Airbnb (ABNB, Financial) was founded in 2008, when Brian Chesky decided to rent out a room in his house to help cover the rent. They laid air beds on the floor, and from that experience, Airbnb was born. Airbnb provides a platform where hosts with surplus accommodation capacity can connect with with renters in need of short-term accommodations, whether it be for vacation, a business conference or whatever.

Airbnb stayed private for a very long time and was growing well until the pandemic hit. The travel industry, Airbnb included, was sent into turmoil as travel shut down globally. The company laid off a quarter of their workforce, or 1,900 employees. Airbnb's lifeline was the bull market of 2020, which saw stocks rise thanks to historic easy money policies. The company saw this as a prime opportunity to go public in December 2020.

I discussed Airbnb at its IPO on my YouTube channel, Motivation 2 Invest. At the time, I said I believed the company was tremendous, but it was clear they were going public to survive rather than for the benefit of public shareholders. Thus, I decided not to invest. Airbnb was valued privately in April 2020 at $18 billion, but by December 2020 the valuation was a staggering $100 billion, making Airbnb the biggest IPO of 2020.

Since Airbnb's IPO, over $28 billion has been wiped off the market cap thanks to that initial overvaluation and the current unfavorable environment for growth stocks. Meanwhile, the company has been growing revenues rapidly and produced a record $1.2 billion in free cash flow in the first quarter of 2022. I believe this is the first signal of the upcoming travel rebound which is about to occur this summer, and given the strong growth and outlook, the stock looks to be trading much more in line with what it's worth than it did around the time of its IPO.

More about Airbnb

Airbnb is one of the largest providers of accomodation in the world but famously doesn't own any hotels, just like Uber (UBER, Financial) doesn't own taxis. Instead, it provides a platform for hosts to connect with guests. The beauty of this business model is that it has low Capex, and the company doesn't have to build or lease hotels where they think demand will be hot.

The hosts are the people who rent out their spare room, house, apartment, log cabin, etc. while the guests are the travellers which stay. The company makes their money by charging booking fees to both the guest and the host via their "Split Fee" structure.

In its summer 2022 presentation, Airbnb showcased the launch of new features which are tailored to the longer stay traveller and remote workers. The company has revamped their app to include "categories" which include everything from beach houses, treehouses, camping and desert homes to "OMG" homes (this is the product category which includes the wacky and wonderful places to stay from unique treehouses to even a yellow submarine). The benefit of this is it appeals to a new range of travellers while simultaneously expanding Airbnb's revenue-generating potential, as longer stays equal more bookings.

Recent earnings

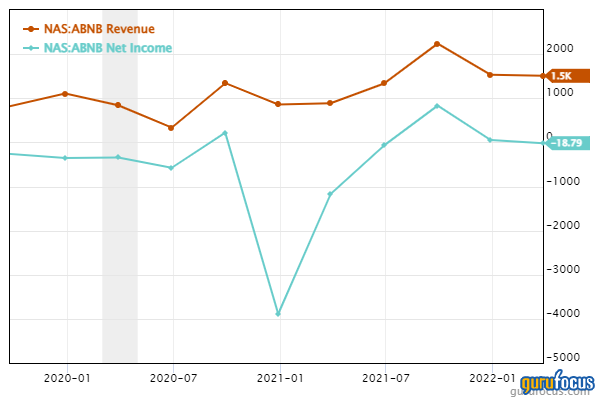

Airbnb produced some incredible results for the first quarter of 2022. Revenue rose by 70% year over year, reaching $1.5 billion and beating analyst expectations. The company's total bookings soared by 59% year over year to 102 million. This was a landmark moment for the company as it was the first time total nights stayed and experience bookings had been greater than 100 million. The cherry on top was the $1.2 billion of free cash flow in the quarter, which was an all-time high for the company.

They did produce a net loss of $19 million in the first quarter, but this was a significant improvement to the same period in 2018 and 2019.

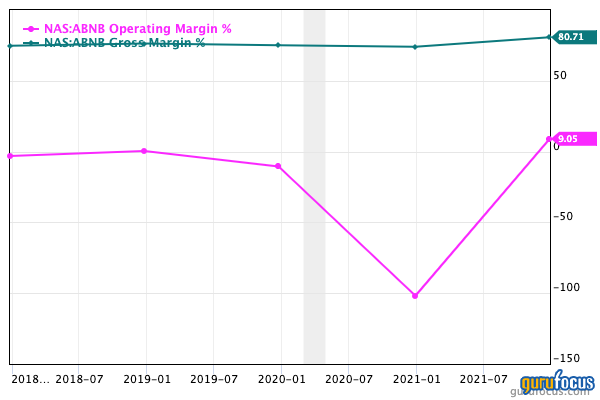

As a software company, Airbnb had a very high gross margin of 80% for full fiscal 2021. The operating margin was also positive for the year.

Valuation

In order to value Airbnb, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted the company to grow 35% next year and 25% for the next two to five years, which is in line with pre-pandemic revenue growth rates of 33% in 2018 to 2019.

I have conservatively predicted the pre-tax operating margin to increase to 14% in the next four years as the company reaches greater scale.

Given these assumptions, I get a fair value estimate of $105 per share. The stock is currently trading at $110 at the time of writing and thus in my eyes is fairly valued. This implies the stock could continue to grow at the rates predicted, I believe in 2022, Airbnb may be able to grow at a much faster rate thanks to the travel rebound tailwinds. However, for my valuation, I prefer to be conservative rather than swing for the fences.

The company trades at an enterprise-value-to-Ebitda ratio of 26.5, which is low relative to their historical average of 60.

Conclusion

Airbnb is a tremendous company with a strong business model and market-leading position as one of the "big three" online travel providers (the others being Booking Holdings (BKNG, Financial) and Expedia (EXPE, Financial)). They have had a fantastic start to 2022 and are poised for tremendous growth ahead thanks to the pent up travel demand tailwinds. Given the stock trades at a fair valuation, I believe this could be a "growth at a reasonable price" opportunity.