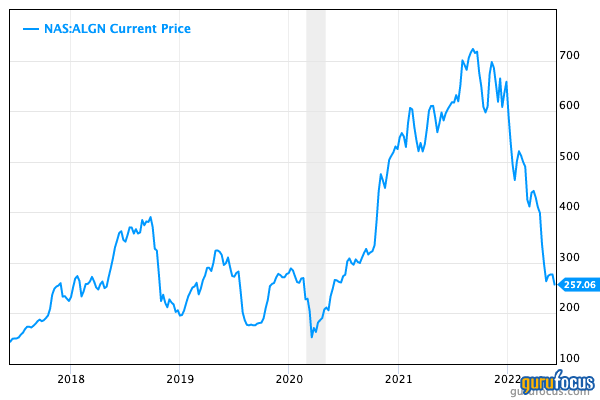

Recently, Align Technology Inc. (ALGN, Financial) looked like a shooting star, with a stock price that soared from about $137 on March 23, 2020 to just over $729 on Sept. 2, 2021. That’s a 5.32-fold increase in18 months.

However, that momentum turned with a vengeance. After hitting that high, the stock went down almost as forcefully as it went up; from $729 to the low $260s in early June 2022. That’s a 2.77-fold decrease in nine months.

Is Align now a stock that investors should run from? Or is this an opportunity to pick up a good company at a low price?

About Align

In 1997, five coworkers got together and began researching the possibilities of leveraging technology to straighten teeth. Two years later, it first introduced the Invisalign orthodontic appliance.

The Tempe, Arizona-based company says, “By combining digital treatment planning and mass-customization, with shape-engineering based on biomechanical principles, we have revolutionized the orthodontic industry.”

Today, the company sells what it calls the Invisalign system, comprising clear aligners, iTero intraoral scanners and exocad CAD/CAM software for digital orthodontics and restorative dentistry.

For its most recent quarter, the first quarter of 2022, the company reported:

- Total revenue of $973.2 million.

- Invisalign volume of 598,800 cases.

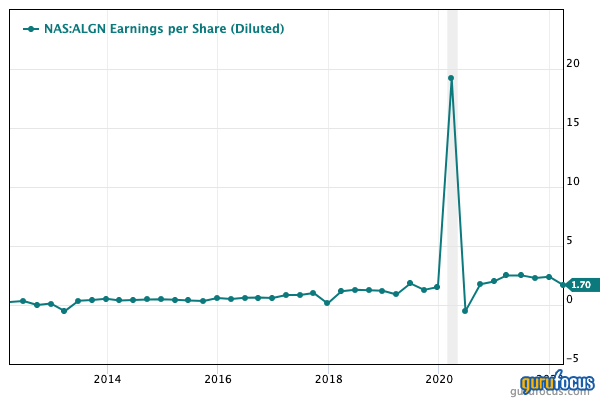

- Diluted net income per share of $1.70.

Competition

According to its 10-K for 2021, the company faces increasing competitive pressures. First, its clear aligner products no longer compete against just traditional orthodontic treatments (brackets and wires).

Competition from other suppliers of clear aligners has increased, in part because its key patents expired in 2017 (domestically) and 2018 (internationally). In addition, the increasing sophistication of 3-D printers sees more doctors manufacturing their own appliances in their offices.

In addition, it faces competition from direct-to-consumer companies offering clear aligners that require little office care from licensed doctors (dentists and orthodontists). Align is reluctant to enter the direct-to-consumer market because of commitments to the doctors it serves.

Still, the company believes it is well-positioned to compete in the aligner market. It has a dedicated sales force of over 4,000 employees, historic and ongoing investments in research and development around the movement of teeth and “an in depth understanding of the drivers and motivations within the orthodontic and GP dental markets.”

That faith is backed up by its margins. Its gross margin of 73.62% is better than 82% of companies in the Medical Devices and Instruments industry. Similarly, its net margin of 17.51% surpasses those of 80.38% companies in the industry.

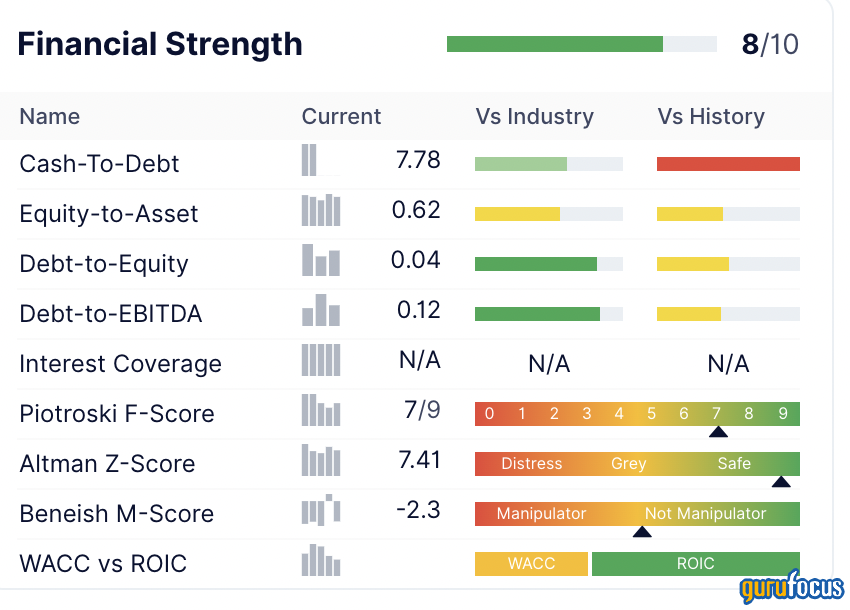

Financial strength

Seeing the N/As on the interest coverage line indicates the company carries little or no debt. The balance sheet tells us it had $23 million of short-term debt at the end of 2021, no long-term debt and $103 million of long-term capital lease obligations.

At the same time, it had $926 million in cash and cash equivalents, as well as $87 million in marketable securities.

To some extent, that good news offsets the bad news about free cash flow, which has fluctuated more than usual in the past two and a half years:

The company does not pay a dividend, so the recent dip into negative free cash flow will not immediately affect investors.

Growth

Align posts tempting growth numbers for revenue, Ebitda and earnings per share, but not so alluring when you see where that high three-year earnings per share rate came from—just one fantastic quarter:

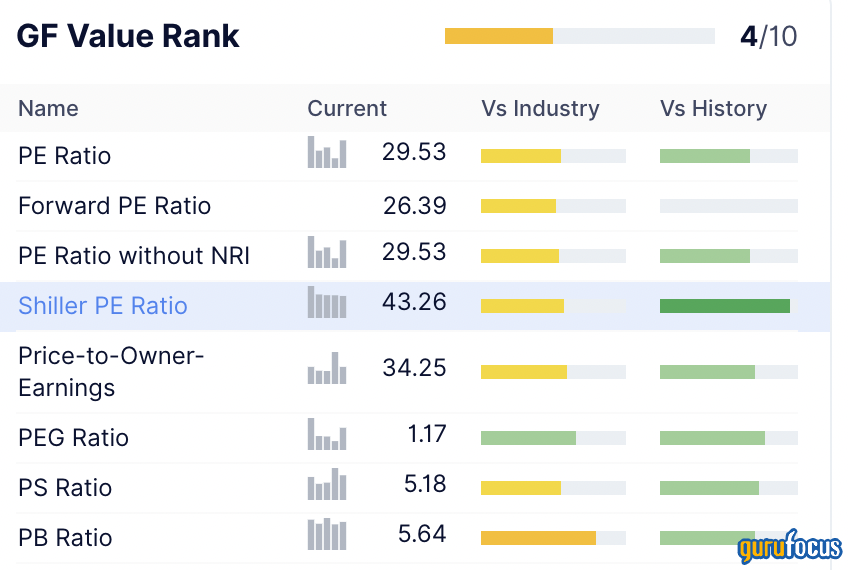

Value

First, let’s address the possibility Align presents a value trap to investors. After all, the share price has fallen for roughly nine months and the best it has been able to do recently is to level out:

While the share price has taken a dive, other factors suggest this is far from a value trap. As noted, it has no long-term debt and very little short-term debt. Its Altman Z-Score comes in at 7.29, which means there is no danger of bankruptcy. In addition, it has nearly a billion dollars worth of cash and cash equivalents.

Second, while the company faces some headwinds, they are manageable. It enjoys the confidence of the dental community and it has ongoing research and development to bolster its future.

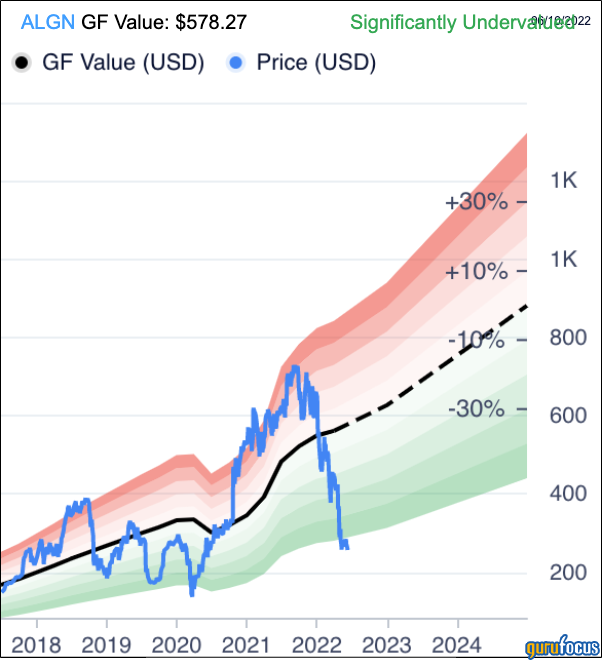

Moving on to specific valuations, the GF Value chart identifies Align as a significantly undervalued name:

Its price-earnings ratio is 29.53, slightly more than the industry average of 26.44.

The PEG ratio, which is the price-earnings divided by the five-year Ebitda growth rate (25.20% per year) clocks in at 1.17. That is close to the fair value mark of 1.

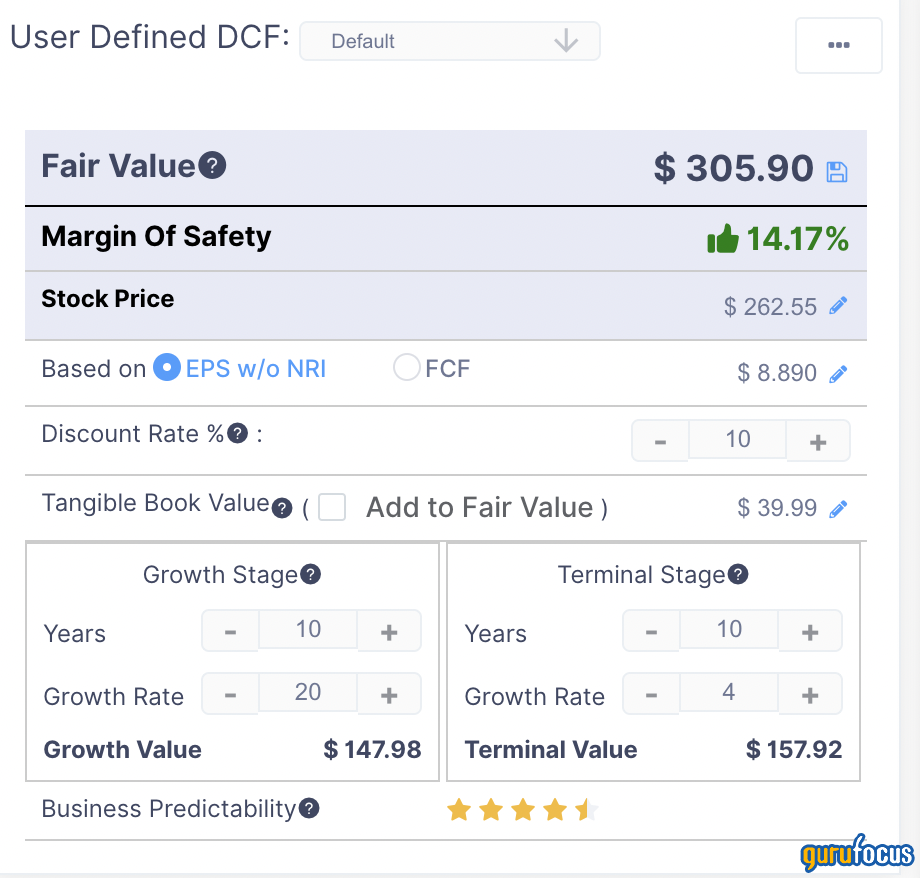

Because Align has a high predictability rating of 4.5 out of five stars, we can have confidence in the discounted cash flow result. It sees a 14.17% margin of safety:

GF Score

This new GuruFocus feature summarizes all essential fundamentals into one overall score. Align’s is very high at 91 out of 100.

Gurus

Align enjoyed the ownership of 10 gurus at the end of the first quarter of 2022. The biggest stakes belonged to:

- Frank Sands (Trades, Portfolio) of Sands Capital Management, who cut his stake by 7.33% to 2,362,663 shares. That represented 3% of Align’s outstanding shares and 2.37% of Sand’s assets under management.

- Ken Fisher (Trades, Portfolio) of Fisher Asset Management; he upped his holding by 6.13% to 571,043 shares.

- Vanguard Health Care Fund (Trades, Portfolio), which increased its position by 170% in the quarter to 455,983 shares.

Conclusion

Align Technology was once a hot stock; it had a few quarters in the sun. But growth that strong was unlikely to persist, and the stock came tumbling back down.

Does this mean it is a dog, or a stock that is poised to deliver outstanding capital gains again? Neither of these cases is likely.

Instead, we should view Align as a solid stock that has reverted to the mean, one that has moved back closer to its longer-term average. In the next five to 10 years, we might expect it to go back to delivering solid but not necessarily outstanding capital gains such as those of a couple of years ago.