MongoDB Inc. (MDB, Financial) is a leading NoSQL database management platform. Its cloud-based tools help customers manage, store and retrieve document-oriented information.

The share price has slid by 49% year to date, mainly due to the rising interest rate environment, which has impacted growth stocks. However, now the company’s stock is starting to look enticing as renowned investors have recently been buying, including Ray Dalio (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Baillie Gifford (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

During the first quarter, shares were trading at an average price of $391 each. Let’s dive into the business model, financials and valuation to see if the stock offers good value currently.

Business model

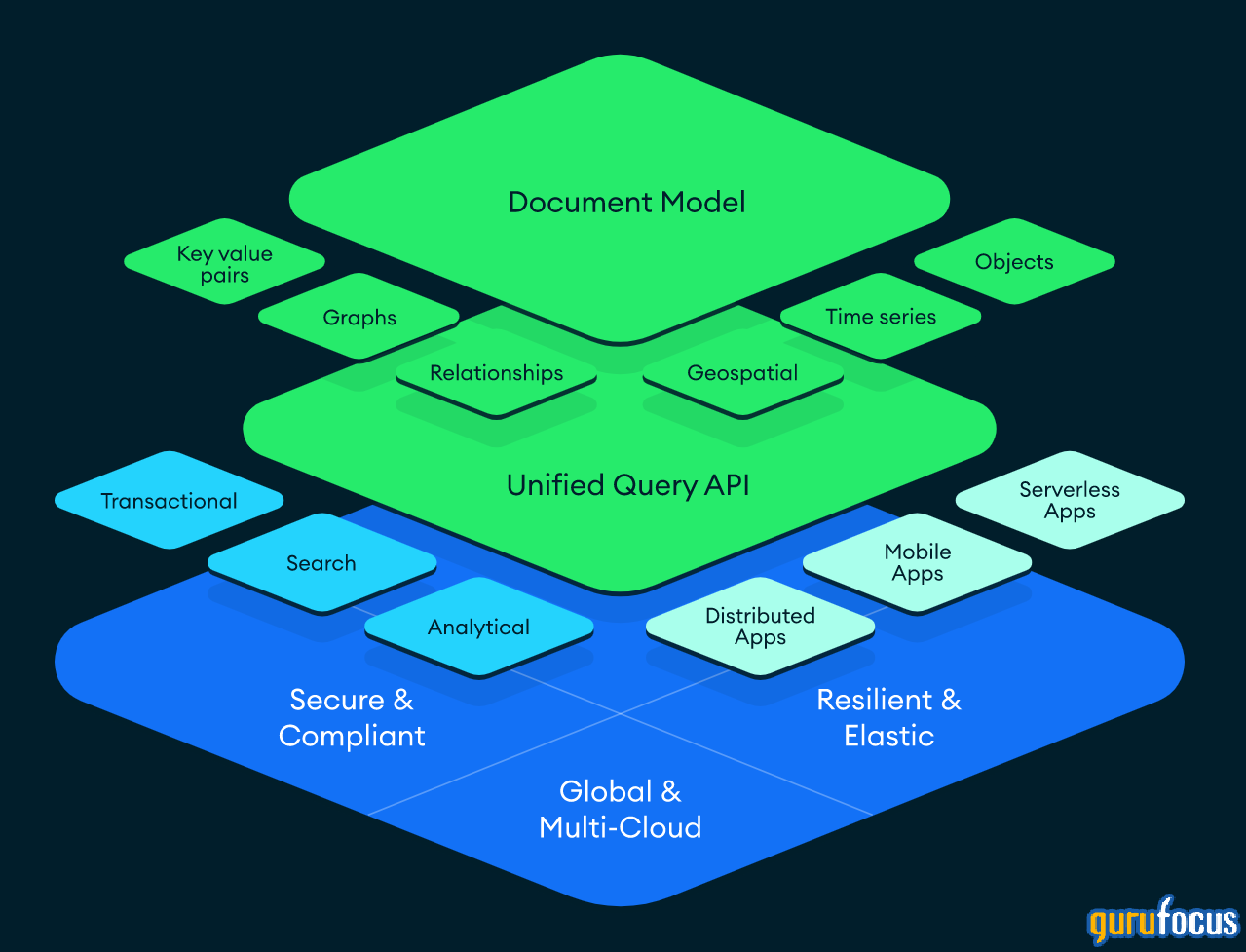

MongoDB offers a cloud native database platform which enables developers to deploy applications faster. Often referred to as a database-as-a-service, the platform gives developers data models, which means they can spend less time creating databases and more time providing business value.

The company has proven to be immensely popular and now has over 33,000 customers across 100 countries. The platform has been downloaded over 240 million times and the MongoDB university course has had over 1.5 million registrations. Its solution is popular across many industries, from financial services and health care to retail and gaming. Popular use cases include internet of things applications, personalization and mainframe offloading.

Growing financials

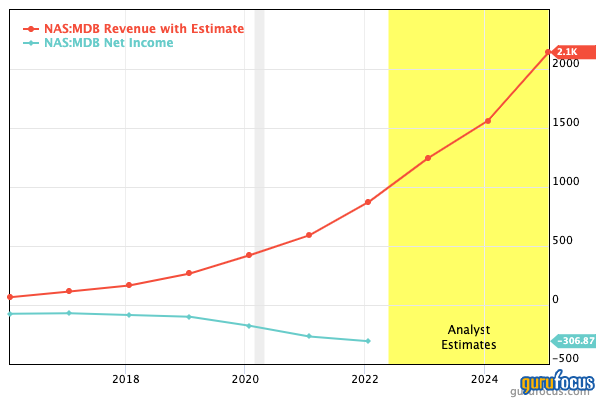

MongoDB has been growing revenue rapidly. For fiscal year 2022, which ended Jan. 31, total revenue grew 48% year over year to $873.8 million. Similarly, in the company's fourth quarter alone, revenue increased 56% to $266 million compared to the same quarter last year.

Gross profit came in at a healthy $614 million for the quarter, which means the company has a high 70% gross margin. MongoDB did report a loss of $289 million, which was greater than the $209 million reported in the year-ago quarter.

During the year, the company invested $308 million on research and development and is also investing into sales and marketing. Without these expenses, the company would be profitable in a traditional sense.

MongoDB generated free cash flow of -$6.7 million for the year, which was a substantial improvement from the -$59 million generated in the prior year.

In terms of valuation, the GF Value Line, which analyzes historical multiples, past financial performance and future earnings projections, indicates the stock is significantly undervalued currnetly. This may be one reason why we are seeing so many hedge fund managers investing in the stock.

Final thoughts

MongoDB appers to be a solid company that offers a best-in-class platform for cloud-based databases. The strong developer community makes the stock particularly appealing to customers, and the growth rates back this up. The stock is undervalued relative to historic multiples and, therefore, could be a great opportunity for the long term.

Also check out: