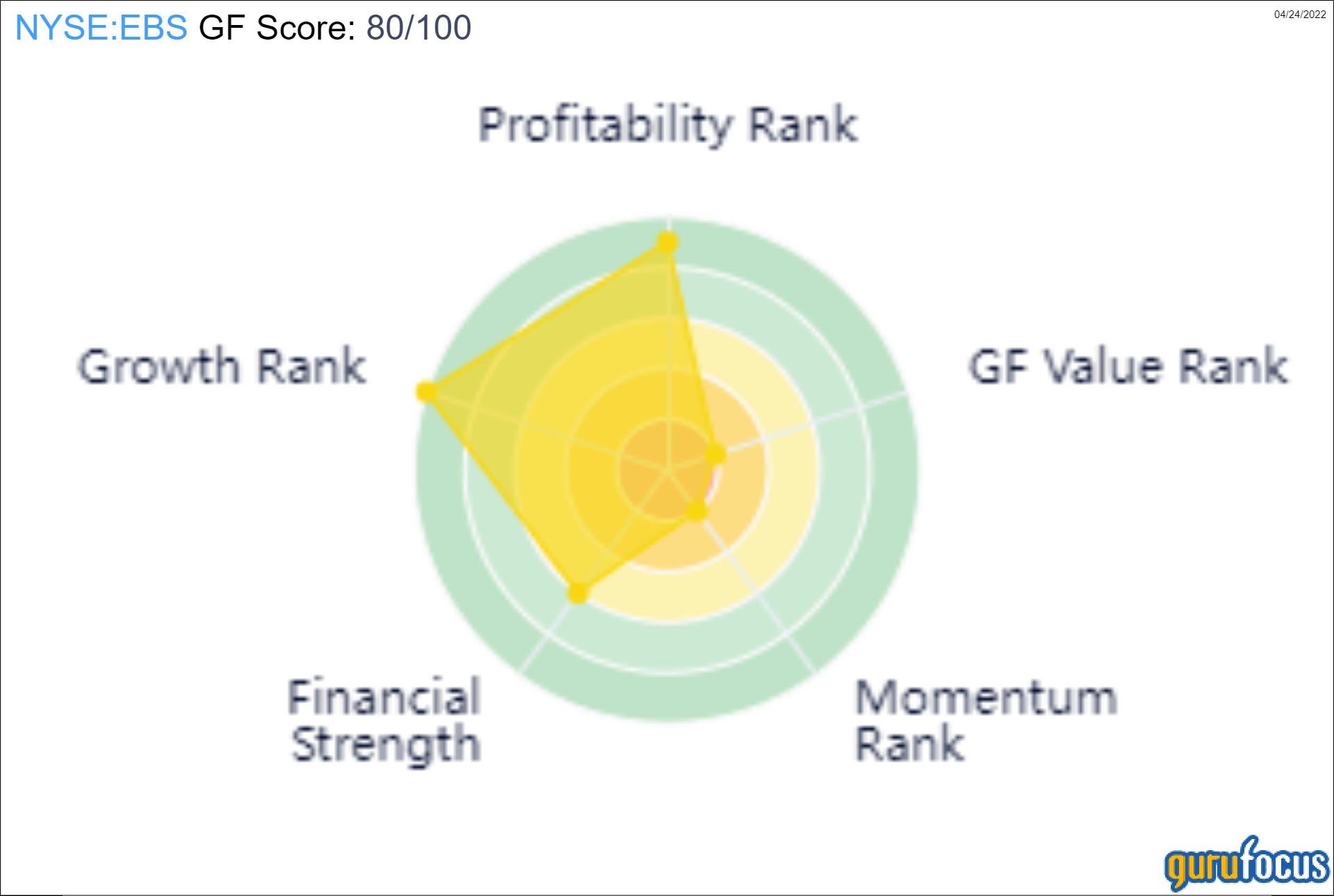

The GF Score is 80 out of 100, with robust growth and profitability ranks and a fair financial strength but weak GF Value and very weak momentum ranks.

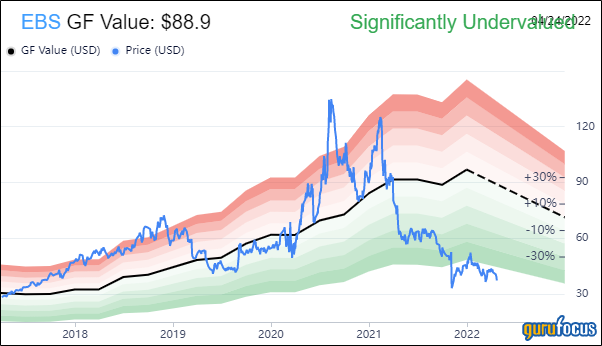

The GF Value chart indicates significant undervaluation.

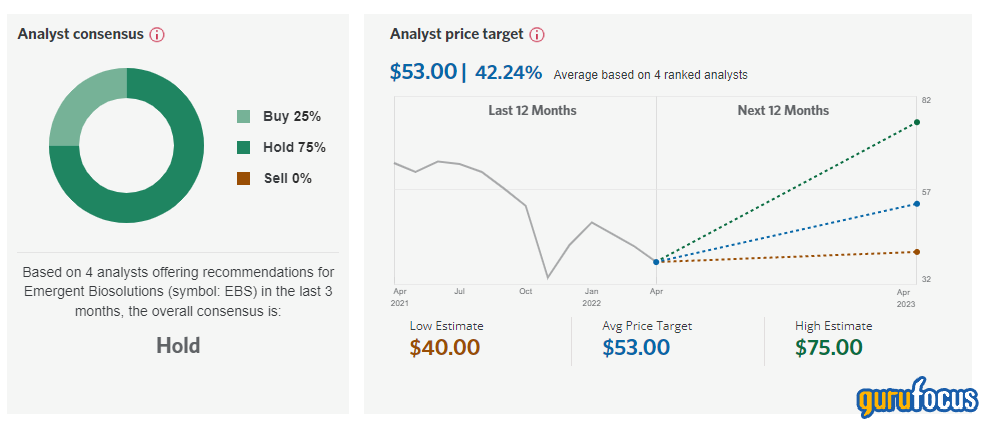

The 12-month consensus estimates from sell side analysts on CIBC is a "Hold."

Source: CIBC

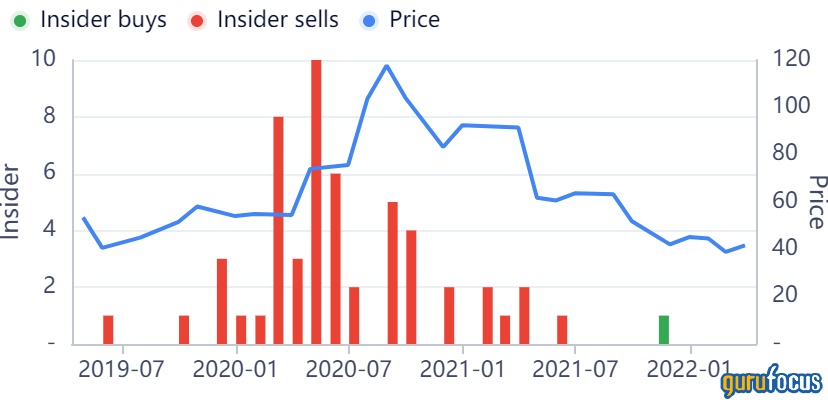

Insider activity

While insiders mostly sold shares when the stock price was flying high, as was to be expected, a lone but influential insider, the Chief Financial Officer, had bought shares at around the current price last year. One would think the CFO would know a bargain in his own stock if he sees one. There have been no insider stock sales since then, so it looks like the insiders are biding their time.

| Insider | Position | Date | Buy/Sell | Shares | Shares Owned | Trade Price($) | Trade Percentage(%) | Cost($1000) | Price change since trade(%) | Share ownership details | Filing Date |

| LINDAHL RICHARD S | EVP, CFO | 2021-11-15 | Buy | 3,000 | 39,919 | 37.46 | 7.52 | 112.38 | -0.53 | 39,919 (Direct) | - |

Conclusion

While I think Emergent represents excellent long-term value in the next three to five years, I think it will continue to struggle in the short term as it gets its Bayview manufacturing facility in order and settles down in the post-pandemic period. I think the company has a narrow moat as it has developed strong capability as a vaccine and biologic manufacturer, which is not an easy thing to do.

It has a large number of government contracts to produce therapeutics for public health threats which are part of the government's stockpile. If anything, the pandemic and geopolitical realities will force governments to stockpile more public health therapeutics to deal with emergencies. Thus, I think it's safe to say Emergent has elements of a defence contractor and is a strategic supplier to the government. It has several product candidates of its own in development, which could also provide an upside to the stock price.

Certainly, this stock is out of favour, but frankly, this is often the best time for value investors to make our moves. As Warren Buffett (Trades, Portfolio) once said, "You pay a very high price in the stock market for a cheery consensus."