There's no doubting the fact that investors aren't sure whether the market's 2022 bear run will continue or not. Many investors have headed for the hills by simply holding cash, while others are even taking on short positions. The fact of the matter is that there are very few stocks that appear to have attractive short-term long propositions as the economic circumstances and broad-based market valuation paint a grim picture. Nonetheless, there's always a bull market somewhere, and I believe the Vanguard High Dividend Yield (VYM, Financial) ETF could provide a solid option.

The market is aligned

The market tends to rotate around several factors, one of them being monetary policy. Contractionary monetary policy adds an appeal to low volatility and high quality stocks. In some instances, value plays might also be lucrative, but in my view, value usually requires an inflationary environment created by a solid underlying economy rather than inflation created by push inflation.

Source: KoyFin

High exposure to financials

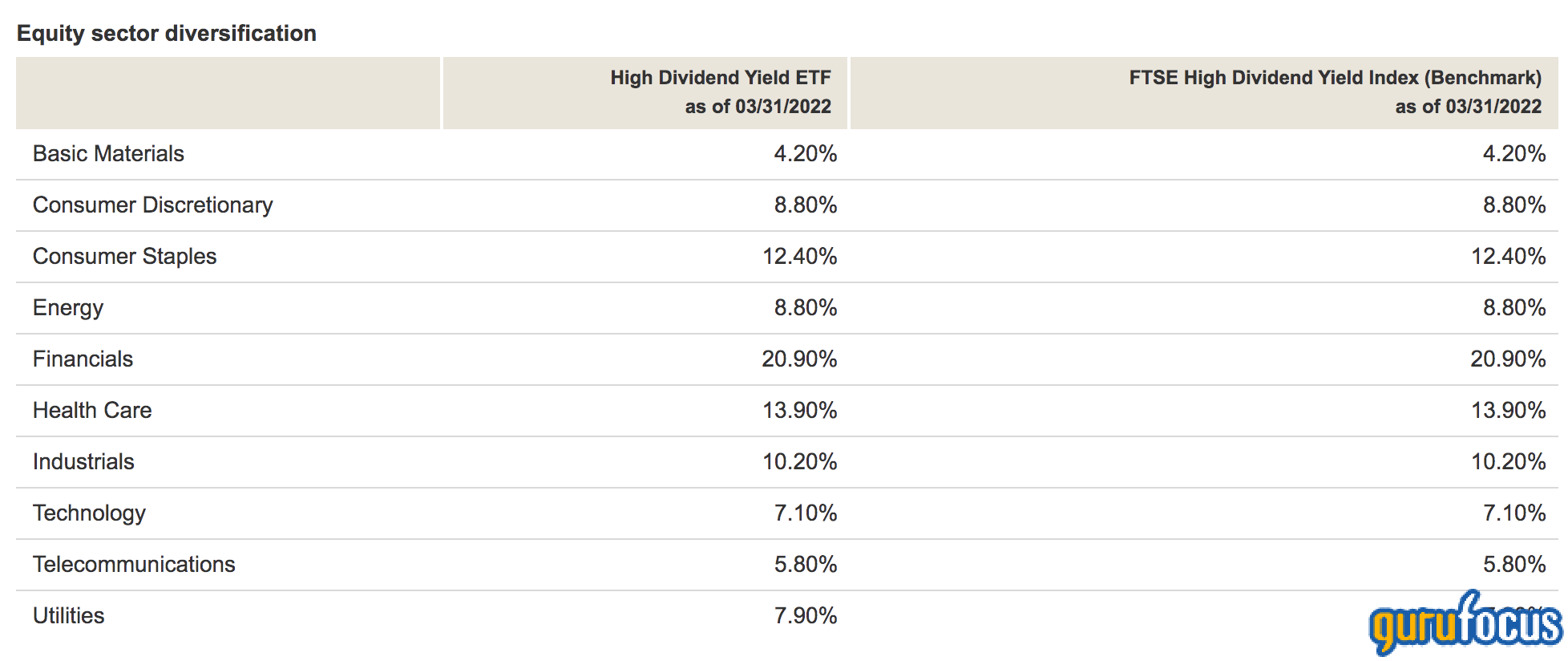

One of the primary attractions of this ETF is its exposure to the financial services sector. Approximately 20.90% of Vanguard's High Yield ETF is exposed to the financial sector with some of its notable financial holdings including JPMorgan (JPM, Financial) and Bank of America (BAC, Financial).

Source: Vanguard

The ETF's sector exposure is exciting as the banking industry will likely benefit from a cyclical upturn. This is because rising interest rates tend to provide support to interest-bearing activities due to rising loan spreads and slower erosion of outstanding debt.

There's no guarantee that the financial services sector will perform well during rising interest rates; however, I certainly think it is a good substitute for some of the recent outperformers, such as metals and energy stocks.

Finally, the ETF exhibits a negative correlation with the iShares 7-10 Year Treasury Bond (IEF, Financial) ETF, indicating that it thrives in a rising yield environment, which we're currently faced with as market participants.

Competent management and dividends galore

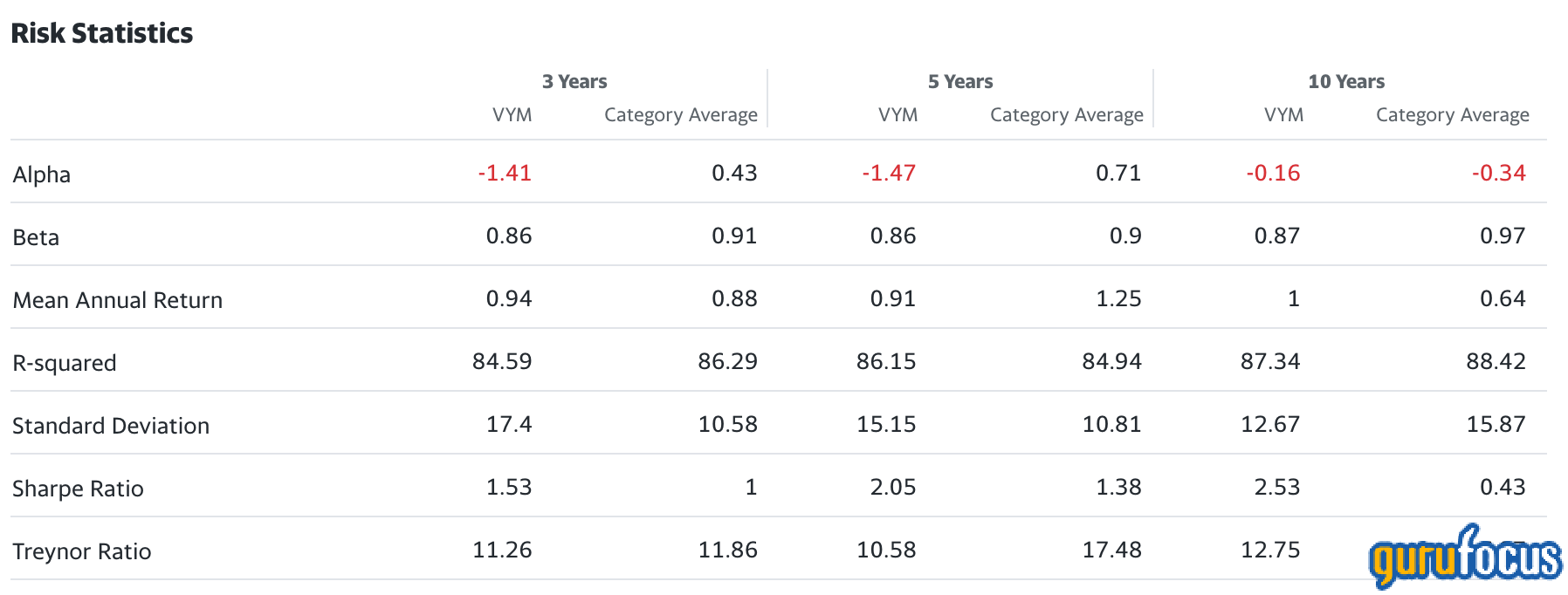

This ETF has respectable Sharpe and Treynor Ratios, meaning that it's a solid risk-return play with both upside and downside risk considered. Additionally, the Vanguard High Dividend Yield ETF has a tracking error of only 6.12%, suggesting that it's closely aligned with its mandate.

Source: Yahoo Finance

Furthermore, the ETF grants a stunning dividend yield of 2.47% with a five-year growth rate of 7.05%, which is very high for this type of security.

The bottom line

The market's in a spot of bother right now. Yet, there are tried and tested methods to perform well even in a bear market. Personally, I believe the Vanguard High Dividend Yield ETF is one of the best investment options out there right now because of its low volatility and high quality aspects. Additionally, the ETF holds high exposure to the financial sector, which could make it a conviction play. It even exhibits great Sharpe and Treynor ratios at a low tracking error, aligning its execution with its mandate.

Become a Premium Member to See This: (Free Trial):