Shares of Texas Instruments Inc. (TXN, Financial) have lost nearly 13% year-to-date as the technology sector has been one of the worst performers for the year. Rising interest rates are likely one of the key reasons why, as the market anticipates that a slower growth environment will impact technology companies more than other sectors.

But for long-term investors, now could be a good time to add high-quality names like Texas Instruments to their portfolios. The pullback has now put Texas Instruments’ valuation below its long-term average multiple and its GF Value. Texas Instruments is one of the most consistent and aggressive dividend growth companies in the technology sector. The stock’s yield is also very attractive.

Company background and results history

Texas Instruments is a leading manufacturer of semiconductors and electronic products. The $153 billion company generated revenue of nearly $19 billion over the last year.

The company’s chief competitive advantage is that it is one of the largest suppliers of analog semiconductor chips. This is an industry with many smaller players, giving the larger Texas Instruments a key leadership position in this arena. Analog chips are used to turn temperature and other real-world physical data into digital signals.

In addition, Texas Instruments has a fairly entrenched position in embedded chips that can be used for a variety of tasks and applications.

These tailwinds have been evident in the company’s long-term success. Revenue has a compound annual growth rate (CAGR) of 4.1% for the 2012 to 2021 period and a 3.8% CAGR for the past five years.

While top-line success has been subtle, it’s the bottom-line where Texas Instruments really shines. Adjusted earnings per share had a CAGR of nearly 22% over the last decade. A 2.2% annual reduction in the share count over this period contributed to some of this growth, but net profit has improved at a rate of just under 18%.

The increased profitability of the company’s products has driven much of the bottom-line gains. Last year, net profit margin was 42.4% compared to just 13.7% in 2012.Texas Instruments’ revenue growth has been slow and steady, but its profitability has been very strong.

Recession performance and dividend growth history

Technology companies, especially those involved in the production of semiconductors, often perform well in high growth environments. Nearly everything consumers use on a daily basis, including computers, phones and vehicles, use semiconductors to function. Higher demand leads to better business performance.

The opposite, of course, can occur during recessionary environments as demand for chips diminishes when the economy is in a downturn.

Listed below are Texas Instruments’ adjusted earnings per share totals before, during and after the Great Recession:

- 2006 adjusted earnings per share: $1.69

- 2007 adjusted earnings per share: $1.83 (8.3% increase)

- 2008 adjusted earnings per share: $1.57 (14.2% decrease)

- 2009 adjusted earnings per share: $1.15 (30% decrease)

- 2010 adjusted earnings per share: $2.62 (128% increase)

Adjusted earnings per share fell more than 37% from 2007 to 2009 as Texas Instruments felt the brunt of the period. Such a drawdown will likely be the case in the next recession as well.

However, Texas Instruments' fortunes changed greatly once a recovery from the recession began as adjusted earnings per share more than doubled from 2009 to 2010. This provides evidence that the company’s products resonate with customers because as soon as conditions started to improve, so did Texas Instruments’ results.

Texas Instruments continued to raise its dividend during the last recession by a total of 50% from 2007 to 2009. In total, the company has a dividend growth streak of 18 years.

Texas Instruments also weathered the Covid-19 pandemic well as the work- and learn-from-home environment led to outsized demand for chips. Revenue improved just 0.5%, but adjusted earnings per share and net profit were higher by 13.9% and 11.5%, respectively, driven by a 380 basis point improvement in the net profit margin. The company increased its dividend by 13.2% in 2020.

Dividend growth has been consistent. Texas Instruments has 15, 10 and five-year dividend growth rates of 20.8%, 21.7% and 18.7%, respectively. Many companies typically have higher growth rates at the onset of the initiation of the dividend as increases are coming off a smaller base. That hasn’t been the case for Texas Instruments as the above growth rates show that raises have been in-line over multiple periods of time.

The company announced a dividend raise of 12.7% for the final payment of 2021. This is below even the medium-term growth rate, but still in the double-digit range. And with a reasonable payout ratio, it is likely that Texas Instruments will continue to offer high levels of dividend growth.

Payout ratios and the impact of debt on future dividend growth

Texas Instruments distributed $4.21 of dividends per share in 2021 while producing adjusted earnings per share of $8.26, leading to a payout ratio of 51%. Shareholders should see at least $4.60 of dividends per share in 2022.

Wall Street analysts expect Texas Instruments to earn $9.10 per share in 2022, implying a projected payout ratio of 51%. Both last year’s payout ratio and the projected payout ratio for this year are nearly in-line with the 10-year average payout ratio of 52%. The earnings payout ratio has been incredibly consistent over the last decade.

Let’s examine dividend safety through free cash flow. Texas Instruments distributed $3.9 billion of dividends in 2021 while generating free cash flow of $6.3 billion for a payout ratio of 62%. The prior three years saw an average free cash flow payout ratio of 52%.

Last year’s free cash flow payout ratio was above the average, but not to a level I would consider dangerous. Dividend growth could slow to the low double-digit range, though, until the free cash flow payout ratio does come down somewhat.

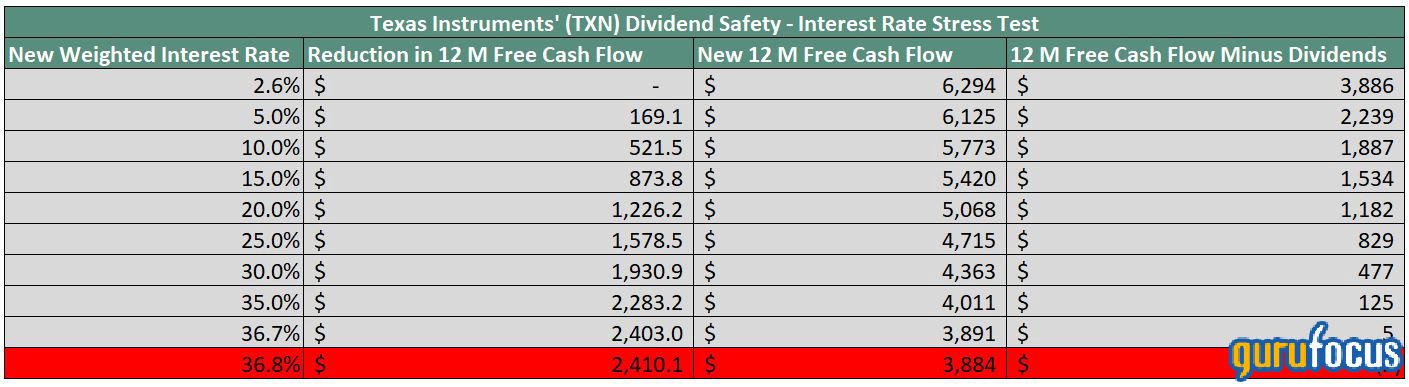

Now let’s consider Texas Instruments’ debt obligations to see if that could impact future dividend growth. The company had interest expense of $184 million last year. Total debt was $7.05 billion at the end of 2021, leading to a weighted average interest rate of 2.6%.

The Excel chart below illustrates where Texas Instruments’ weighted average interest rate would need to be before free cash flow wasn’t enough to be cover dividend payments.

Source: Author’s calculations

As we can see above, Texas Instruments’ weighted average interest rate would need to reach almost 37% before dividend payments were not covered by free cash flow.

Between reasonable payout ratios and limited debt obligations, Texas Instruments’ dividend looks to be very safe and should provide for future dividend raises as well.

Valuation analysis

According to Value Line, Texas Instruments has traded with a price-earnings ratio of just over 20 since 2012. Shares are currently trading at $169. Using earnings estimates for the full year of fiscal 2022, Texas Instruments is trading at a forward price-earnings ratio of 18.6.

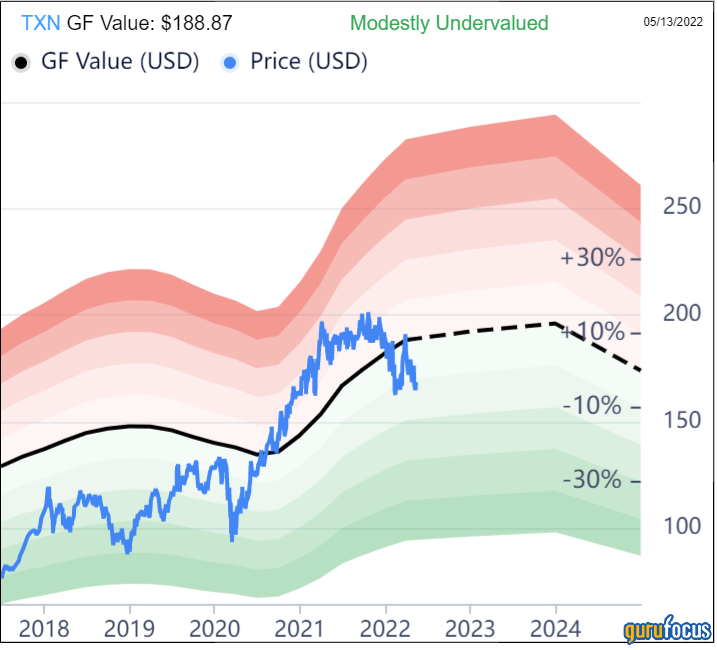

Texas Instruments also looks undervalued according to the GF Value chart:

With a GF Value of $188.87, Texas Instruments has a price-to-GF-Value ratio of 0.89. Reaching the GF Value would result in a 11.8% gain before factoring in the stock’s current yield of 2.7%. The chart above shows that Texas Instruments hasn't traded this far below its GF Value since late 2020. Shares are rated as modestly undervalued by GuruFocus.

Final thoughts

Texas Instruments maintains a strong leadership position in its industry and has performed very well for long periods of time. The company is not recession proof, but Texas Instruments’ performance following the 2007 to 2009 period shows the strength of its business.

The company has also been an aggressive grower of its dividend over multiple periods of time, with shareholders enjoying extremely high dividend growth rates. The payout ratios are close to the averages and allow for future increases as well.

Finally, Texas Instruments is trading below both its long-term historical average earnings multiple and its GF Value. Adding it all up, not only is Texas Instruments a dividend growth juggernaut, it is also offering double-digit total return potential from the current price by my estimates.