Warren Buffett (Trades, Portfolio), the CEO of Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial), loves to buy companies with strong cash flows and focus on the long-term. Buffett’s investments also tend to have a strong competitive advantage or moat and usually operate with very simple business models. His highly successful investing strategy has made him a true value investing icon.

With the economy threatening to tip over into recession, investors are looking for safety, which can come in the form of dividend-paying stocks. Thus, let's take a look at the top three dividend-paying stocks with the highest yields in Buffett’s portfolio.

Store Capital

Dividend Yield: 5.7%

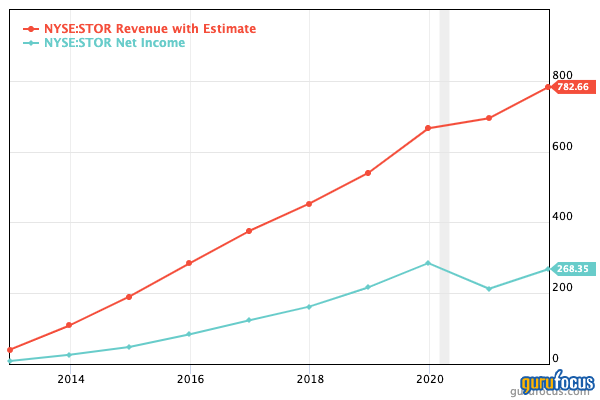

Store Capital (STOR, Financial) is a Real Estate Investment Trust which specializes in buying and then leasing real estate to service, manufacturing and service-oriented retail companies. It has a $13.2 billion portfolio spread across 2,965 properties and rented to 573 customers across 121 industries. The beautiful thing about this REIT is it’s extremely diversified across industries, states and customers. Their top customers include Spring Education Group, U.S. LBM, Fleet Farm, Cadence education, AMC (AMC, Financial) and more. They have an exceptional 99.5% occupancy rate, with a 13.3 year weighted average lease term, which is higher than the industry average

Source: Store Capital investor materials

For the first quarter of 2022, Store Capital beat Wall Street expectations, with adjusted funds from operations [FFO] per share of $0.57 vs. the $0.52 average analyst estimate. This was up slightly from $0.56 in the fourth quarter of 2021 and up substantially from $0.47 in the first quarter of 2021.

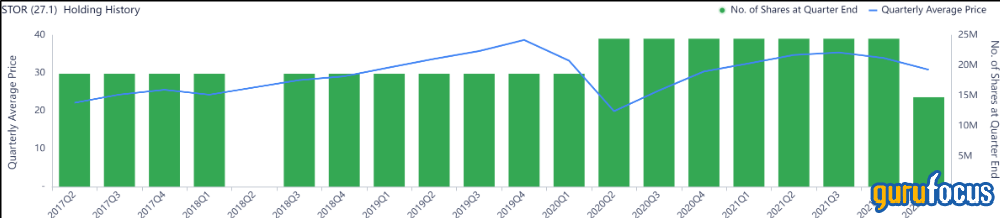

Berkshire Hathaway snapped up $377 million of Store Capital in the second quarter of 2017. Since then Buffett has added 31% and then trimmed the position by 39%, but other investors have been piling in. Ray Dalio (Trades, Portfolio) of Bridgewater associates was buying in the first quarter of 2022. Value Investor Joel Greenblatt (Trades, Portfolio) was also loading up on shares in the fourth quarter of 2021 at a similar level.

2. Verizon

Dividend Yield: 5%

Verizon (VZ, Financial) is one of the largest telecommunications providers in the U.S. The company is currently expanding into 5G and aims to become the backbone of the industry. The company even went as far as to purchase the “mid band” 5G spectrum and wants to cover over 50 million households with home broadband by 2025.

Revenue has been fairly stable at $32 billion for the first quarter of 2022, while consumer revenue jumped by a healthy 10.9% year over year.

The GF Value chart, a unique intrinsic value estimate from GuruFocus, suggests the stock is modestly undervalued at the time of writing.

3. Kraft Heinz

Dividend Yield: 4.27%

Kraft Heinz (KHC, Financial) is a processed food company which qualifies as a defensive stock, as people will always need to eat. The company’s “beloved brands” include Kraft, Heinz, Capri Sun, Kool-Air and many more.

Kraft Heniz generated revenue of $26 billion for full fiscal 2021, which has been fairly flat over the past few years. Net income has also hovered around the $1 billion mark over the past few years.

The company hasn’t been Buffett’s best pick, and they had to do a $15.4 billion writedown on certain brands. Their 4.27% dividend looks to be stable for now, but they do have a large amount of long-term debt equating to an eye-watering $21 billion. Some hope for investors could come from the company's plan to split into two separate businesses, but only time will tell.