Cybersecurity is a growing necessity in our modern digitally-connected world. Whether it’s the need to secure devices working remotely or to protect pipelines from hackers, cybersecurity has been called the "fifth defensive strategy" alongside land, air, sea and space.

According to Global Newswire, the cybersecurity market globally is forecasted to grow at a 12% CAGR between 2022 and 2028, reaching a size of $366 billion. With the Russia-Ukraine crisis heating up, cybersecurity is at the forefront of everyone's mind.

Thus, in this article, I reveal my top three favorite cybersecurity stocks to play this growing market.

1. Crowdstrike

Crowdstrike (CRWD, Financial) offers a leading “Security Cloud" software, which is on the Department of Homeland Securities' approved products list. Their flagship platform, Falcon, covers multiple large security markets: Cloud Security, Corporate Endpoint Security, Threat Intelligence, Identity Protection and more. Endpoints such as laptops, servers and IoT devices are becoming vulnerable to cyber attacks as the world transitions toward remote working and the cloud.

The company has an established customer base equating to 254 of the Fortune 500, 65 of the Fortune 100 and 15 of the top 20 banks. Customers include Mercedes-Benz Group AG (FRA:MBG, Financial), Virgin Hyperloop and Goldman Sachs (GS, Financial). Crowdstrike is expecting 16,325 subscription customers by the end of 2022, up a further 65% year over year.

Source: Crowdstrike investor materials

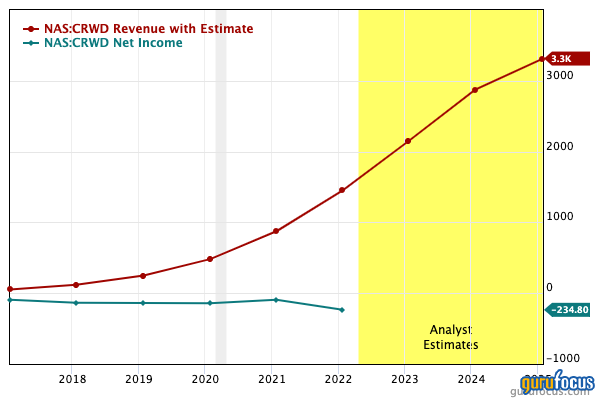

Crowdstrike recently smashed Wall Street expectations with annual recurring revenue (ARR) coming in at $1.73 billion, which is up an incredible 65% year-over-year, beating analysts' expectations of $1.68 billion. The company also reported adjusted earnings of 30 cents per share for the fourth quarter of 2021, which was above analysts' expectations.

Analyzing the stock's price-sales ratio history, it is currently looking cheap relative to historical metrics with a forward price-sales ratio of 20 and a current price-sales ratio of 32.

2. NortonLifelock

NortonLifelock (NLOK, Financial) is a leader in consumer-focused cybersecurity. They are most famous for their flagship antivirus products, which are classed in the “Cyber-Safe” category. Their flagship Norton 360 product is an easy to use platform which helps consumers to protect themselves against the growing cyber threats online.

Norton has been growing revenue at a solid 10% rate recently, and they expect this to continue for full-year revenue results of $2.8 billion in 2022. Earning per share is also expected to pop to $1.75, above the prior guidance of $1.65.

The board also declared a quarterly cash dividend of $0.125 per common share, with dividend yield of a modest 0.52%.

In terms of valuation, the stock looks to be fairly valued according to the GF Value line:

Norton has recently proposed a merger with Avast PLC (LSE:AVST, Financial), another antivirus provider which offers both consumer and product synergies, especially on the privacy and identity side. However, the merger has come under fire from U.K. regulators, who are concerned that the close competitors merging could result in “U.K. consumers getting a worse deal when looking for cyber safety software in the future,” according to the Competition and Markets Authority (CMA).

3. Palo Alto Networks

Palo Alto Networks (PANW, Financial) is a legacy cybersecurity company which has its roots in firewalls, which protect networks from dangerous web traffic coming in and out. However, the company has transformed into a cloud security provider through the acquisition of over 12 small cloud businesses.

The company grew revenues by a healthy 24% from $3.8 billon in 2020 to $4.2 billion in 2021, while gross profit jumped from $2.4 billion to $2.9 billion. Palo Alto is operating at a loss of $304 million, but without the $1.1 billion on R&D investment, they would be profitable.

The company’s price-sales ratio has increased significantly over the past couple of months, indicating it's become more expensive.

The GF Value line also rates the stock as significantly overvalued. Thus, I'd be looking for a pullback on this stock.

Final thoughts

Cybersecurity is a fast-growing market. As 5G, cloud and IoT devices grow in popularity, so will the need for cybersecurity. It has been called the fifth line of defense after land, sea, air and space. The stocks on this list offer a range of options for the industry. Those unsure about picking specific stocks in this industry could also look into a cybersecurity ETF such as the First Trust NASDAQ CEA Cybersecurity ETF (CIBR, Financial) to give exposure to a range of stocks in this growing industry.