Cybersecurity attacks are on the rise, from the Colonial Pipeline attack to several notable email hacks and data breaches. Our increased connectivity has widened the attack surface for potential bad actors. In 2021, the world saw a 105% surge in ransomware cyberattacks according to the 2022 Cyber Threat Report from cyberecurity company SonicWall. Ransomware attacks are designed to cripple businesses until a ransom is paid.

Thus, it’s no surprise that the global cybersecurity market is a hot topic. This industry is forecasted to grow at a rapid 13.4% compounded annual growth rate (CAGR) between 2022 and 2029 according to estimates from Fortune Business Insights, reaching $376 billion by the end of the period.

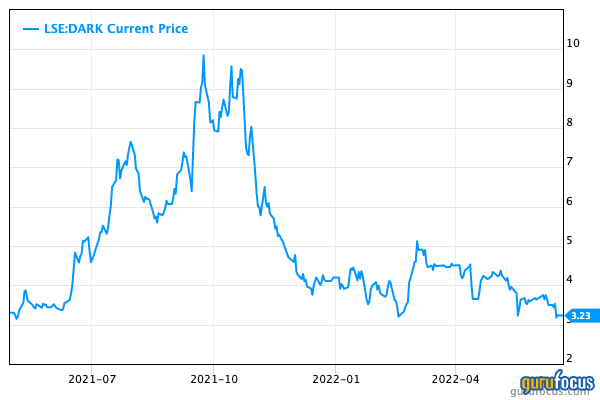

One interesting company in this space is Darktrace (LSE:DARK, Financial), an artificial intelligence-focused cybersecurity company which debuted on the London Stock Exchange just last year. Let’s dive into the business model, financials and valuation to see why I belive this rapid-growth stock is a value opportunity after the recent share price pullback.

Business model

Darktrace was founded by cyber defense experts at the University of Cambridge in 2013. Today, the company is a global leader in cybersecurity AI applications and offers real-time threat protection. The technology learns the “pattern of life” for every user and device in order to spot anomalies in the system. This helps to bolster the “cyber Immune system” of a company. Darktrace employs over 1,600 people in 44 global offices and provides cybersecurity protection to over 5,600 customers across multiple industries. The company has over 80 patents (protected or pending) for various machine learning and AI concepts.

The business model focuses on a “try before you buy” approach, in which the company installs the platform on clients' systems during a free trial period so they can see the “proof of value” for themselves. This is a low friction method of selling and has resulted in high conversions for the business.

Next, the company upsells multiple products/modules to the customers, and as of June 2021, 62.2% of customers had three or more products and 39.2% had four or more products from among their current 10-product platform.

Finally, the business focuses on retaining these customers, and they have a record 103% net annual recurring revenue retention rate.

Financials

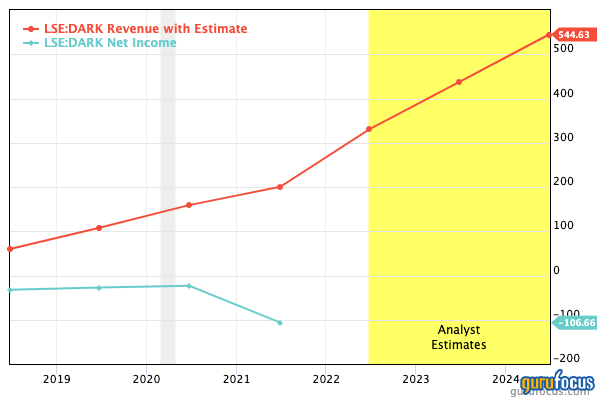

Darktrace generated revenue of $109.8 million for its third quarter of fiscal 2022. This was up a meteoric 50.1% year over year. They added 359 net new customers to bring the total customer base to 6,890, representing growth of 37.3% year over year. This growth came from the acquisition of Cybersprint in March. Net annual recurring revenue was $462.6 million, up 46.3% year over year, with 1.4% related to the Cybersprint acquisition.

The company operates with a super high gross margin of 89.9%, which is one of the highest levels in the industry. They are operating at a loss of $9 million for the trailing 12 months, mainly due to large investments into R&D, sales andmarketing.

Valuation

In terms of valuation, Darktrace is trading at a price-sales ratio of 8.9, which is lower than historic levels and peers in the industry. For example, Crowdstrike (CRWD, Financial) trades at a price-sales ratio of 23 and SentinelOne (S, Financial) trades at a price-sales ratio of 21.

In additoin to its heritage at the University of Cambridge, Darktrace is backed by British Intelligence Agencies, which gives the company immense credibility in a world of buzzwords. The patent protections act as a competitive advantage, and the “try before you buy technique” is working fantastically for gaining customer confidence. The stock is currently undervalued relative to historical levels and the industry at large, which I believe makes this growth stock a rare value opportunity.