Value investors could be interested in the following stocks, since their share prices are trading below their respective Peter Lynch earnings lines. This indicates they could be undervalued by the market. These stocks have also received positive ratings from sell-side analysts on Wall Street.

Bank of America Corp

The first stock investors could be interested in is Bank of America Corp. (BAC, Financial), a U.S. bank major.

The chart below shows the share price ($37.13 at close on May 3) is currently trading below the intrinsic value estimate of $52.50 calculated by the Peter Lynch earnings line.

The stock has fallen 9.52% over the past year through Tuesday for a market capitalization of $303.40 billion and a 52-week range of $35.40 to $50.11.

The stock has a median recommendation rating of overweight on Wall Street and an average target price of $49.24.

GuruFocus has assigned a score of 3 out of 10 to the company's financial strength and 5 out of 10 to its profitability.

Warren Buffett (Trades, Portfolio), Vanguard Group Inc. and BlackRock Inc. are among the company's largest shareholders. Warren Buffett (Trades, Portfolio) holds 12.53% of its shares outstanding, Vanguard Group Inc. owns 7.27% and BlackRock Inc. has 6.12%.

Ford Motor Co.

The second stock investors could be interested in is Ford Motor Co. (F, Financial), a Dearborn, Michigan-based U.S. auto manufacturing giant.

The chart below shows the share price ($14.56 as of May 3) is currently trading below the Peter Lynch earnings line's intrinsic value estimate of $42.90.

The stock has risen nearly 25% over the past year through Tuesday, determining a market capitalization of $58.43 billion and a 52-week range of $11.23 to $25.87.

Wall Street sell-side analysts have issued a median recommendation rating of overweight for this stock with an average target price of $19.44.

GuruFocus has assigned a score of 4 out of 10 to the company's financial strength and 7 out of 10 to its profitability.

Vanguard Group Inc., BlackRock Inc. and State Street Corp. are among the company's largest shareholders. Vanguard Group Inc. holds 7.43% of its shares outstanding, BlackRock Inc. holds 6.72% and State Street Corp. has 4.17%.

BP PLC

The third stock investors could be interested in is BP PLC (BP, Financial), a London-based oil and gas giant.

The chart below shows the share price ($31.18 at close on May 3) is trading below the Peter Lynch earnings line's intrinsic value estimate of $33.50.

The stock has risen by 17.03% over the past year through Tuesday for a market capitalization of $101.64 billion and a 52-week range of $22.64 to $34.16.

The stock has a median recommendation rating of overweight on Wall Street with an average target price of $37.22 per share.

GuruFocus has assigned a score of 4 out of 10 to the company's financial strength and 5 out of 10 to its profitability.

State Street Corp. and Ken Fisher (Trades, Portfolio) are among the largest shareholders of the company, holding 0.78% and 0.42%, respectively, of total shares outstanding.

Barclays PLC

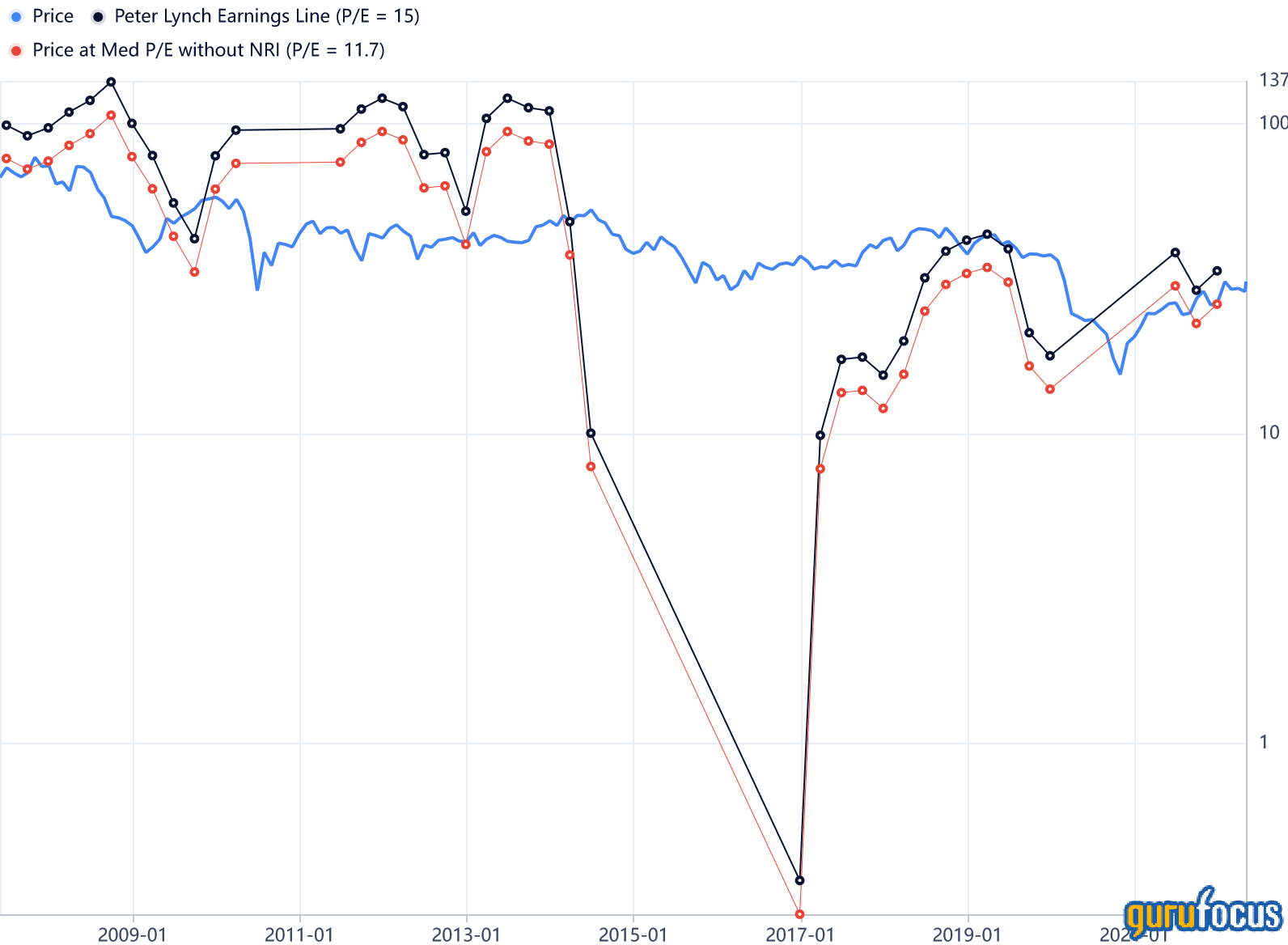

The fourth stock investors could be interested in is Barclays PLC (BCS, Financial), a London-based provider of various financial products and services to its clients in the U.K. and internationally.

The chart below shows the share price ($7.75 at close on May 3) is trading below the Peter Lynch earnings line's intrinsic value estimate of $33.35.

The stock has declined by 21.75% over the past year through Tuesday for a market capitalization of $32.33 billion and a 52-week range of $7.19 to $12.20.

The stock has a median recommendation rating of overweight on Wall Street with an average target price of $11.57 per share.

GuruFocus has assigned a score of 3 out of 10 to both the company's financial strength and its profitability.

Bank Of America Corp. and Lazard Asset Management LLC are among the largest shareholders of the company, holding 0.37% and 0.19%, respectively, of total shares outstanding.

Also check out: