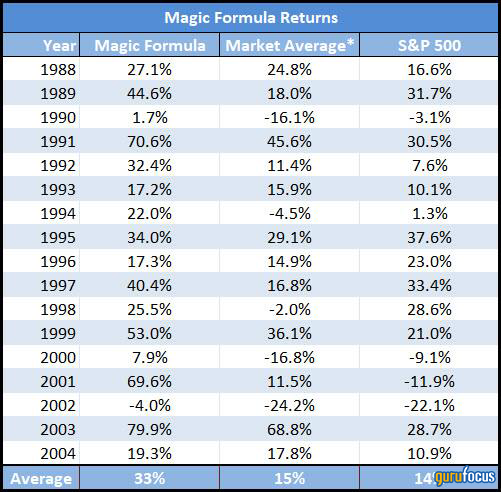

Joel Greenblatt (Trades, Portfolio) is a legendary value investor who founded Gotham Asset Management. In 2005, he wrote “The Little Book that Beats the Market,” which became an iconic investment publication and instant best seller. In the book, Greenblatt reveals the "Magic Formula," a special screening method for selecting stocks with low price-earnings ratios (or "cheap stocks") and high returns on capital (also known as "good companies”).

According the Greenblatt, this method when backtested outperformed the stock market index. The original Magic Formula method suggests purchasing 20 stocks which fit the criteria, hold them for one year and then sell for the most tax-efficient investing. The process is then repeated. The idea is to systemize your investing to get the best returns and avoid psychological biases.

GuruFocus has a special Magic Formula screener, which is updated regularly. I am going to discuss two recent additions.

Wise

The first is Wise PLC (LSE:WISE, Financial), a fintech company founded in Estonia that specializes in low-cost international transfers. Despite the share price decline, the company is rapidly growing revenue and is profitable, which is really quite unique when compared to most other fintech growth stocks.

Wise, formerly known as TransferWise, was founded in 2011 by two Estonians. The company has been backed by top-rated investors, including Sir Richard Branson (approximately 15% shareholder with $1.5 billion position), Peter Thiel and Max Levchin (co-founders of PayPal (PYPL, Financial)) and venture capital firm Andressen Horowitz.

According to Thiel, "Wise demonstrates true innovation in banking by enabling its users to retain their wealth across borders, instead of paying big fees to big banks."

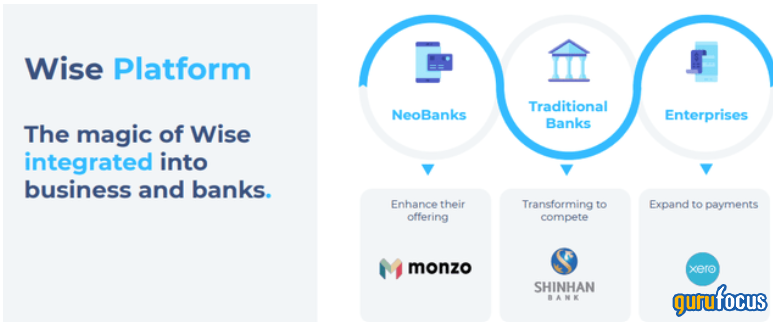

This comment from Wise best sums up the company’s unique infrastructure.

When people move money across borders with Wise, what they are really doing is sending money to a local account in one country. And once it receives the funds, the company pays out from a local account in the destination country. So in reality, money does not really cross borders.

Thus, the company has a network of connected “local payment systems” that essentially removes all the middle men and enables fast, efficient and low-cost money transfers.

Source: Wise presentation.

Growing financials

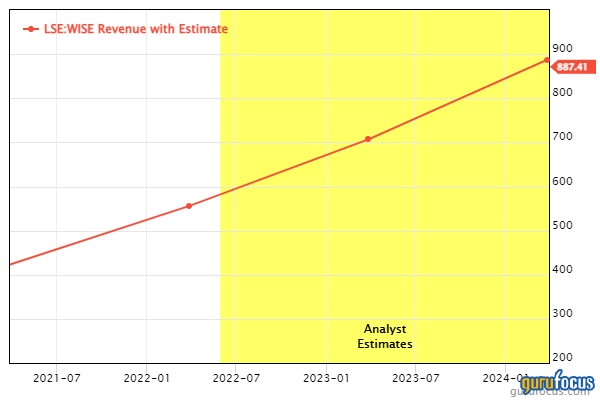

Wise grew revenue from 302 million pounds ($387 million) in 2020 to 421 million pounds for fiscal 2021, which is an increase of 39% year over year. By 2024, analysts are forecasting revenue will more than double to $887 million.

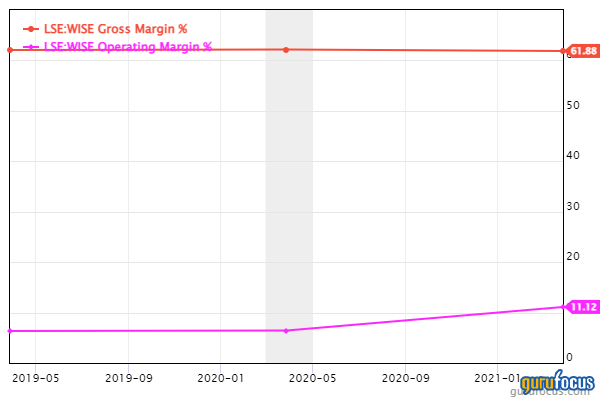

As a software-based company, Wise has high gross margins of 64%, which has resulted in the gross profit increasing 39% to 260 million pounds in 2021. Operating profits have also grown from 19.5 million pounds to 46.8 million pounds, an incredible 140% gain.

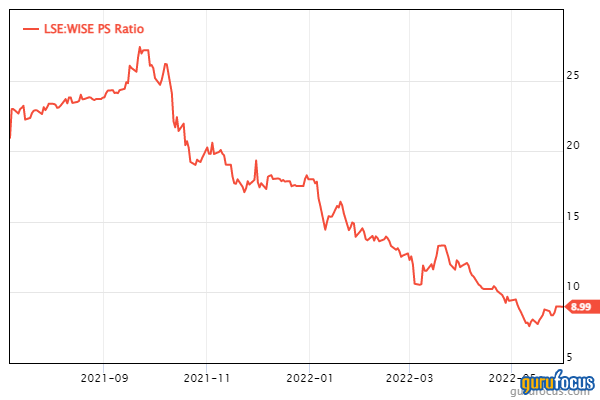

According to Greenblatt’s formula, the stock has an earnings yield of 51%, a price-earnings ratio of 122 (which is very high) and an extremely high return on capital of 194%. Since these numbers are so high, I think they could be slightly skewed as Wise is a growth company. Thus, if we analyze the price-sales ratio, we can see the stock trades at a low multiple of 8.99 relative to historic levels of 24. Therefore, I would reason the stock is undervalued.

Gestamp Automocion

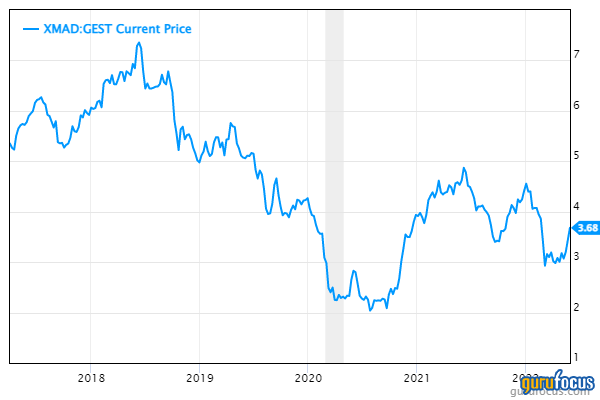

Second is Gestamp Automoción (XMAD:GEST, Financial). It is a Spanish multinational automotive engineering company and one of leaders in the European automotive industry. The company was founded in 1997, but did not have its initial public offering until 2017. Since then, the stock has slid 36%, despite some volatile periods.

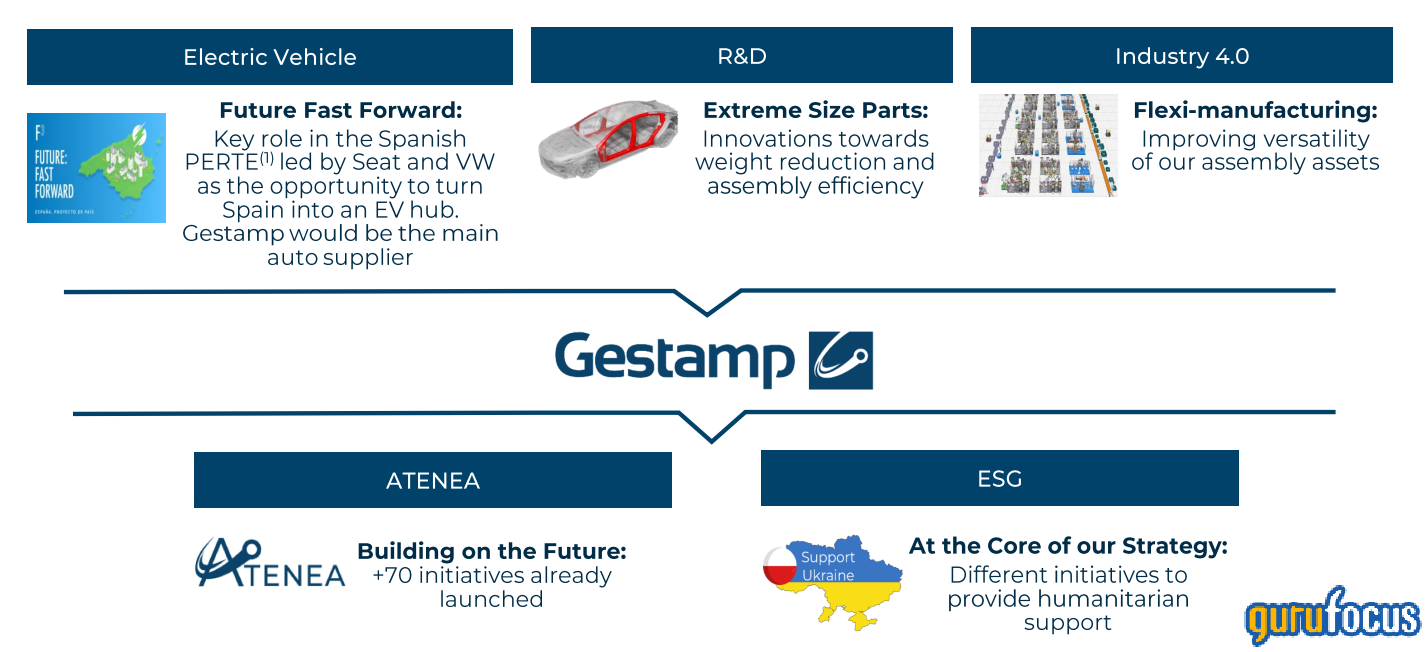

The company is working on key initiatives like “Future Fast Forward,” which is led by automaker giants Seat and Volkswagen (XTER:VOW3, Financial). The initiative will turn Spain into an electric vehicle hub with Gestamp as the main auto supplier. The company is also innovating with flexi-manufacturing.

Source: Gestamp presentation.

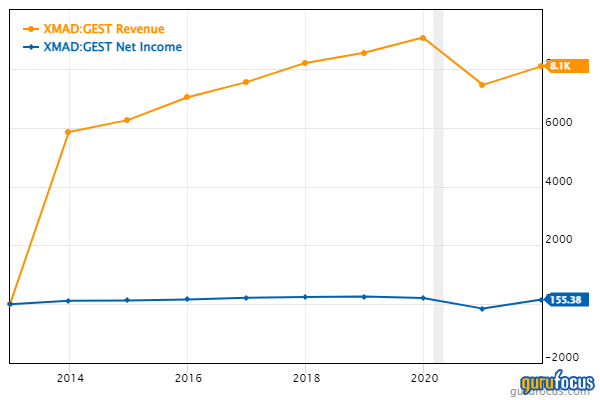

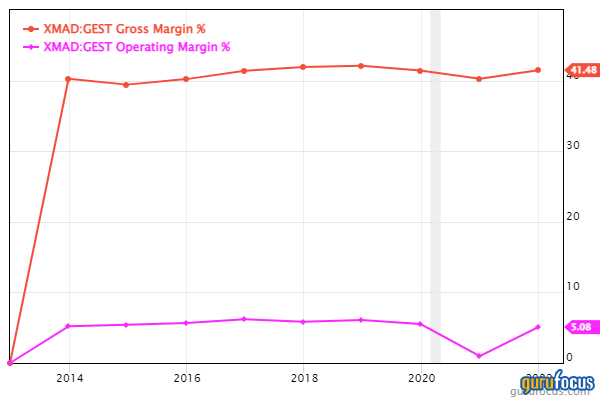

Since 2014, revenue has steadily risen to 8.09 billion euros ($8.62 billion), while net income has stayed fairly constant at around 155 million euros.

As an automotive manufacturing company, Gestamp operates with a 41% gross margin and just a 5% operating margin. This could be an issue as we move into a high inflation environment and the company’s input costs for materials and labor expand in price.

According to Greenblatt's Magic Formula, the stock has an earnings yield of 9.34%, a return on capital of 9.62% and a cheap price-earnings ratio of 13. Thus, it is clear this is a good company thanks to the nearly 10% return on capital. Gespamp also trades at a price-to-free cash flow ratio of 1.67, which is above the industry average.

Gestamp’s balance sheet has 1.4 billion euros in cash and is highly levered with 2.6 billion euros in long-term debt, but, as a mature company, this is expected.

Final thoughts

The renowned investor's formula is a great screening method for finding good companies trading at cheap valuation multiples. I personally like to use it as a starting point for further research, but you can also follow the entire systemized approach to investing.

Also check out: