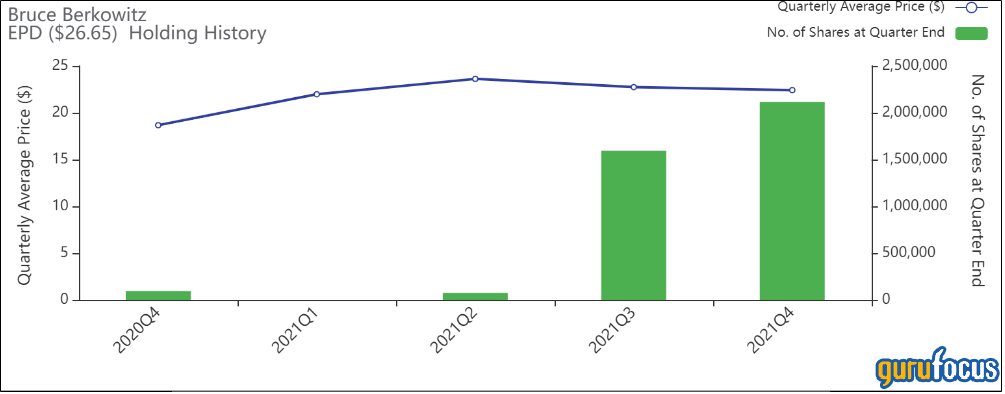

Bruce Berkowitz (Trades, Portfolio) continues to pile into Enterprise Products Partners LP (EPD, Financial).

GuruFocus' portfolio data, which is based on NPORT-P filings with the SEC as of March 31, shows Berkowitz, who runs the Fairholme Fund (Trades, Portfolio), has added to the position again.

Investors should be aware that, just like 13F reports, NPORT-P reports do not provide a complete picture of a guru’s holdings to the public. Filed by certain mutual funds after each quarter’s end, the filings collect a wide variety of information on the fund for the SEC’s reference, but in general, the only information made public is in regard to long equity positions. Unlike 13Fs, they do require some disclosure for long equity positions in foreign stocks. Despite their limitations, even these limited filings can provide valuable information.

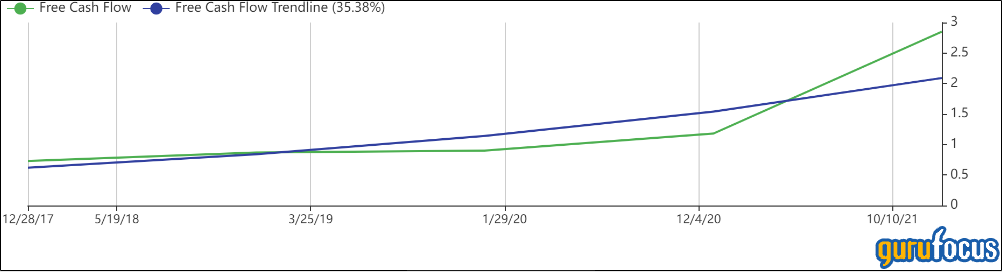

One reason for the contined expansion to the position could be the company's free cash flow. Over the past five years, free cash flow growth has been spectacular, increasing by an incredible 35% per year.

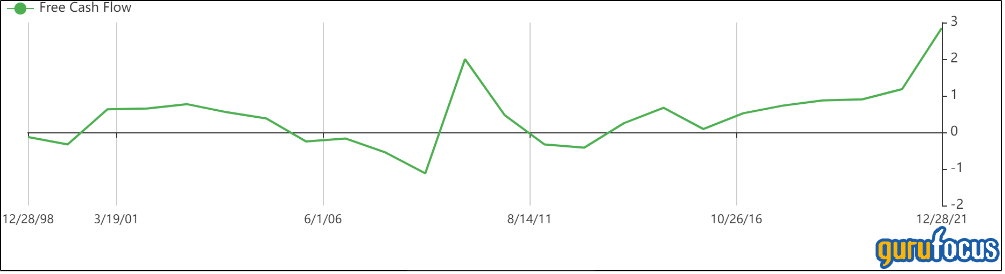

The five-year chart above, however, is quite different from the longer-term free cash flow chart below, where it was erratic and inconsistent.

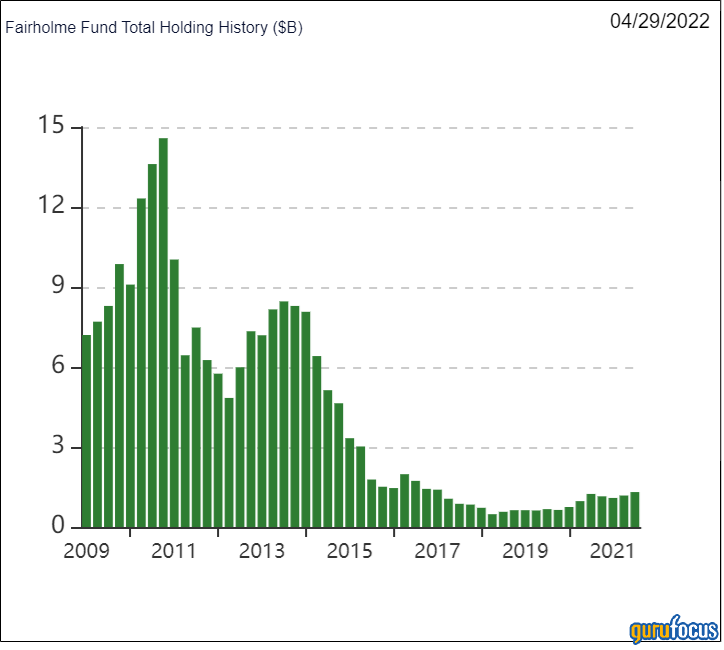

Berkowitz, who runs a concentrated, deep-value equity portfolio, was named Fund Manager of the Decade in 2010 by Morningstar. The 10-year period during which Berkowitz shone saw the demise of growth investing with the dot-com crash and resurgence of value. Berkowitz's star faded when the reverse happened between 2013 to 2021. The cycle reversed in the 2010s when growth surged and value languished. Now the cycle seems to be reversing again with value investing and Berkowitz getting their mojo back.

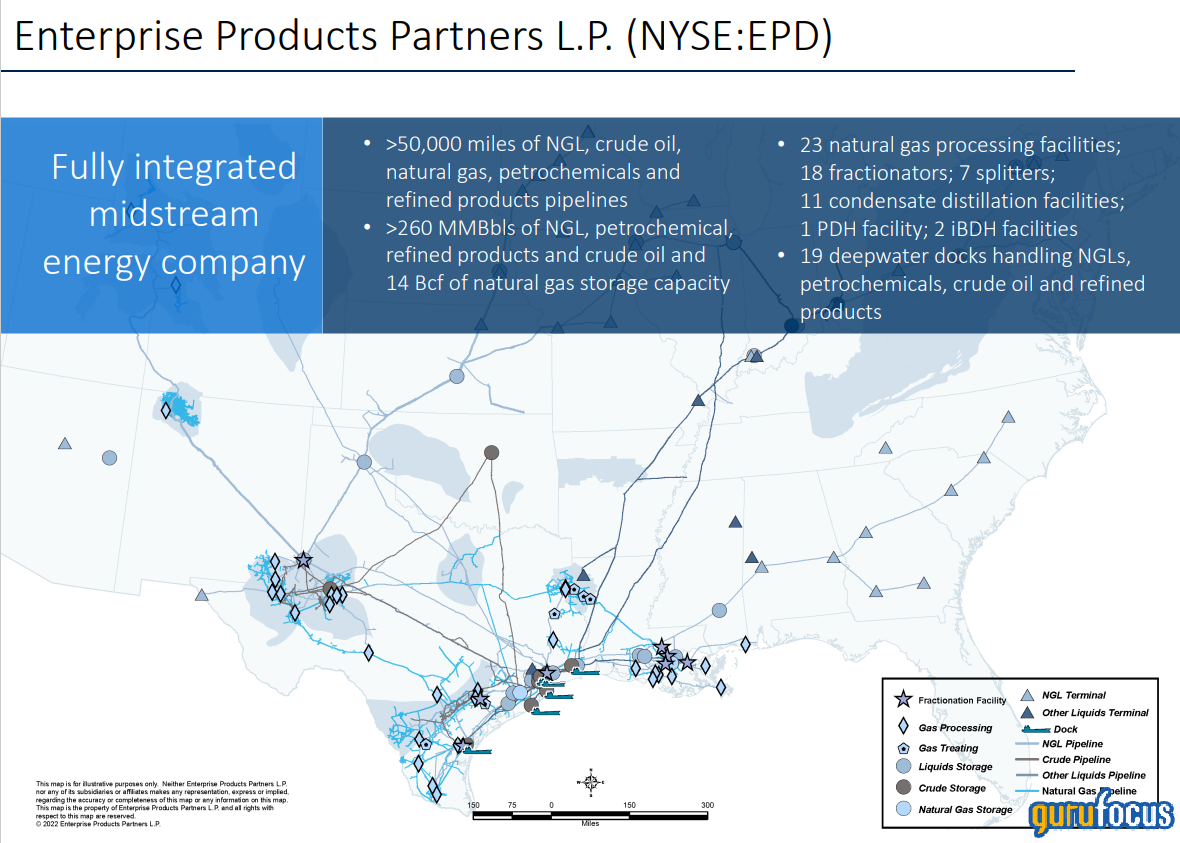

Enterprise Products Partners is a dominant provider of midstream energy services to producers and consumers of natural gas, natural gas liquids, crude oil, petrochemicals and refined products in North America. The company's segments include NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services and Petrochemical & Refined Products Services. Enterprise can aggregate supply of every type of hydrocarbon from multiple sources in major North American producing basins and deliver it to multiple end markets (i.e., refiners, petrochemicals and exports).

The NGL Pipelines & Services segment includes its natural gas processing and related NGL marketing activities, NGL pipelines, NGL fractionation facilities, NGL and related product storage facilities and NGL marine terminals. The company has built out a dominant position in natural gas liquids. This means it will be a major beneficiary as U.S. NGL exports increase in the coming years.

The Crude Oil Pipelines & Services segment includes its crude oil pipelines, crude oil storage and marine terminals and related crude oil marketing activities. The Natural Gas Pipelines & Services segment includes its natural gas pipeline systems. The Petrochemical & Refined Products Services segment includes its propylene production facilities and marine transportation business.

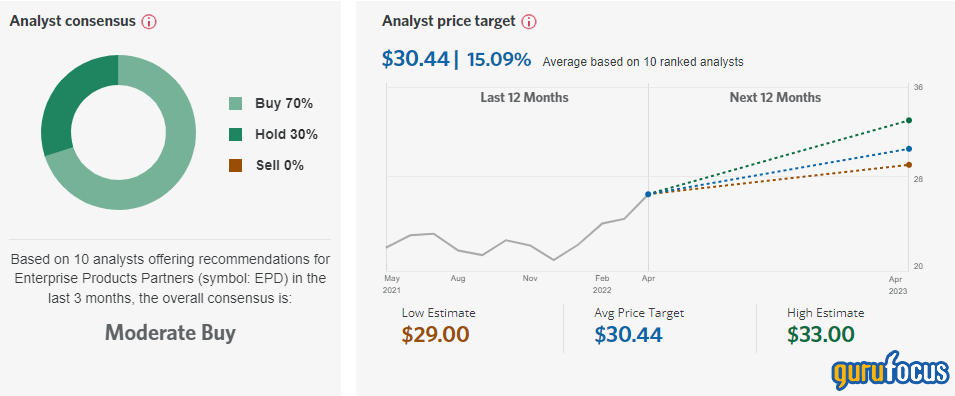

Analysts are generally quite bullish, with a consensus midpoint stock price target of over $30 is 12 months.

Source: CIBC

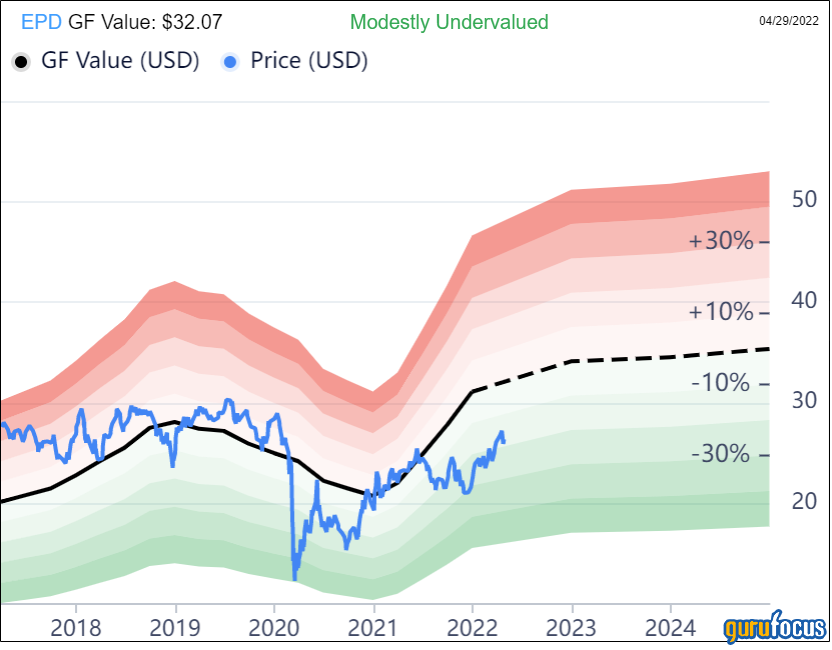

This is consistent with the GF Value Line, which indicates the stock is modestly undervalued based on historical ratios, past financial performance and future earnings projections.

