Finland-based Kone Oyj (OHEL:KNEBV, Financial) is one of the major manufacturers of elevators in the world. The stock is down in part due to concerns about sales in China and the war in Ukraine. Once the war passes, the stock should recover some of the ground it has lost this year.

The stock trades for 44.51 euros ($47.17), there are 442 million shares and the market cap is 19.6 billion euros. Trailing 12-month earnings per share were 1.84 euros and the price-earnings ratio is 24. The dividend is 1.75 euros and the yield is a whopping 4%.

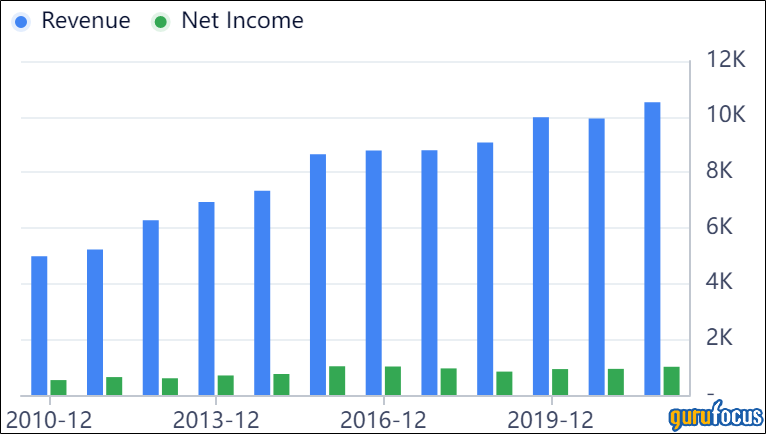

Income statement growth looks like something out of a college finance textbook—everything seems to go up year after year. Sales were 6.28 billion euros in 2012 and have gone up just about every year and reached 10.63 billion euros for the trailing twelve months. Earnings per share went from 1.17 euros to 1.84 euros over that period. Dividends increased from 0.70 euros to 1.75 euros. Shares outstanding have remained rock solid and have barely budged.

Kone has traded at a valuation of about 2.4 times sales for much of the last 10 years or so. It is now trading at about 1.84 times. For much of the past decade, the stock traded at a 2.6% dividend yield. Now it is almost 4%.

The balance sheet is incredibly strong, recording 557 million euros in cash, while accounts receivables is 2.4 billion euros and current deposit and loans receivable is at 1.5 billion euros. The liability side shows 1.1 billion euros in receivables and 549 million euros in debt.

In the most recent quarter, Kone reported 11% order growth but a 0.4% revenue decline. Ebitda margins contracted 2.7% to 8%.

Elevators

Kone has about 1 million elevators worldwide. Around 30% of its revenue comes from maintenance. It makes another 13% overhauling old elevators. In its annual report, the company said it moves 1 billion people a day, which I find amazing.

By region, 38% of the company's sales come from Europe, the Middle East and Africa, 44% from Asia and 18% from the Americas. New equipment accounts for 53.6% of sales, while maintenance accounts for 32.8% and modernization 13.6%.

Shares

There is an annoying dual-class share structure where “A” share owners receive one vote and “B” shares receive 1/10 of a vote. There are about 76 million “A” shares and 441 million “B” shares. It’s often like this in Scandinavia and the Baltics.

Antti Herlin owns 22.8% of the stock and controls 62.2% of the votes. The Herlin family has controlled Kone since 1924. The 10 largest shareholders are European and unfamiliar to me.

War in Ukraine

The war in Ukraine has dragged down Nordic and Scandinavian stocks. Kone and iShares Finland both tanked on March 7. They recovered on March 16, but subsequently have dropped again.

My guess of Russia doing anything if Finland joins NATO is about one in a hundred. My second guess is this war passes sometime. Obviously, I could be wrong. So many people were wrong about the strength of Russia since this war started. So part of my thesis is the war dissipates and Kone recovers.

Can you imagine what would have happened had Russia won its war with Finland in the early part of the 20th century? The Finnish culture and strong economy that you know would not exist.

Analyst reports

Morningstar is bullish with a 56 euros price target. That would be a 25.8% increase. Morninstar’s analyst thinks maintenance in China will make up for new order losses and the replacement of elevators in Europe and the U.S. should be strong. They think revenue growth will be 2% and expect a 150 basis-point drop in operating earnings.

Morgan Stanley has a price target of 54 euros. The invest bank has an estimate of 1.85 euros this year, 2.06 euros next year and 2.21 euros the following year. They see inflation pressure and a drop in China, as does everyone else. The mean price target is 58.84 euros.

What I find odd with analyst reports is they say very little of Herlin’s control of Kone or the war in Ukraine weighing on shares. The analyst reports focus on profitability and revenue. There is so much more to know about a company. If you were going to buy a gas station that was 60% controlled by someone else in a country next to an ongoing war, wouldn’t you want to know that?

Conclusion

I think Kone could be a great place to invest. The American markets are doing poorly and Kone is already beaten up. You get the 4% dividend yield, which I doubt will get cut. As such, the company is a great potential value opportunity in a great value picker’s market.

Also check out: (Free Trial)