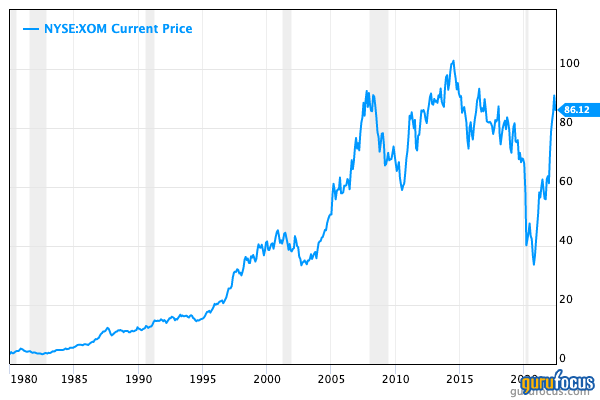

Exxon Mobil (XOM, Financial) is the fourth largest oil company in the world and has grown its dividend for 39 years in a row. As one might expect, the company’s performance correlates pretty much tit for tat with oil prices. Given the likelihood that higher oil prices are here to stay, combined with Exxon's market-leading position and solid financial strength, I believe the stock still has plenty of room to run at current levels.

Business model

Exxon Mobil is the descendant of John D. Rockefeller's Standard Oil. Its current structure was formed in 1999 by the merger between Exxon and Mobil. Exxon has a well diversified business model which focuses on a long-term view of commodity prices. It conducts conventional oil and natural gas operations in 17 countries, where it focuses on maximizing cash flow by lowering costs. The company is also a leader in liquefied natural gas (LNG) and produces over 87 million metric tons per year, which accounts for one fifth of the global supply. In addition, it is one of the largest chemical producers globally with a staggering 26 million metric tons produced annually.

It has continued production in the Permian and doubled drilling efficiency since 2019. It has recently been focused on Guyana, which contains one of the largest oil deposits discovered in the past decade.

While Exxon Mobil is behind many peers in terms of reducing the environmental impact of its operations, it does have some low carbon solutions. This supports reducing emissions from their operations and creating solutions such as carbon capture, hydrogen and biofuels to help lower world emissions.

In 2021, it announced progress on 10 large carbon capture and storage opportunities. It also produced 1.3 million metric tons of hydrogen per year and has plans to scale this technology. Exxon aims to provide 40,000 barrels per day of biofuels by 2025, with a further 200,000 barrels per day by 2030. These are bold plans which would reduce annual CO2 emissions from the transportation sector by a staggering 25 million metric tons, equivalent to removing 5 million cars from the road.

Financials

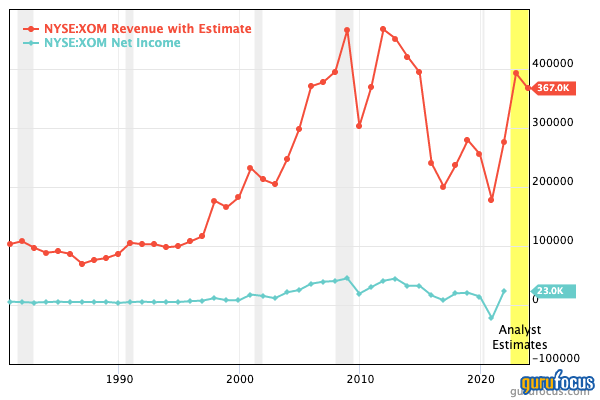

In full fiscal 2021, Exxon Mobil had a tremendous year and delivered earnings of $23 billion thanks to soaring gas prices. Their cash flow from operations totaled $48 billion, which was the highest level since 2012.

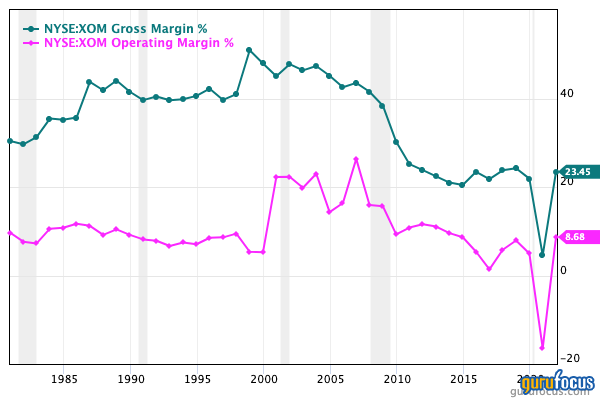

Their margins have started to recover to pre-pandemic levels with a 23% gross margin and an 8.68% operating margin.

The company prudently used its excess cash flows to pay down debt borrowed in 2020 and reduce costs by almost $5 billion compared to 2019. In addition, it announced a $10 billion share repurchase plan in 2022.

Valuation

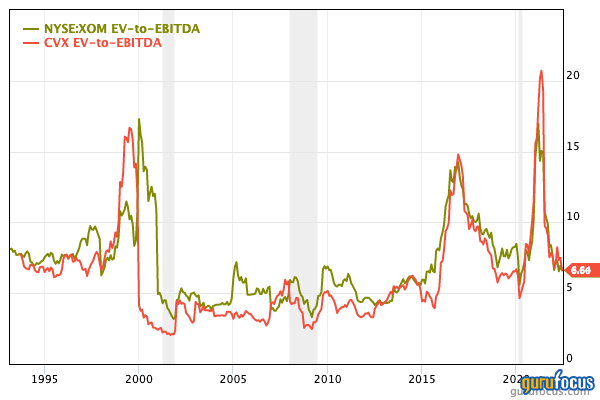

In terms of valuation, Exxon Mobil is trading at an enterprise-value-to-Ebitda ratio of 6.6, which is lower than historic levels and similar to peer Chervon (CVX, Financial).

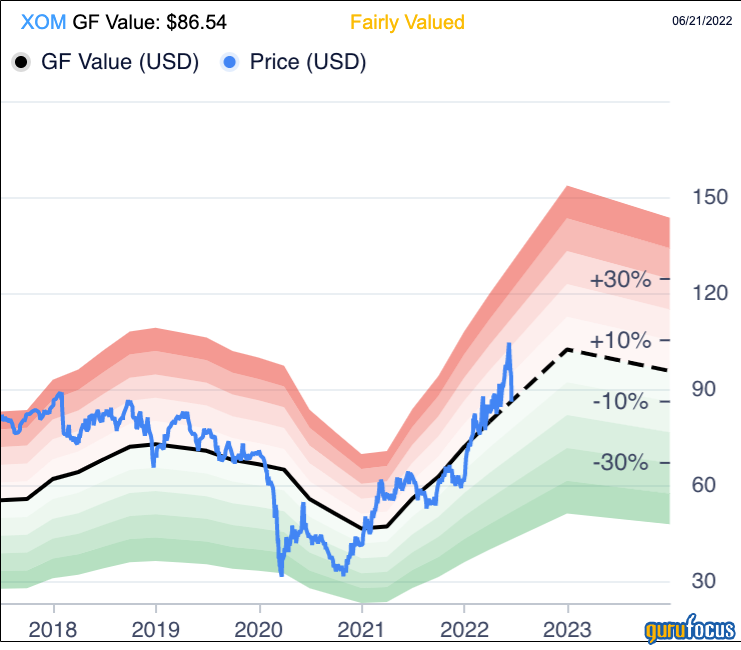

The GF Value line indicates the stock is fairly valued.

Exxon Mobil offers a diversified portfolio across oil and gas and is even investing some funds into various carbon capture, biofuel and hydrogen solutions. Personally, I believe this is one of those stocks that just makes sense in the currnet environmkent, since it's on a strong cyclical upswing that seems set to continue for a while.