Legendary investor Warren Buffett (Trades, Portfolio), head of Berkshire Hathaway (BRK.A)(BRK.B), is known for his preference of investing in wonderful companies at fair prices that have strong competitive advantages and predictable businesses for the long term. This strategy has contributed to his strong performance of an average annual return of 20% since 1965.

Comparatively, when picking stocks, Wallace Weitz (Trades, Portfolio)’s Weitz Investment Management combines Benjamin Graham's principles of price sensitivity and insistence on margin of safety with a conviction that qualitative factors that allow the company to control its future can be more important than statistical metrics like book value and earnings.

While the two Omaha, Nebraska-based gurus take slightly different approaches to investing, they still have several holdings in common.

According to the Aggregated Portfolio, a Premium GuruFocus feature based on 13F filings, the veteran value investors both have positions in Visa Inc. (V, Financial), Aon PLC (AON, Financial), Amazon.com Inc. (AMZN, Financial), Markel Corp. (MKL, Financial), Liberty SiriusXM Group (LSXMA, Financial) and Mastercard Inc. (MA, Financial) as of the end of the first quarter.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Visa

In the first quarter, Buffett left his Visa (V, Financial) position unchanged, while Weitz boosted his holding by 0.33%. The gurus have a combined equity portfolio weight of 4.93% in the stock.

The San Francisco-based company, which facilitates electronic payments and provides credit card services, has a $395.91 billion market cap; its shares were trading around $187.09 on Friday with a price-earnings ratio of 29.41, a price-book ratio of 12.01 and a price-sales ratio of 15.03.

The GF Value Line suggests the stock is modestly undervalued currently based on historical ratios, past financial performance and future earnings projections.

GuruFocus rated Visa’s financial strength 7 out of 10 on the back of adequate interest coverage. In addition, the high Altman Z-Score of 6.65 indicates it is in good standing. The return on invested capital also overshadows the weighted average cost of capital, indicating value is being created as the company grows.

The company’s profitability fared better, scoring a 10 out of 10 rating as a result of strong margins and returns on equity, assets and capital that outperform a majority of competitors. It also has a high Piotroski F-Score of 8 out of 9, meaning operations are healthy. Visa has recorded consistent earnings and revenue growth, contributing to a predictability rank of five out of five stars. According to GuruFocus research, companies with this rank return an average of 12.1% annually over a 10-year period.

GuruFocus estimates Buffett has gained 324.36% on his investment since the third quarter of 2011, while Weitz has gained roughly 97.81% since the third quarter of 2016.

Of the gurus invested in Visa, Ken Fisher (Trades, Portfolio) has the largest stake with 0.64% of its outstanding shares. Frank Sands (Trades, Portfolio), Chuck Akre (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Steve Mandel (Trades, Portfolio), Al Gore (Trades, Portfolio)’s Generation Investment, Andreas Halvorsen (Trades, Portfolio), Philippe Laffont (Trades, Portfolio) and several others gurus also have significant holdings.

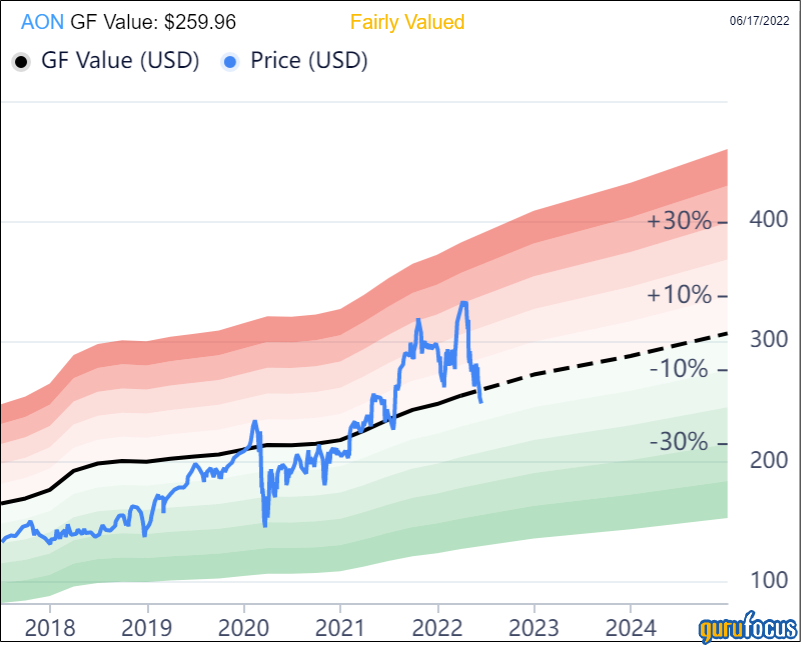

Aon

Buffett left his Aon (AON, Financial) stake unchanged at 4.4 million shares, while Weitz reduced his position by 37.07% during the quarter. The combined equity portfolio weight is 2.69%.

The British insurance company, which offers a range of financial risk-mitigation products, has a market cap of $52.59 billion; its shares were trading around $247.60 on Friday with a price-earnings ratio of 39.30, a price-book ratio of 44.80 and a price-sales ratio of 4.46.

According to the GF Value Line, the stock is fairly valued currently.

Aon’s financial strength was rated 4 out of 10 by GuruFocus. Although the company has issued new long-term debt over the past several years, it is still at a manageable level due to adequate interest coverage. The low Altman Z-Score of 1.57, however, warns it could be at risk of bankruptcy. The WACC also eclipses the ROIC, indicating struggles with creating value.

The company’s profitability fared better with an 8 out of 10 rating on the back of operating margin expansion and strong returns that outperform over half of its industry peers. Aon also has a moderate Piotroski F-Score of 5, meaning conditions are typical for a stable company. As a result of recording losses in operating income, the one-star predictability rank is on watch. GuruFocus says companies with this rank return an average of 1.1% annually.

GuruFocus data shows Buffett has gained an estimated 11.59% on his investment since the first quarter of 2021, while Weitz has generated a 110.11% return since the second quarter of 2010.

With a 2.07% stake, Buffett is Aon’s largest guru shareholder. Other top guru investors include Halvorsen, First Pacific Advisors (Trades, Portfolio), Steven Romick (Trades, Portfolio) and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

Amazon

Weitz increased his holding of Amazon (AMZN, Financial) by 13.79% to 330,000 shares during the quarter, while Buffett left his stake unchanged at 10.6 million shares. They have a combined equity portfolio weight of 2.89% in the stock.

The e-commerce giant, which is headquartered in Seattle, has a $1.07 trillion market cap; its shares were trading around $105.63 on Friday with a price-earnings ratio of 50.98, a price-book ratio of 8.03 and a price-sales ratio of 2.28.

Based on the GF Value Line, the stock appears to be significantly undervalued currently.

GuruFocus rated Amazon’s financial strength 6 out of 10. In addition to adequate interest coverage, the company has a high Altman Z-Score of 3.91, indicating it is in good standing even though assets are building up at a faster rate than revenue is growing. The ROIC also exceeds the WACC, so value creation is occurring.

The company’s profitability scored a 9 out of 10 rating due to operating margin expansion, strong returns that top a majority of competitors and a moderate Piotroski F-Score of 5. Despite steady earnings and revenue growth, Amazon’s five-star predictability rank is on watch.

GuruFocus says Buffett has gained an estimated 24.57% on his investment since the first quarter of 2019, while Weitz has gained 46.55% since the fourth quarter of 2015.

Fisher is Amazon’s largest guru shareholder with a 0.46% stake. Baillie Gifford (Trades, Portfolio), Sands, Segalas, Mandel, Gore’s firm, Halvorsen, PRIMECAP Management (Trades, Portfolio), Chris Davis (Trades, Portfolio), Simons’ firm and several other gurus also have significant positions in the stock.

Markel

While Buffett entered a new 420,293-share holding during the quarter, Weitz trimmed his position by 11.89%. Together, the gurus have a combined equity portfolio weight of 3.45%.

The Glen Allen, Virginia-based insurance company has a market cap of $17.23 billion; its shares were trading around $1,272.92 on Friday with a price-earnings ratio of 9.94, a price-book ratio of 1.29 and a price-sales ratio of 1.39.

The GF Value Line suggests the stock is modestly undervalued currently.

Markel’s financial strength was rated 6 out of 10 by GuruFocus. Although the company has issued new long-term debt in recent years, it is manageable due to sufficient interest coverage.

The company’s profitability scored a 7 out of 10 rating, driven by margins and returns that top a majority of industry peers and a moderate Piotroski F-Score of 4. Due to a slowdown in revenue per share growth over the past 12 months, the 2.5-star predictability rank is on watch. GuruFocus data shows companies with this rank return, on average, 7.3% annually.

According to GuruFocus, Buffett has lost an estimated 1.43% on his investment so far. Weitz has gained approximately 13.67% since the first quarter of 2018.

Of the gurus invested in Markel, Buffett has the largest stake with 3.10% of its outstanding shares. Baillie Gifford (Trades, Portfolio), Davis, Jeremy Grantham (Trades, Portfolio), Arnold Van Den Berg (Trades, Portfolio), Cohen, Tom Russo (Trades, Portfolio), Murray Stahl (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Simons’ firm also own the stock.

Liberty SiriusXM

During the quarter, both gurus left their Liberty SiriusXM (LSXMA, Financial) positions unchanged. Buffett has a 20.2 million-share stake, while Weitz holds 420,000 shares. The two gurus have a combined equity portfolio weight of 1.11% in the stock.

One of three tracking stocks under Liberty Media’s umbrella, Liberty SiriusXM’s main asset is its 78% ownership of satellite radio operator Sirus XM Holdings Inc. (SIRI, Financial).

The tracking stock, whose parent company is headquartered in Englewood, Colorado, has a $13.21 billion market cap; its series A shares were trading around $35.76 on Friday with a price-earnings ratio of 13.28, a price-book ratio of 1.43 and a price-sales ratio of 1.35.

According to the GF Value Line, the stock is modestly undervalued currently.

GuruFocus rated Liberty SiriusXM’s financial strength 3 out of 10. As a result of issuing approximately $2.9 billion in new long-term debt over the past three years, it has weak interest coverage. The low Altman Z-Score of 0.78 warns the company is in distress and could be at risk of bankruptcy. The WACC also surpasses the ROIC, indicating the company is struggling to create value.

The company’s profitability fared better with an 8 out of 10 rating. Although the operating margin is in decline, it outperforms a majority of competitors. Its returns are also outperforming. Liberty SiriusXM is supported by a high Piotroski F-Score of 7 and a one-star predictability rank.

Buffett has lost an estimated 7.10% on the investment over its lifetime based on GuruFocus data, while Weitz has gained 11.42%.

Once again, Buffett is the largest guru shareholder of Liberty SiriusXM. It is also held by Seth Klarman (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Tom Gayner (Trades, Portfolio), Stahl, Simons’ firm, Louis Moore Bacon (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio).

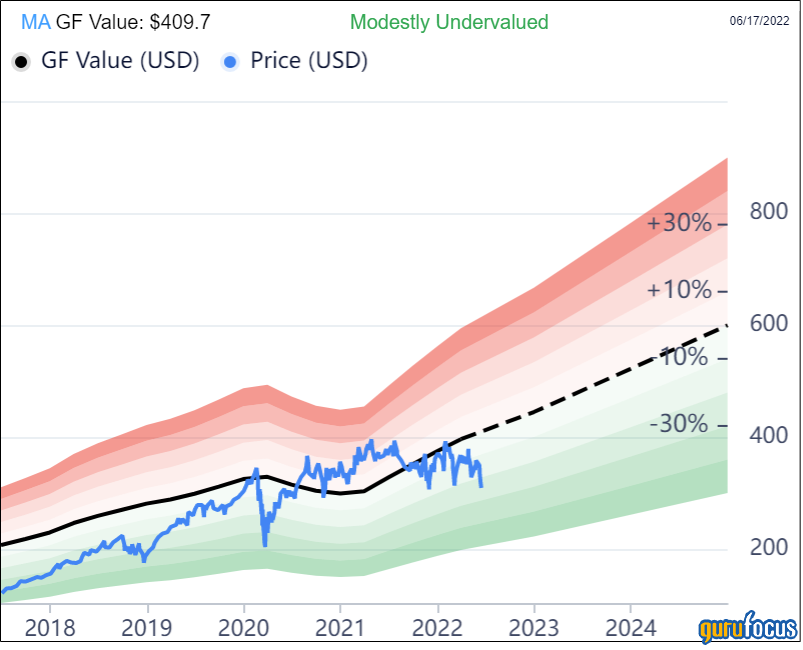

Mastercard

Weitz boosted his Mastercard holding by 0.45% to 259,050 shares during the quarter, while Buffett left his stake unchanged at 3.9 million shares. Together, they have a combined equity portfolio weight of 4.53% in the stock.

The Purchase, New York-based financial services company, which provides global payment technology solutions and services, has a market cap of $302.19 billion; its shares were trading around $310.69 on Friday with a price-earnings ratio of 32.34, a price-book ratio of 43.05 and a price-sales ratio of 15.42.

Based on the GF Value Line, the stock appears to be modestly undervalued currently.

Mastercard’s financial strength was rated 6 out of 10 by GuruFocus, driven by a comfortable level of interest coverage despite new long-term debt being issued. Even though the Altman Z-Score of 9.47 is healthy, assets are building up at a faster rate than revenue is growing, indicating it may be becoming less efficient. The ROIC also outshines the WACC, suggesting good value creation is occurring.

The company’s profitability fared even better, scoring a 10 out of 10 rating on the back of strong margins and returns that outperform a majority of industry peers as well as a high Piotroski F-Score of 8. Mastercard also has a five-star predictability rank, bolstered by consistent earnings and revenue growth.

GuruFocus estimates Buffett has gained 652.87% on his long-held investment. Weitz has gained 153.01%.

Akre is Mastercard’s largest guru shareholder with a 0.60% stake. Other top guru investors include Fisher, Baillie Gifford (Trades, Portfolio), Russo, Mandel, Segalas and Halvorsen.

Portfolio composition

Buffett’s $363.55 billion equity portfolio, which is composed of 49 stocks, is largely invested in the technology and financial services sectors.

Slightly over half of Weitz’s $2.23 billion equity portfolio, which is made up of 57 stocks, is invested in the financial services and communication services sectors.

Also check out: