As investors continue to contend with market volatility, five high dividend yield stocks with a high number of guru buys as of the first-quarter 13F filing date are Verizon Communications Inc. (VZ, Financial), 3M Co. (MMM, Financial), AT&T Inc. (T, Financial), Gilead Sciences Inc. (GILD, Financial) and Steelchase Inc. (SCS, Financial) according to the Dividend Stocks Screen, a Premium feature of GuruFocus.

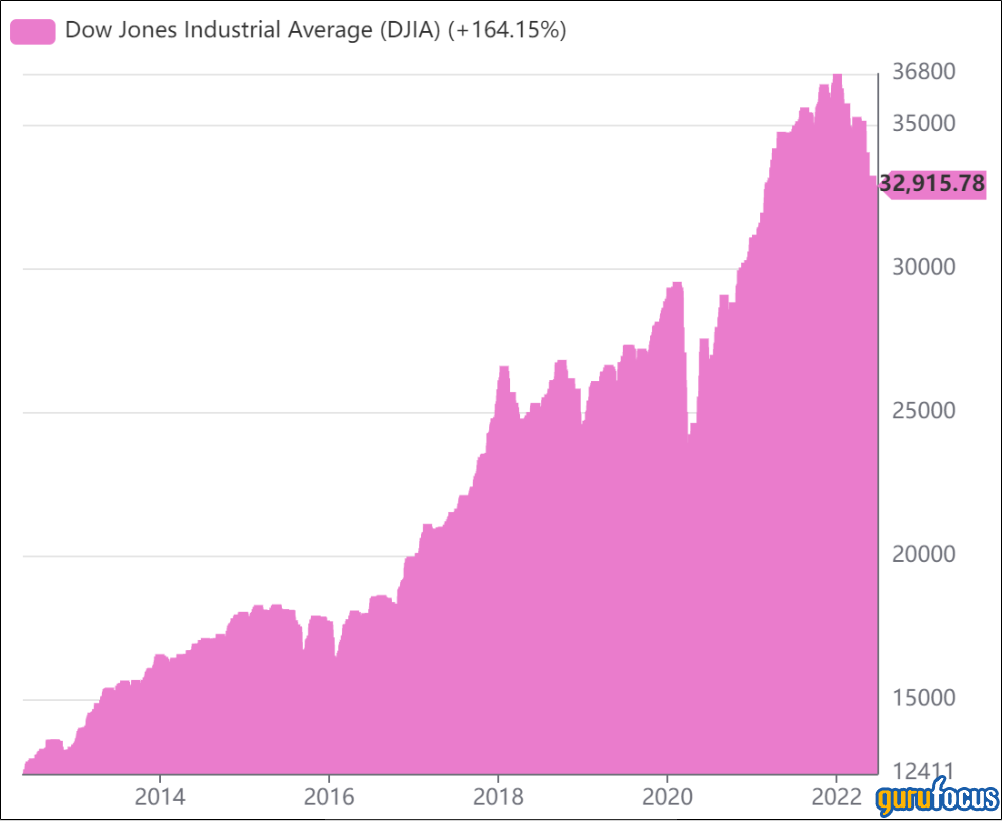

Dow rebounds from early tumble although volatility remains high

On Tuesday, the Dow Jones Industrial Average closed at 33,179.81, up 264.03 points from Monday’s close of 32,915.78 despite opening near the intraday low of 32,641.85.

Stocks surged despite multichannel retailer Target Corp. (TGT, Financial) issuing a profit warning for its current quarter, pressuring the retail sector. Additionally, the CBOE Volatility Index stood at 24.79, higher than the one-year median of 21.69 and the three-year median of 22.88.

As investors continue monitoring geopolitical concerns around the globe, GuruFocus’ Dividend Stocks Screen listed several stocks with a dividend yield of at least 4% and at least nine gurus buying shares during the first quarter.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Verizon

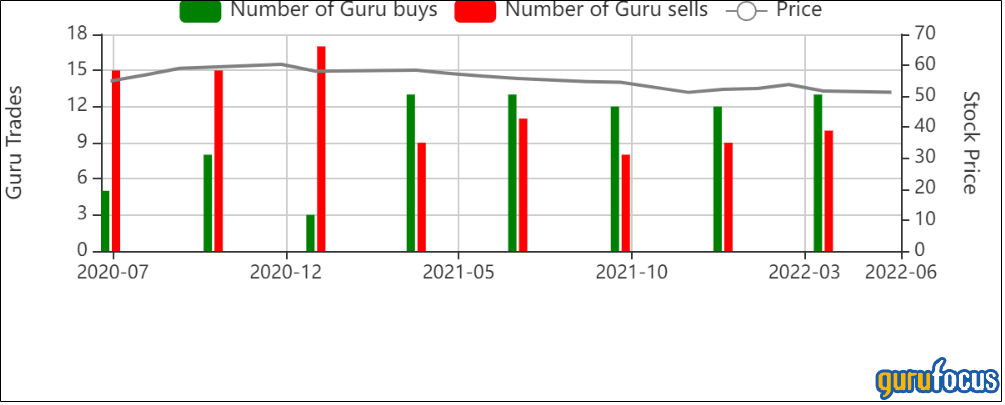

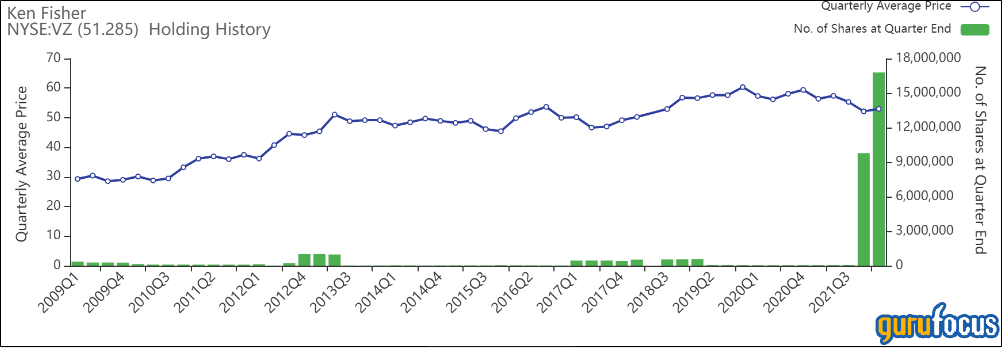

Thirteen gurus bought shares of Verizon (VZ, Financial) during the first quarter.

Shares of Verizon traded around $51.39, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.88. The stock’s dividend yield of 4.97% is near a 10-year high and outperforms more than 69% of global competitors.

The New York-based wireless telecom company has a GF Score of 75 out of 100: Although the stock has a GF Value rank of 9 out of 10 and a profitability rank of 7 out of 10, Verizon’s financial strength, growth and momentum rank just between 4 and 5 out of 10.

Gurus with holdings in Verizon include Ken Fisher (Trades, Portfolio)’s Fisher Investments and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

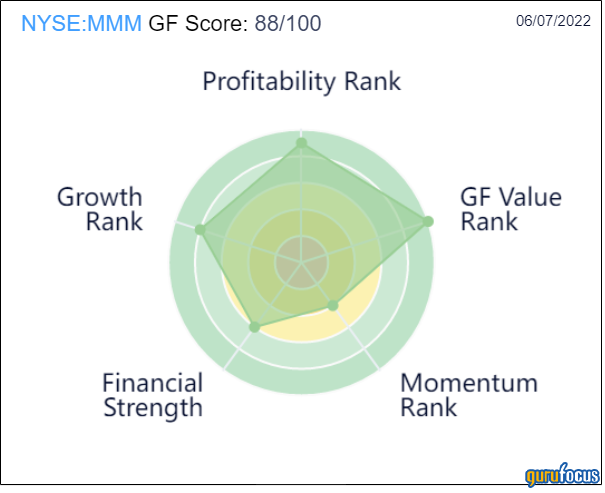

3M

Twelve gurus purchased shares of 3M (MMM, Financial) during the first quarter.

Shares of 3M traded around $146.89, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.78. The stock’s dividend yield of 4.06% is near a two-year high and outperforms more than 71% of global competitors.

The St. Paul, Minnesota-based industrial conglomerate has a GF Score of 88 out of 100 based on a GF Value rank of 10 out of 10, a growth rank of 8 out of 10, a financial strength rank of 6 out of 10 and a momentum rank of 4 out of 10.

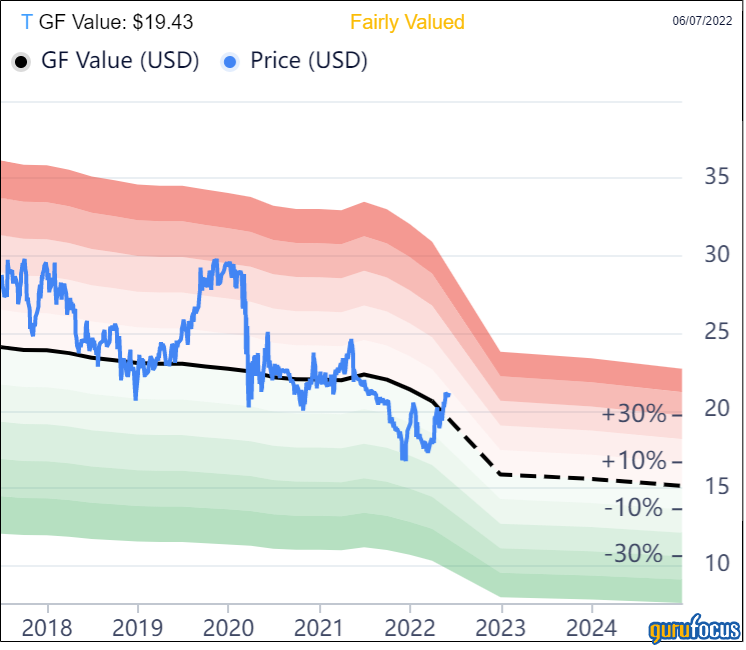

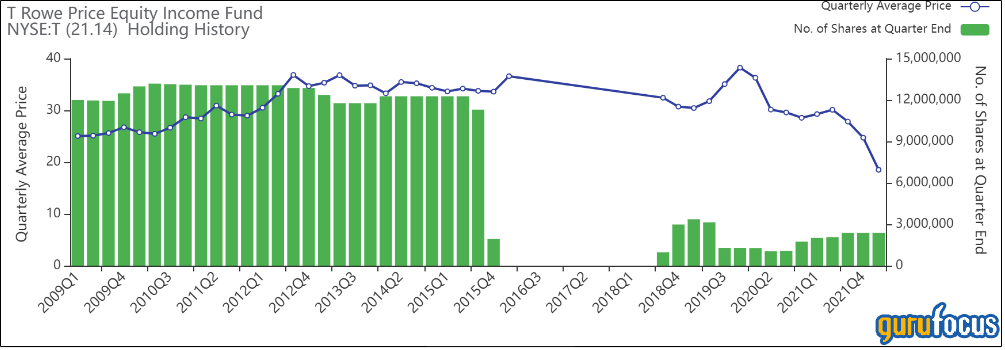

AT&T

Ten gurus purchased shares of AT&T (T, Financial) during the first quarter.

Shares of AT&T traded around $21.14, showing the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 1.09. The stock’s dividend yield of 8.78% outperforms more than 90% of global competitors.

The Dallas-based telecom company has a GF Score of 75 out of 100: Although the company has a momentum rank of 10 out of 10 and a profitability rank of 7 out of 10, AT&T’s growth, financial strength and GF Value rank just between 4 and 5 out of 10.

Gurus with holdings in AT&T include the T Rowe Price Equity Income Fund (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio)’s GMO.

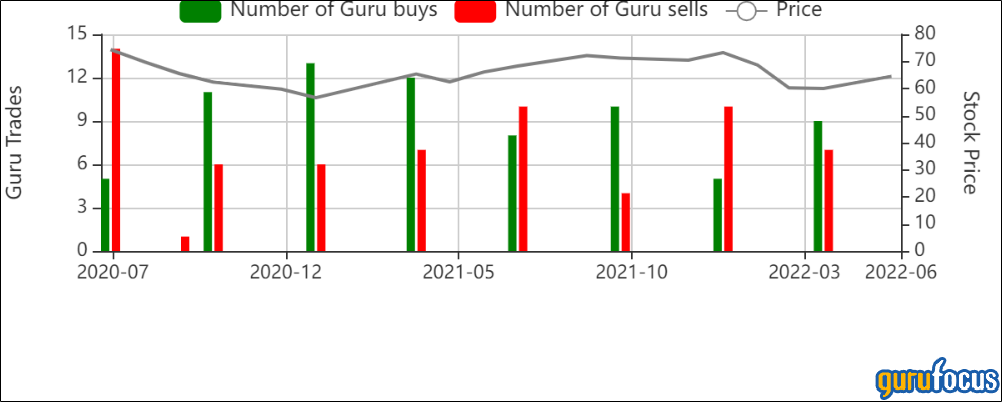

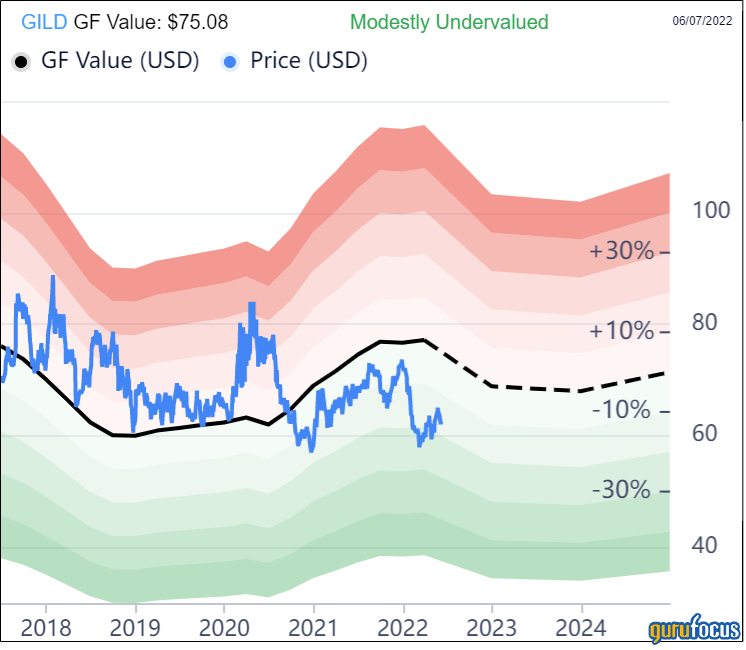

Gilead Sciences

Nine gurus bought shares of Gilead Sciences (GILD, Financial) during the first quarter.

Shares of Gilead Sciences traded around $62.54, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.83. The stock’s dividend yield of 4.61% is near a 10-year high and outperforms more than 90% of global competitors.

The Foster, California-based drug manufacturer has a GF Score of 71 out of 100: Although the company has a GF Value rank of 9 out of 10 and a profitability rank of 8 out of 10, Gilead has a momentum rank of 1 out of 10 and a rank of 5 out of 10 for financial strength and growth.

Gurus with holdings in Gilead include Dodge & Cox and John Rogers (Trades, Portfolio)’ Ariel Investment.

Steelchase

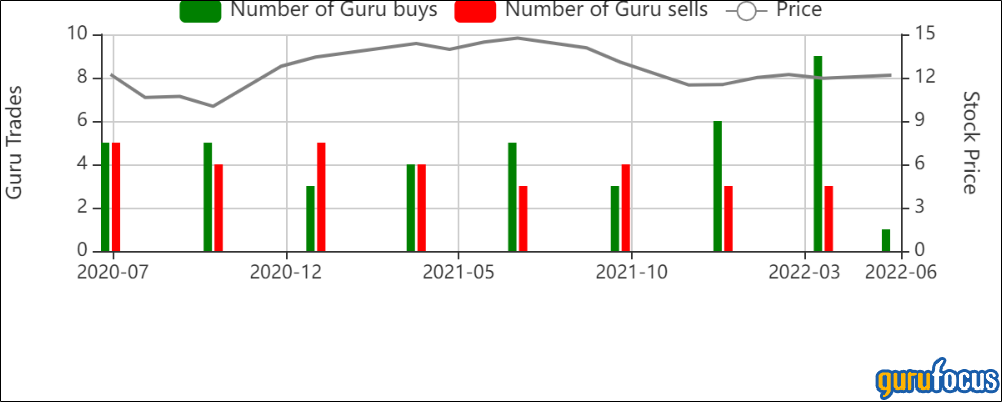

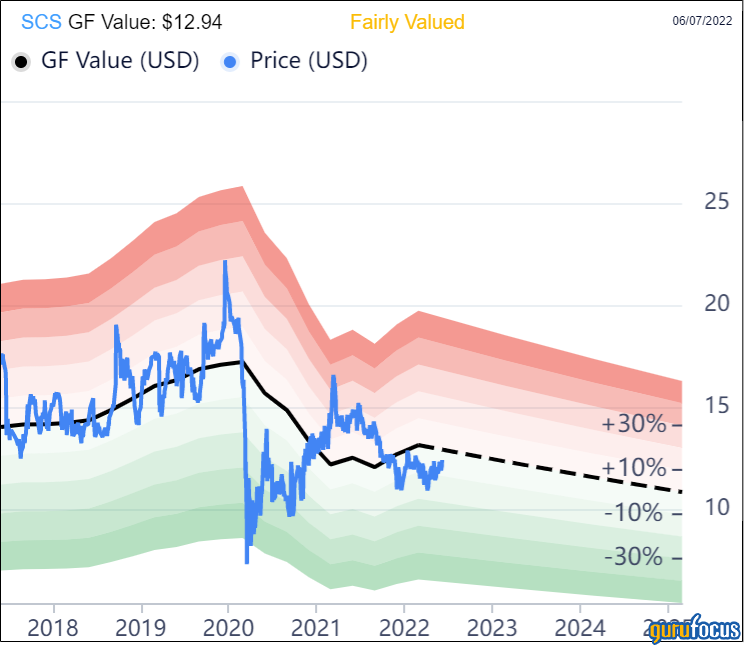

Nine gurus purchased shares of Steelchase (SCS, Financial) during the first quarter.

Shares of Steelchase traded around $12.43, showing the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.96. The stock’s dividend yield of 4.78% is near a two-year high and outperforms more than 90% of global competitors.

The Grand Rapids, Michigan-based industrial company has a GF Score of 77 out of 10, driven by a momentum rank of 8 out of 10, a financial strength rank of 6 out of 10, and a rank of 7 out of 10 for profitability and GF Value despite growth ranking just 3 out of 10.

Also check out: (Free Trial)