Founded in 2009, Uber Technologies Inc. (UBER, Financial) sparked a major disruption of the entire taxi cab industry.

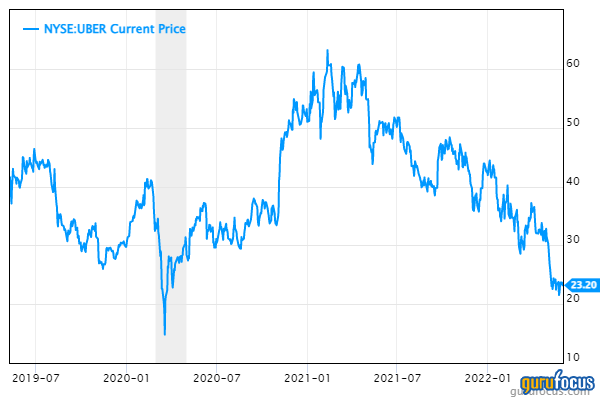

The company held its initial public offering in 2019 with major fanfare, which saw the stock reach $41 per share. Since then, the share price has slid 44% while revenue has nearly doubled from 2018.

The stock is now trading at all-time lows of $23 per share. Let’s dive into the business model, financials and valuation to see if the stock could be a good opportunity.

Business model

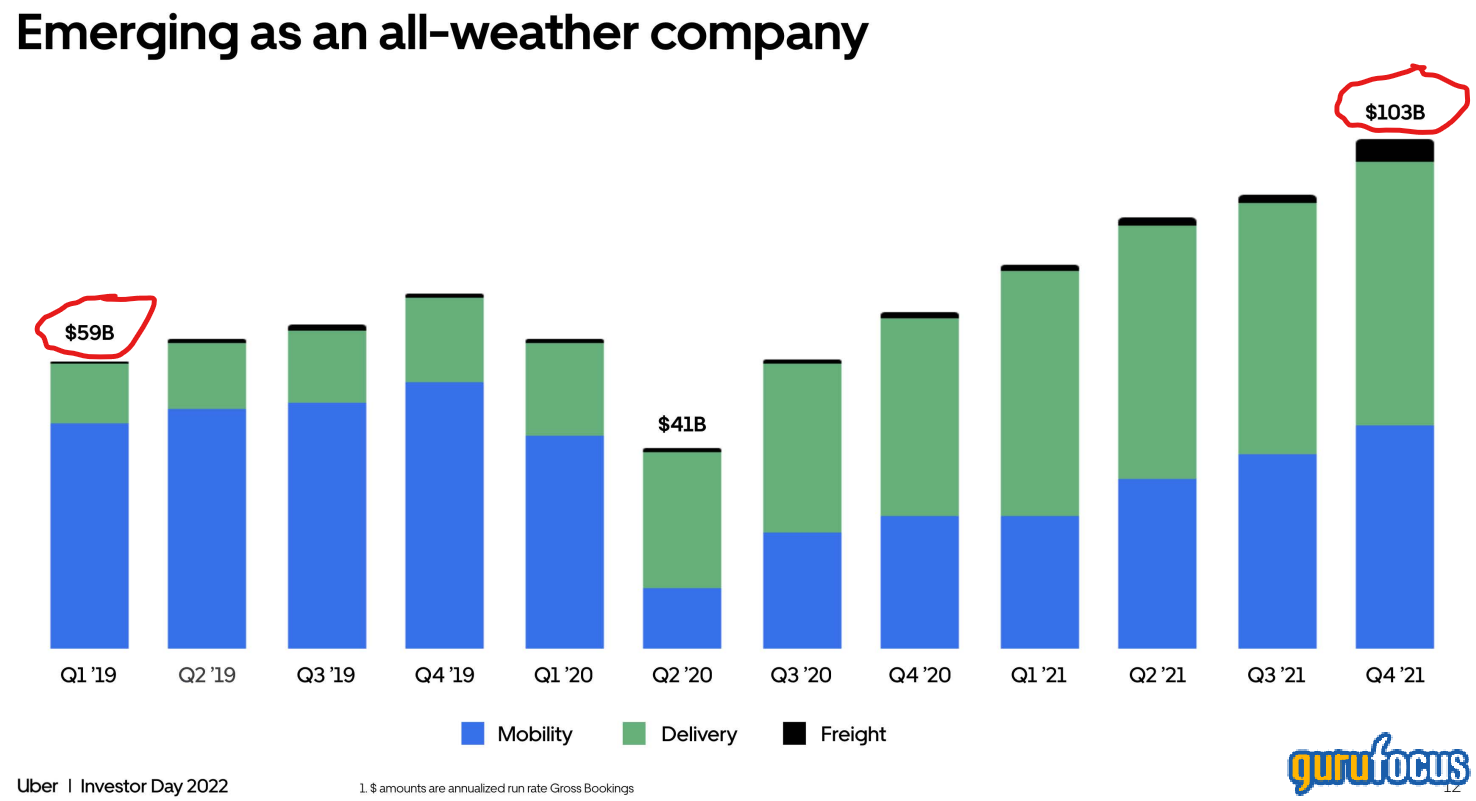

Uber is a market leader in ride-hailing with 69% market share in the U.S., compared to Lyft (LYFT, Financial) at 31% based on data from Statista. The company has two main growth engines, the Mobility (rides) business and the Delivery business. These currently make up the vast majority of the company's gross bookings, which have grown from $59 billion in 2019 (the majority made up by rides) to $103 billion in 2021, with delivery and rides recording similar bookings.

Uber's ride business was seriously affected by the Covid-19 travel lockdown, as people being stuck at home caused Uber’s Mobility segment to decline substantially. The good news is this is now starting to rebound and approach pre-pandemic levels. Trips during the quarter grew 23% year over year, bringing the total to 1.77 billion trips, or 19 million trips per day on average.

In contrast, the Food Delivery business (Uber Eats) saw extreme growth during the lockdown. The delivery segment generated $4.8 billion in revenue in 2020, a massive 152% increase.

There was an expected slowdown in 2021, but gross bookings were still up 35% year over year. As you can see from the graph below of Uber’s business segment gross bookings, the Mobility segment is smaller than in 2019, but the massive growth in deliveries makes the entire business substantially larger. Gross bookings increased from $59 billion in first-quarter 2019 to $103 billion by fourth-quarter 2020.

The company also has a third segment, Freight (trucking), which could be lucrative for Uber. Driven by the popularity of e-commerce and Amazon (AMZN, Financial), the market size for freight is expected to reach $2.7 trillion by 2026. Uber plans to penetrate this market in its own tech-first way. Uber's new tagline of "Go anywhere, Get anything" really does sum up the vast offering the company provides.

Growing financials

For the first quarter of 2022, Uber beat analysts' expectations for revenue. The San Francisco-based company recorded revenue of $6.85 billion versus projections of $6.13 billion. Sales increased 135% year over year, driven by a major increase in the company’s Mobility revenue, which came in at $2.5 billion, tripling year over year and beating estimates.

Uber reported an earnings loss of $3.03 per share, which was larger than the prior year. This was primarily driven by a $5.6 billion write-off of investment losses from the company's stakes in Grab, Aurora and DiDi (DIDI, Financial).

"We are pleased with our Q1 results, with outperformance of our quarterly guidance and strong incremental margins,” Chief Financial OfficerNelson Chai said. “With free cash flow approaching breakeven in Q1, we now expect to generate meaningful positive free cash flows for full-year 2022.”

As of the first quarter of 2022, Uber has a strong balance sheet with $4.1 billion in cash, but the long-term debt is fairly high at $9.2 billion. The company's management provided guidance for the second quarter. They forecast gross bookings of between $28.5 billion and $29.5 billion as well as adjusted Ebitda ranging from $240 million to $270 million.

According to CEO Dara Khosrowshahi, he expects Uber to produce “meaningful positive cash flows” for full fiscal 2022.

In terms of valuation, Uber trades at a price-sales ratio of 2, which is the lowest the stock has traded at since the pandemic crash of 2020.

Based on historical ratios, past financial performance and future earnings projections, the GF Value Line indicates the stock is undervalued but a possible value trap at current levels.

However, the CEO has been recently buying shares, which could indicate he believes the stock is undervalued.

Final thoughts

Uber is a solid company that dominates the ride-hailing space and has grown a substantial delivery business throughout the pandemic. A series of recent acquisitions have allowed the company to expand its Freight business, which could be lucrative due to the very large total addressable market.

The low-margin operating model is a risk given the high inflation environment we are currently experiencing. Regardless, the stock is undervalued at current levels, so it could be a great long-term play for when the cycle changes.