The first earnings reports of the calendar year among retailers have been mixed. For exaple, Target Corporation (TGT, Financial) saw its stock lose a quarter of its value in a single trading session when profits were well below analysts’ estimates. Dollar General (DG, Financial) topped what the market had expected and enjoyed a double-digit percentage gain.

Costco Wholesale Corporation (COST, Financial) produced one of the better quarters seen in retail. Despite the earnings beat, shares are down more than 23% off of their 52-week high, but the company’s most recent quarter adds to my bullish thesis on the name.

Earnings highlights

Costco released its fiscal third-quarter fiscal 2022 earnings results on May 26. Revenue grew 16.2% year-over-year to $52.6 billion, beating Wall Street analysts’ estimates by more than $1 billion. Net income of $1.35 billion, or $3.04 per share, compared favorably to net income of $1.22 billion, or $2.75 per share, in the prior year.

Adjusting for a one-time pre-tax charge of 13 cents per share for higher benefits for employees, earnings per share of $3.17 compared to $2.84 in the prior year and was 15 cents better than expected.

Total company comparable sales grew 14.9%, higher than estimates of 11.5%. Removing the impact of fuel and currency exchange fluctuations, same-store sales grew 10.8%.

By region, the U.S., Canada and Other International segments had comparable sales growth of 16.6%, 15.2% and 5.7%, respectively. Adjusting for fuel and currency exchange, the three regions saw growth of 10.7%, 12.8% and 9.1%, respectively.

E-commerce remains strong with a 7.4% gain for the quarter. Membership fees, which provide the bulk of Costco’s net income, grew 9.2% to $984 million.

Rounding out the quarter, Costco opened one new warehouse and has opened a net 14 stores thus far for the fiscal year. The company projects it will open a further 10 stores in the fourth quarter of fiscal 2022.

Takeaways

Costco posted excellent numbers in the quarter, and this was coming off very tough comparisons. In the same period of the prior year, revenue grew 21.5%, the company’s best year-over-year growth rate in at least five years. Costco’s comparable sales two-year stake rate is almost 38%, which is the best level seen in recent memory.

Costco did see a benefit from the Covid-19-induced hoarding rush that occurred during calendar year 2020, but the growth rates since show that this was not a one-time benefit for the company. It's likely that people have been shopping at Costco more thanks to high inflation, helping to sustain the gains. Revenue has increased by at least 10% in each of the past eight quarters. The company has very strong growth rates even removing fuel and currency exchange from the equation.

Membership fees grew at a high rate, up 10.4% when taking into account currency headwinds. Membership renewal rates hit an all-time high as well, with U.S. and Canada renewal rates climbing 30 basis points to 92.3% for the last 12 weeks. Worldwide, the renewal rate remains strong, expanding 40 basis points to 90%.

First-year members are also sticking with the company at a high rate, and executive members, which pay a higher fee, account for 43% of the member base and more than 71% of annual sales. The company now has more than 64 million member households and nearly 117 million paying members. These factors provide evidence that the vast majority of members continue to show willingness to pay to shop at Costco.

Costco will eventually raise its membership fees on its typical five-and-a-half year schedule, but this shouldn’t impact renewal rates as members tend to stick with the company.

E-commerce, which exploded during the pandemic, was higher by a mid-single-digit rate, but this comes on top of a 38% increase in the prior-year quarter. Interestingly, larger ticket items, such as appliances and TVs, ran ahead of the overall category. This was an area that other retailers, like Target, struggled with during their quarter. Costco grocery, which provides delivery, was up in the low-double-digits. Deliveries are expected to be up 23% for the fiscal year, demonstrating the popularity of this service.

If there is a quibble with the quarterly report, it is on the margin front. Gross margins fell almost 100 basis points to 10.19%. Gas inflation contributed 46 basis points to the decline. The remainder of the decline was due in part to sales mix, a difficult comparison for fresh food and higher raw material and labor costs. A new holiday for employees also contributed.

The good news is that inflation in fresh foods was lower sequentially, which could be a sign that the company could start to see input costs stabilize. Despite these headwinds and higher input costs, SG&A expenses contracted by 84 basis points to 8.6%.

Valuation analysis

Costco closed Friday at $470.76 per share. Using Wall Street's estimates for the year, shares have a forward price-earnings ratio of nearly 36. The stock has five- and 10-year average price-earnings ratios of 27.8 and 30.5, respectively. Shares are thus trading at a premium to the historical averages.

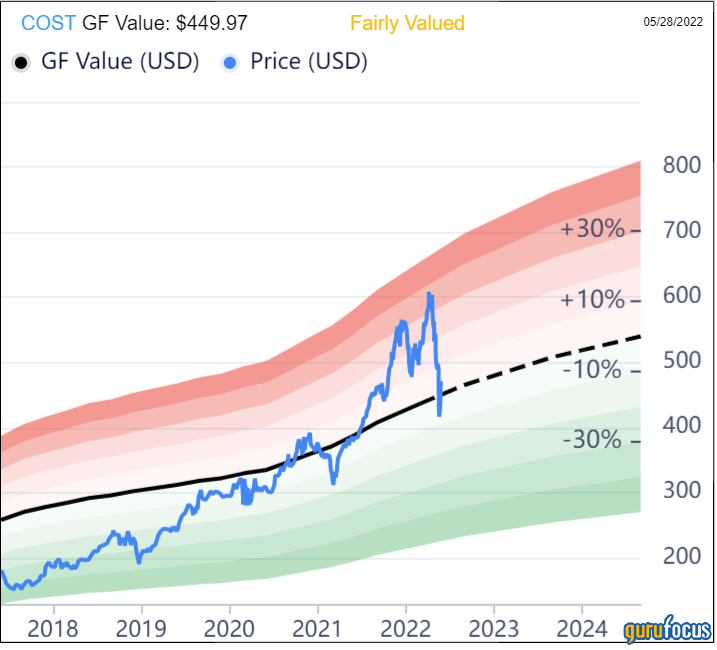

On an GF Value basis, however, shares are viewed as fairly valued.

With a GF Value of 449.97, Costco has a price-to-GF-Value ratio of 1.05, earning the stock a rating of fairly valued from GuruFocus.

Final thoughts

Costco’s third quarter of fiscal 2022 showed that the impressive comparable sales it has demonstrated over the past few years show no signs of slowing down. The company is seeing strength across geographic regions and business channels.

Shares are not cheap on a historical basis, but look reasonably valued using GF Value. Value investors might not find the current share price appealing, but those looking for exposure to a fast-growing retailer that will likely benefit from worsening economic conditions might consider it.