The undervaluation is supplemented by the generous 7% distribution paid out by the company.

Valuation

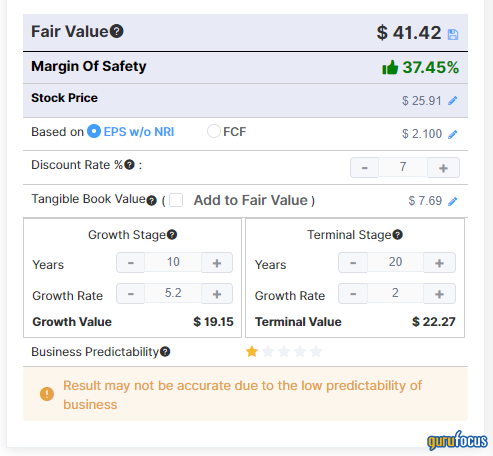

I used the Gurufocus DCF Calculator to estimate the value of EPD Stock. To be conservative I used earnings per share even though the tendency in the midstream space is to use operating cash flow. EPS accounts for depreciation of asset and I feel even thought the assets are long lived they require maintenance and eventually wear out. I used a discount rate of 7% and assumed a growth rate of 5.2% for the fist decade (which is the same as the last decade) and 2% for the next two decades (a total company life of 30 years). I came up with value of $41.42 per share which is a margin of safety of over 37% from the current stock price.

Summary

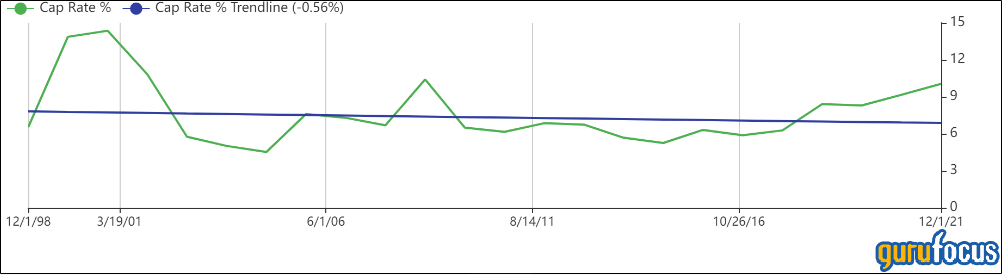

Enterprise is a wide-moat company with huge geographical footprint in the continental U.S. and very important hydrocarbon storage and transportation infrastructure. Its exposure to hydrocarbon prices is small and mostly depends on a fee for service. These are long-term assets with strong cash-generating potential. The midstream industry has gotten over its reckless capital expenditure phase in the last decade and now generating copious free cash flow. Enterprise is one of the best. The company's long term capitalization rate (operating cash flow divided by enterprise value), which was around 7%, is now on a upward trajectory.

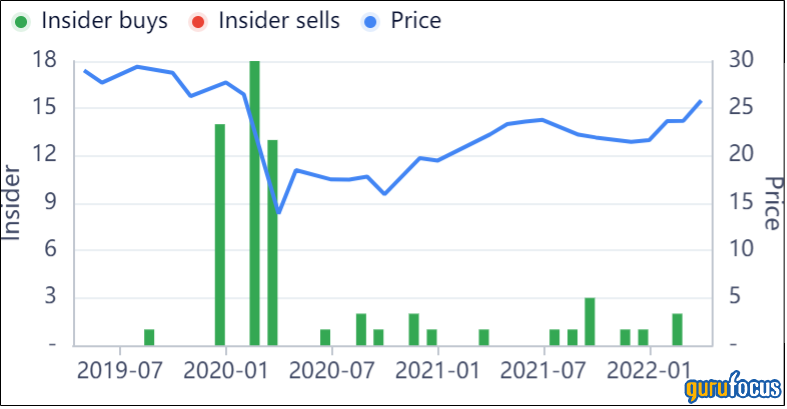

Recent insider buying of the stock has been uniformly positive with no selling.

Based on these factors, investors can get a better understanding of potential reasons why Berkowitz likes the stock.

Also check out: