Nearly three years since I wrote an article for GuruFocus speculating that Johnson & Johnson (JNJ, Financial) might be interested in buying Boston Scientific Corp. (BSX, Financial), rumors are percolating once again that we might see an offer soon.

Last week, Needham & Co. analyst Mike Matson upgraded his rating of Boston Scientific shares to buy on the takeout rumors, according to an article in Mass Device. Matson said, “If JNJ decides to acquire a large medtech company, we believe that BSX could be a good fit.”

Of course, we’ve heard that before, and it's still all speculation. But this time, I believe this deal has a higher likelihood of happening given that J&J is spinning off its consumer health business next year and may want a medical device company to fill the gap and bring that business in line with the size of its pharma offerings.

Giving more credence to the rumor is what J&J said during its first-quarter earnings call in April: that the health care giant is keen to buy companies with technologies that would beef up its medtech platform, and that the size of the acquisition wouldn’t be a deterrent.

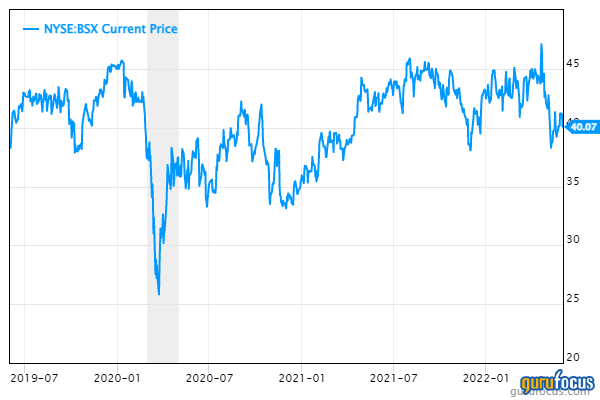

Boston Scientific’s market cap is just under $59 billion, just about where it was three years ago, so its shareholders would likely welcome a buyout at a nice premium. The company has good support on Wall Street, with 18 of 24 analysts rating it a buy or strong buy with an average 12-month target price of $50.28 and a high of $55.50.

Forty percent of Boston Scientific’s sales come from cardiovascular products. CEO Mike Mahoney has led a diversification of the company’s business over the past 10 years. In 2012, drug-eluding stents and cardiac rhythm management accounted for half of its sales; now, it's less than 20%. Boston Scientific products are sold in more than 120 countries reaching over 35,000 hospitals, clinics, outpatient facilities and medical practices.

Various business segments linked to elective surgeries that were considerably weakened throughout the pandemic are starting to normalize. Hospitals still face staffing shortages and periodic Covid surges, but trends reflecting pre-pandemic business are returning.

According to Matson, J&J has other medtech options, but Boston Scientific offers a nice mix of size, business mix and sales growth.

In January, J&J's chief financial officer Joseph Wolk told CNBC that the company is also looking for acquisitions in biotech, as shares of many companies have become a lot cheaper. The company invested a record $15 billion in R&D last year, topping its 2020 high mark, and has the firepower to make a big buy since its balance sheet hits the lowest level of net debt in years - roughly $2 billion, which is a five-year low.

J&J stock is up about 5% year-to-date, while the iShares U.S. Pharmaceuticals ETF (IHE) has dropped just over 2.5%. CNN Business reports the 16 analysts offering 12-month price forecasts for the stock have a median target of $187.00, with a high estimate of $215.00 and a low estimate of $173.00. The shares are rated a hold. J&J has long been a favorite of dividend seekers and currently yields 2.5%.