Markel Gayner Asset Management Corp., the investment arm of insurance company Markel Corp. (MKL, Financial), disclosed in a regulatory filing that its top five trades during the first quarter included the closure of its holdings in Mohawk Industries Inc. (MHK, Financial) and Albemarle Corp. (ALB, Financial) and boosts to its holdings in Dollar General Corp. (DG, Financial), Allstate Corp. (ALL, Financial) and FedEx Corp. (FDX, Financial).

Managed by Chief Investment Officer Tom Gayner (Trades, Portfolio), Markel operates with a margin of safety in its investment portfolio. The fund seeks undervalued companies in which management has good knowledge and understanding of a company’s fundamentals and future cash flows.

As of March, Markel’s $8.39 billion 13F equity portfolio contains 125 stocks, with 10 new positions and a quarterly turnover ratio of 1%. Investors should be aware that the 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

The top-three sectors in terms of weight are financial services, industrials and consumer cyclical, representing 42.38%, 13.26% and 11.61% of the equity portfolio.

Mohawk Industries

Markel sold all 221,00 shares of Mohawk Industries (MHK, Financial), trimming 0.46% of its equity portfolio.

Shares of Mohawk averaged $150.29 during the first quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.88.

The Calhoun, Georgia-based flooring and furniture company has a GF Score of 83 out of 100, driven by a rank of 8 out of 10 for profitability and GF Value, a financial strength rank of 7 out of 10, a growth rank of 6 out of 10 and a momentum rank of 4 out of 10.

Gurus with holdings in Mohawk Industries include John Rogers (Trades, Portfolio)’ Ariel Investment and Charles Brandes (Trades, Portfolio)’ Brandes Investment.

Albemarle

The firm sold all 76,000 shares of Albemarle (ALB, Financial), trimming 0.20% of its equity portfolio.

Shares of Albemarle averaged $211.24 during the first quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 2.20.

The Charlotte, North Carolina-based lithium company has a GF Score of 71 out of 100, driven by a financial strength rank of 6 and a rank of 8 out of 10 for profitability and momentum despite the GF Value ranking just 1 out of 10 and growth ranking just 4 out of 10.

Dollar General

The firm purchased 56,000 shares of Dollar General (DG, Financial), boosting the position by 80.29% and its equity portfolio by 0.15%.

Shares of Dollar General averaged $212.32 during the first quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 1.01.

The Goodlettsville, Tennessee-based discount retailer has a GF Score of 93 out of 100, driven by a growth rank of 10 out of 10, a profitability rank of 9 out of 10 and a momentum rank of 8 out of 10. The stock received a high GF Score despite financial strength and GF Value ranking just between 5 and 6 out of 10.

Allstate

The firm added 76,250 shares of Allstate (ALL, Financial), boosting the position by 191.58% and its equity portfolio by 0.12%.

Shares of Allstate averaged $125.51 during the first quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.89.

The Chicago-based company has a GF Score of 92 out of 100, driven by a rank of 10 out of 10 for growth and momentum and ranks between 7 and 8 for profitability and GF Value.

FedEx

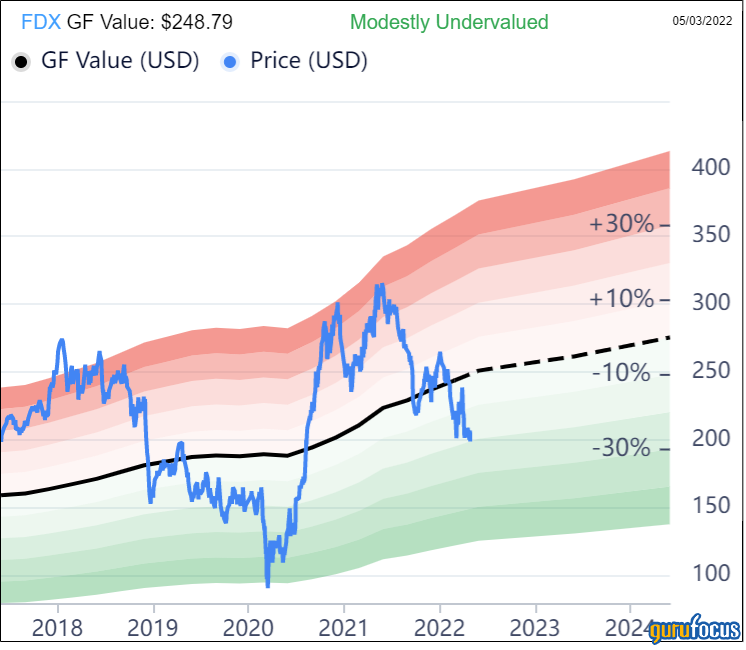

The firm added 41,000 shares of FedEx (FDX, Financial), giving the shares 0.11% weight in the equity portfolio.

Shares averaged $235.12 during the first quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.80.

The Memphis, Tennessee-based logistics company has a GF Score of 93 out of 100, driven by a rank of 10 out of 10 for growth and GF Value and a profitability rank of 9 out of 10 despite financial strength and momentum ranking just 5 out of 10.