It is an old, old name, but Western Union Co. (WU, Financial) still has potential for investors.

What’s more, it has better-than-average fundamentals, as summarized by its high GF Score of 85 out of 100.

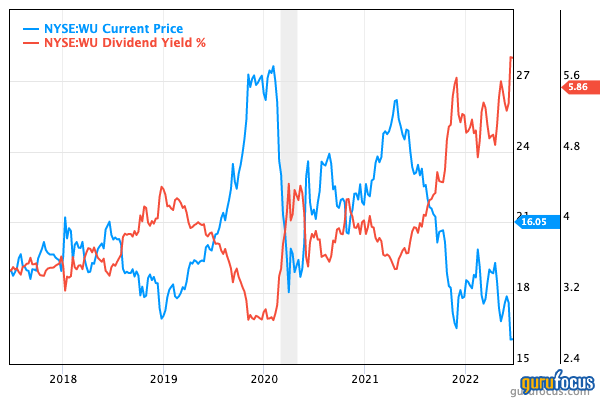

Because its share price has tumbled along with the rest of the market, it currently offers a dividend yield of roughly 6%.

About Western Union

Founded in 1851, the Denver-based company describes itself in its 10-K for 2021 as “a leader in global money movement and payment services, providing people and businesses with fast, reliable and convenient ways to send money and make payments around the world.”

The company once synonymous with the telegram now uses digital technologies to transfer money among people and organizations worldwide.

Recently, though, it clipped its own wings by selling its business solutions division for about $910 million to private equity firm Goldfinch Partners LLC and investment manager Baupost Group LLC (associated with Seth Klarman (Trades, Portfolio)). Western Union is now deciding how it will use the proceeds.

It also reduced its footprint by suspending operations in Russia and Belarus after the Russian invasion of Ukraine.

The company outlined its growth strategy in this slide from the first-quarter 2022 presentation:

Source: Western Union presentation.

Competition

Western Union faces competition on several fronts for consumer-to-consumer transfers. As it explained in its 10-K, it is seeing increasing competition from global money transfer providers, regional money transfer providers, digital channels and others.

Digital channels include digital wallets and digital currencies, including cryptocurrencies.

Not included in the 10-K is any discussion about a potential disruptor called NEAR Protocol. It is a collective/community initiative based on blockchain technology.

According to some observers, NEAR has the potential for nearly instantaneous transfers at extremely low cost. Perhaps we might use the analogy of the telegram and the Pony Express.

Presumably, Western Union's management is studying this potential game-changer and trying to figure out how to deal with it.

As for competitive factors, the 10-K reported, “We believe the most significant competitive factors in Consumer-to-Consumer remittances relate to the overall consumer value proposition, including brand recognition, trust, reliability, consumer experience, price, speed of delivery, distribution network, variety of send and receive payment methods and channel options.”

The company has strong positions on each of these factors, especially brand recognition.

Financial strength

Debt pulls down this ranking, although it still has a reasonable interest coverage ratio. As GuruFocus notes, “Ben Graham requires that a company has a minimum interest coverage of 5 with the companies he invested. If the interest coverage is less than 2, the company is burdened by debt. Any business slow or recession may drag the company into a situation where it cannot pay the interest on its debt.”

The Piotroski F-Score and the Altman Z-Score appear to provide contradictory indications, with the latter in what’s called the “distress zone.” That would indicate bankruptcy is possible within the next two years.

But a quick glance at the balance sheet challenges that possibility. At the end of March 2022, Western Union held cash and cash equivalents of $1.29 billion (before the $910 million from the sale of the business solutions segment), while having $100 million of short-term debt and $2.43 billion in long-term debt. There is no concern about financial distress here.

It is also worth noting that return on invested capital, at 16.67%, is more than double the weighted average cost of capital at 6.37%.

Profitability

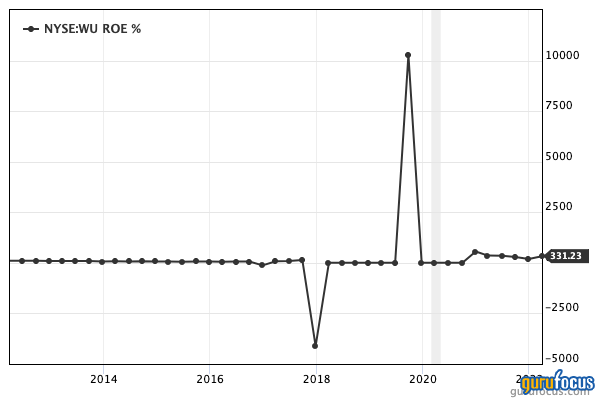

While Western Union’s margins are reasonable, what draws the eye on this table is the return on equity. Not only is it high, but it outperforms 99.81% of companies in the credit services industry.

