On Tuesday, Unilever PLC (LSE:ULVR, Financial) announced the appointment of Nelson Peltz (Trades, Portfolio), CEO and co-founder of Trian Fund Management, as a non-executive director of the company and a member of its compensation committee, effective July 20.

The company also disclosed that Peltz’s firm now owns a 1.5% stake in Unilever. Since this holding is below the 5% threshold to be reported in a Form 3 or Form 4 filing, though, investors will need to wait until Trian Fund Management’s next 13F filing in order to have SEC documentation of the position.

The appointment of the activist investor comes amidst Unilever’s attempts to revamp its business following the failure of its bid to acquire GlaxoSmithKline's (GSK, Financial) consumer health care business. Could the alliance with Peltz, who successfully revamped Procter & Gamble (PG, Financial), mark a turning point for the struggling consumer goods giant?

Peltz and the P&G turnaround

Five years ago, Peltz set out to overhaul P&G’s cluttered management structure, which the company’s executives had identified as a key factor holding back growth.

After what was at that time the biggest proxy fight for a U.S. company, Peltz was appointed to P&G’s board in 2018. The main issues the activist investor worked to address were the management structure and the company’s emphasis on big brands.

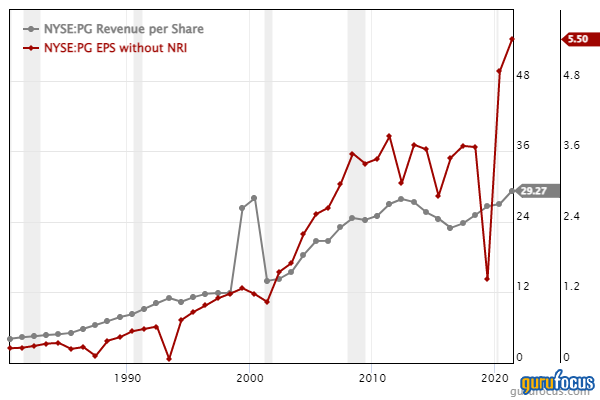

While Peltz was resoundingly successful on the management front, P&G ultimately did not follow his advice to de-emphasize the big brands. As it turns out, the management overhaul was effective enough for P&G; the company was able to shake itself out of a slump and create value for investors. Over the past three years, it has grown revenue per share at a rate of 5.2% per year and earnings per share at a rate of 14.4% per year.

Unilever’s troubles

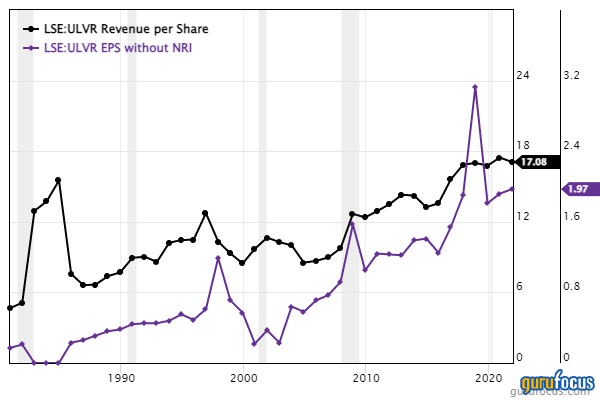

Unilever has seen its revenue per share flatline and its earnings per share decrease at a rate of 14.3% per year for the past three years. This performance is worse than 78% of peers in the consumer packaged goods industry.

This underperformance can be partially attributed to a couple of disasters in the mergers and acquisitions scene. Five years ago, Unilever had to fend off a hostile takeover attempt from The Kraft Heinz Co. (KHC, Financial), which wanted to strengthen its business with brands such as Dove, Hellmann’s, Magnum and Ben & Jerry’s. Then, just earlier this year, Unilever tried and failed to acquire GlaxoSmithKline’s consumer health care business, which will spin off into its own separate company later this year.

According to analysts with Bank of America (BAC), Unilever is also suffering due to management’s focus on profitability over growth. The company is unwilling to up its investments in order to secure higher revenue, though personally, I do not think that would solve Unilever’s problems considering its bottom line is already in decline.

Instead, I think it likely has more to do with Unilever’s geographical mix. The company derives approximately 60% of its revenue from emerging markets, and it’s facing increasing competition from homegrown players in many of these countries. Raising prices won’t do any good if customers have cheaper alternatives from their home countries to turn to.

Plans for a Unilever overhaul

Going forward, Unilever’s plans for growth hinge on health, beauty and hygiene, which offer “higher rates of sustainable market growth” compared to food, refreshments and home care. In particular, it sees room for growth in consumer health care, which currently only accounts for 5% of its business.

As per the Trian Partners website, the team at Trian Fund Management provided the following commentary on its Unilever investment:

“Trian believes Unilever has significant potential, through leveraging its portfolio of strong consumer brands and its geographical footprint. Trian looks forward to working collaboratively with management and the Board to help drive Unilever’s strategy, operations, sustainability, and shareholder value for the benefit of all stakeholders.”

It seems Trian has identified big brands and diversification as Unilever’s key areas of strength to improve upon. Management compensation will likely also be a focus given Peltz’s appointment to the compensation committee.

"Nelson Peltz (Trades, Portfolio) is a man with extensive experience of taking activist stakes in some of the largest consumer companies in the world and has been enormously successful doing so," commented Jack Martin of Oberon Investments, another Unilever shareholder.

Valuation

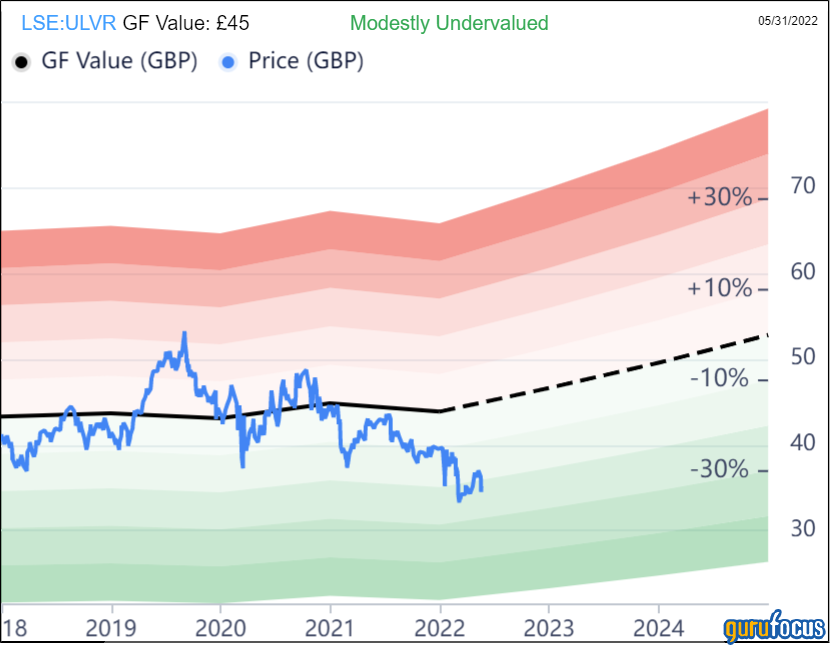

As one might expect, Unilever’s valuation reflects its weakness from recent years. The price-earnings ratio of 17.64 is below the 10-year median price-earnings ratio of 20.63, while the GF Value chart rates the stock as modestly undervalued.

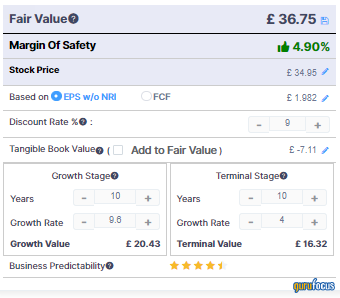

Unilever has a business predictability rating of 4.5 out of five stars, meaning that over the past decade, the company has reliably grown its earnings without any quarterly losses. Thus, we can utilize the discounted cash flow calculator in assessing whether or not the stock has a margin of safety.

Trading around 34.96 British pounds ($44.06) per share on May 31 and using a discount rate of 9%, we can see that Unilever wound need to grow at least 9.6% per year for the next decade in order to be undervalued at current levels based on the DCF calculator.

Takeaway

Unilever is currently undervalued compared to many of its peers, and for good reason. The company has been struggling in recent years, and it is facing increasing competition from local players in emerging markets, making it difficult to find pricing power in this high-inflation environment. Another issue to keep an eye on is the weaking of the British pound in light of the unexpectedly difficult post-Brexit situation.

Peltz is gearing up to push for a turnaround at Unilever. If successful, it seems likely that the activist investor could also trigger a stock price recovery to bring it more in line with the valuations of industry peers. A lot will hinge on Unilever’s ability to maintain its brand strength in emerging markets, which are its main source of income.

Also check out: