Domo Inc. (DOMO, Financial) is a software-as-a-service (SaaS) company which offers a leading big data analytics and visualization platform. The big data market is forecasted to increase in value by 47% between 2022 and 2027, reaching $103 billion by the end of the period according to Statista. Thus, Domo has a huge opportunity to benefit from this trend as a company which helps enterprises manage and understand their vast data sets.

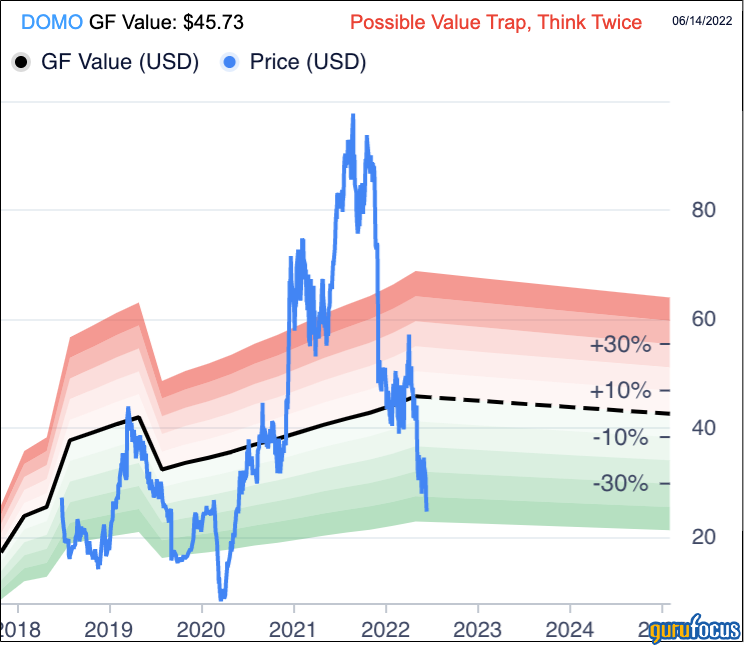

The company was founded in 2010 and had their IPO in 2018. Since then, the stock has had a volatile couple of years. From November 2021 to the present, the stock has had a major correction, dropping by 74% and falling lower than its IPO price of $27 per share. Does this mean the stock now represents a value opportunity?

Business model

Domo provides a leading software platform which enables multiple data sources to be analyzed in one place and visualized via a single dashboard. This is a game-changer for businesses which have multiple data sets in various "siloed" locations. This could include business intelligence (BI) data, marketing analytics data, advertising data, supply chain data, market share data and more.

Domo has over 2,200 customers which include major brands such as ebay (EBAY, Financial), Cisco (CSCO, Financial), Zillow (ZG, Financial), Unilever (LSE:ULVR, Financial) and more. Loreal calls Domo their "cockpit" and they use the platform for managing all their global data sources and to help discover return on investment for their marketing efforts.

Their business model primarily focuses on subscription services, and they claim they are on a "path to $1 billion in billings." The company aims to accomplish this through various initiatives such as adding 25% more sales reps per year and increasing their customer retention rate from 88% in 2021 to 92% in the future. They also aim to move from "challenger to leader" on the Gartner Magic Quadrant, a popular benchmark for B2B technology companies. Recently they announced new integrations with Microsoft (MSFT, Financial) 365 and Teams, which should increase the value proposition offered to users.

Financials

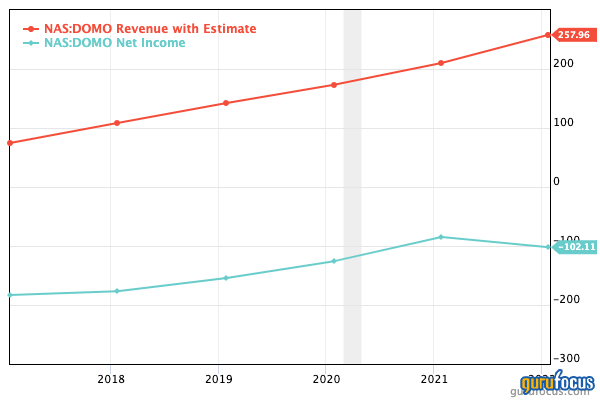

Domo recently released their earnings for the first quarter of 2022. Total revenue came in at $74.5 million, which was an increase of 24% year over year. Subscription revenue made up 87% of this at $64.6 million for the first quarter. Billings came in at $72.9 million, which represented a 25% increase year over year.

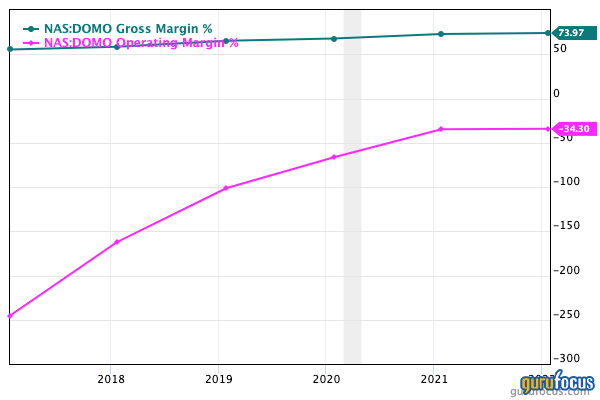

Domo has a very high gross margin of 73%, which is consistent with the prior quarter. They are operating at a loss of -$88 million in the trailing 12 months, but this is due to their aggressive investments into both R&D ($81 million) and sales and marketing ($198 million).

Domo has a strong balance sheet with cash and cash equivalents of $84.0 million as of April 30 with virtually no interest bearing debt.

For full fiscal 2022, they are guiding for revenue between $315.0 million and $319.0 million, up 24% year over year at the low end of the range.

Valuation

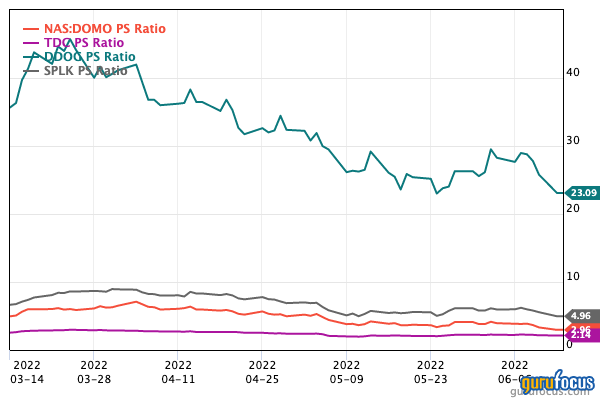

In terms of valuation, the company trades at a price-sales ratio of 2.96, which is lower than historic levels.

The GF Value chart indicates the stock is undervalued but also a possible value trap, which could be due to the sharp and fast decline seen recently.

Domo's competitor platforms include other business analysis tools such as Microsoft Power BI, Tableau Desktop, Qlik Sense, SAP Business Objects BI Suite, Sisense Fusion Analytics, MicroStrategy (MSTR, Financial), TIBCO Spotfire and Looker. The majority of these are owned by larger corporations; for example, Microsoft BI, SAP and Tableau have all been acquired by Salesforce (CRM, Financial).

Thus, a more useful comparison for valuation may be more SaaS based growth stocks. In the chart below, I compare it to Teradata (TDC, Financial), Datadog (DDOG) and Splunk (SPLK). Domo is the second-cheapest stock when compared to this group of companies with a price-sales ratio of 2.96.

Domo is a tremendous company which is attacking the growing $100 billion big data market opportunity. They are investing aggressively for growth and are growing at a steady rate. Overall, I believe the stock is undervalued because it is cheap relative to historic multiples.