And the current ROE is no flash in the pan, as shown by this 10-year chart:

The now-digital company requires relatively little capital investment, presumably just IT equipment and infrastructure.

Growth

The revenue, Ebitda and earnings growth rates are low, but on a positive note, earnings per share with non-recurring items rate is higher than those of revenue and Ebitda. This indicates the company is becoming more effective or efficient.

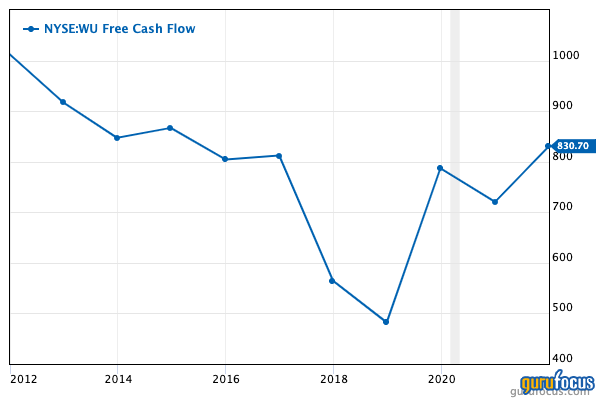

Free cash flow growth over the past three years also outdoes many other companies in the industry—but if you took an average over more than three years, the rate would be slower:

Dividends and share buybacks

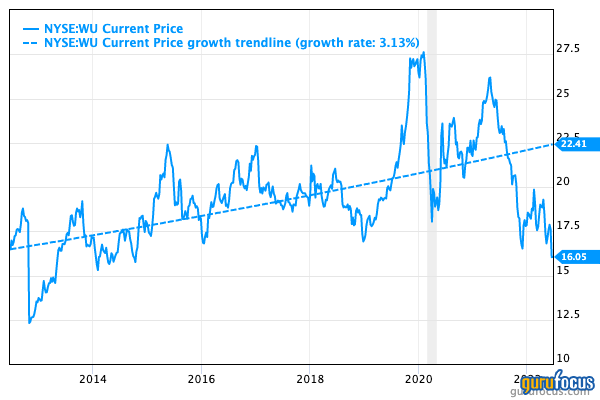

Thanks to the long slide in the share price, from around $26 per share in April 2021, the dividend yield is now at a 10-year high:

Western Union has increased its dividend every year since 2015. Over the past 10 years, it has grown by an average of 8.98% per year.

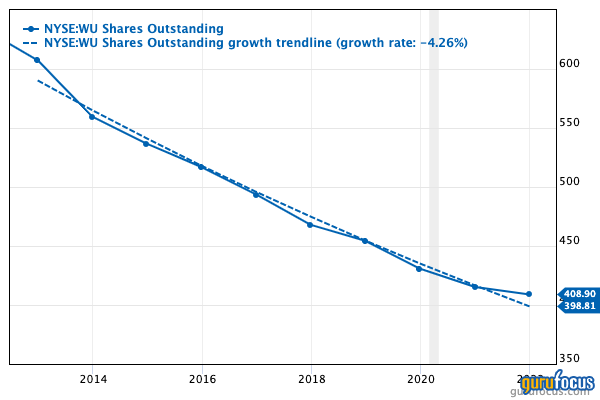

It has also made shareholders richer with stock repurchases every year of the past decade:

Valuation

Because the share price has slipped so far in the past 14 months, Western Union gets full marks for value:

In addition, it has a price-earnings ratio of 7.08, almost half the credit services industry median of 13.47.

Divide that by the average annual growth rate of Ebitda over the past five years, 16.90% per year, and we have a PEG ratio of 0.42. That is well below the fair value mark of 1.

The GF Value Line arrives at a similar conclusion of modestly undervalued:

Gurus

That valuation may account for the interest of the nine gurus who held shares at the end of the first quarter. The three largest holdings were those of:

- Jeremy Grantham (Trades, Portfolio) of GMO LLC, who added 12.57% to his firm's position for a total of 1,499,700 shares. That represented 0.39% of Western Union’s shares and 0.14% of GMO’s assets under management.

- Jim Simons (Trades, Portfolio)' Renaissance Technologies initiated a new holding by buying 1.4 million shares.

- John Rogers (Trades, Portfolio) of Ariel Investment, who upped his count by 4.68% to 449,292 shares.

Conclusion

Western Union still has something to offer investors. A dividend yield of around 6% from a company that has excellent fundamentals is worth consideration. Although we have no idea about a bottom for the share price, it is currently undervalued.

Potential investors should spend some time researching where the company might go in the next five years, given the competition it could face.

Income investors may find Western Union attractive with its high dividend and the potential for capital gains when the share price turns around. Value investors will not find much here, while growth investors may wish to look at it again when the share price begins to rise consistently.

Also check out: (Free Trial)